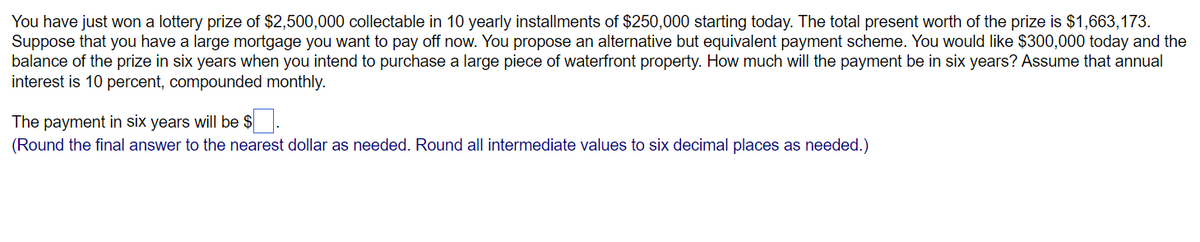

The payment in six years will be $ (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)

Q: Meadow Dew Corporation currently has an EPS of $3.80, and the benchmark PE for the company is 37.…

A: The Earnings per share is used to measure the performance of a company by finding out how much…

Q: d the present value of a 4-year $60 annuity when the stated rate is 6%, compounded monthly. Make…

A: Present value of annuity is equivalent value of today considering the the time and interest of the…

Q: 0.Analyze the relationship between the federal budget and national debt. Explain how a federal…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: There are 2 types of residents in town. 20% are financially stable who can pay back the loan they…

A: The break even is the situations where there is no loss and there is no profit but all cost are…

Q: A high level of financial leverage exposes firms to default risk. However, as a result of it,…

A: Financial leverage is related to the capital structure of company and it is very important for the…

Q: The Dawson Corporation projects the following for the year 2012: Earnings before interest and taxes…

A: Given, Earnings Before Interest and Taxes (EBIT) - P35,000,000 Interest Expense = P5,000,000 Tax…

Q: A construction company plans to open an account for a major future equipment purchase. The plan is…

A: An annuity pays a fixed sum at regular intervals to save for a future lump-sum payment. It uses the…

Q: Synovec Company is growing quickly. Dividends are expected to grow at a rate of 22 percent for the…

A: First, we will find dividend of first three years Dividend paid(D0) =1.30 D1=D0*(1+G) Where G=…

Q: xper lysis Re nas information about three companies you are currently evaluating: Company Degree of…

A: DOL is degree of operating leverage shows changes in operating income with change in sales and DFL…

Q: Workman Software has 10.2 percent coupon bonds on the market with 16 years to maturity. The bonds…

A: Bonds are debt instruments that companies issue to raise funds. Companies pay fixed periodic coupons…

Q: Suppose that a loan of R$6,000,000.00 must be paid monthly as follows: From the 10th to the 100th…

A: We have quantum and timing of cash flows emanating from a loan. We have to find the IRR per period…

Q: Maple Aircraft has issued a 4¾% convertible subordinated debenture due 3 years from now. The…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: Your company needs to take another capital budgeting consideration regarding expansion of seafood…

A: Given, Initial cost of $1,250,000 Annual sale of 3,500,000 units

Q: Given i(4) = 3.150%, find the equivalent effective bi-weekly rate. O a. 0.11592% O b. 0.11954% O c.…

A: Interest rate (r) = 3.15% Number of compounding in a year (n)= 4 Effective annual rate =…

Q: Find the value today of a cash flow stream that pays $3,000 for three years and then zero dollars…

A: Given, Rate is 6% compounded continuously Cashflows $3000 for 3 years

Q: Aya and Sakura would like to buy a house and their dream home costs $500,000. Their goal is then to…

A: This is a question from amortization of loan. We need to find the monthly mortgage payment to be…

Q: Consider this simplified balance sheet for Geomorph Trading: Current assets Long-term assets $ 110…

A: A) Debt-Equity Ratio=Total debt/Total shareholders' equity Total debt=Long term debt+ current…

Q: An analysis of the income statement revealed that interest expense was P60,000. Grant Company's…

A: Given: Income before income taxes =P420,000 Income tax expense =P120,000 Net income = P300,000…

Q: (Related to Checkpoint 9.4) (Bond valuation) A bond that matures in 15 years has a $1,000 par value.…

A: Par Value $ 1,000.00 Time Period 15 Coupon rate 12% Yield 17%

Q: 1. What is depreciation?

A: As per Bartleby guidelines, If multiple questions are posted, only the first 1 question will be…

Q: Jane Austen purchased shares with a market price of $50 when the initial margin requirement was 70%.…

A: The initial margin requirement is the minimum amount of the shares that need to be paid to buy a…

Q: When Su Young-Ji went to withdraw $3,000 from the Nationwide Fidelity Mutual fund, he was informed…

A: This is a case of exit load. Exit load is that fee that mutual funds charge when an investor exit a…

Q: Which of the following can be adjustment(s) to gross income on the 1040 form? Multiple correct…

A: Form 1040 indicates what is considered by the individual taxpayers for sile the tax with the…

Q: Determine the risk-neutral value of a eight-month European put option to sell a FLB (First Local…

A: We have to price the put option. We will use the Black Scholes Option pricing model. It's a fairly…

Q: Accounting practice in the United States follows the generally accepted accounting principles (GAAP)…

A: Hi, there, Thanks for posting the question. As per our Q&A honour code, we must answer the first…

Q: (Related to Checkpoint 9.2) (Yield to maturity) The market price is $925 for a 17-year bond ($1,000…

A: Time Period (Years) 17 Par Value $ 1,000.00 Coupon Rate 8% Market Price $ 925.00

Q: Voyager, Inc. has 1000 shares issued with 800 shares outstanding. If Voyager Inc. pays a dividend…

A: Number of shares outstanding 800 shares Dividend per share $4

Q: A friend asks to borrow $54 from you and in return will pay you $57 in one year. If your bank is…

A: Future value of an amount is calculated as follows: FV = PV*(1+r)t Where, FV = Future value of…

Q: You have just taken out a $22,000 car loan with a 6% APR, compounded monthly. The loan is for five…

A: Loans are paid by the equal monthly installments these monthly payments carry the payment for…

Q: Find the numerical value of the factor (P/A,16.3%,15).

A: numerical value of the factor (P/A,16.3%,15) Series Present worth: To find P, Given A (P/A, i, n)…

Q: (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will…

A: Time Period (Years) 16 Par Value $ 1,000.00 Coupon…

Q: List 3 operational problems or issues in the Banking & Financial Services sector.

A: 1. Increase in competition There is a huge competition to banks due to emerging fintech companies…

Q: On the back of a check "payable to Huan," Huan signs her name and negotiates the item to Ito. To…

A: In finance, "without recourse" limits the liability of the endorser who negotiates the check to…

Q: What is the quarterly effective rate equivalent to a nominal rate of 200% p.a. capitalized monthly?

A: Interest Rate = 200%

Q: Examine the effect of the actions below on the current ratio. Assume that the prevailing current…

A: Current ratio is a ratio that explains the relationship between current assets and current…

Q: Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost…

A: The salvage value is the asset's estimated realizable value after its useful life has ended. The…

Q: What is the total future value ten years from now of $400 received in 1 year, $350 received in 2…

A: Future value of a present amount With present value (PV), annual interest rate (r) and period (n),…

Q: The Gilbert Instrument Corporation is considering replacing the wood steamer it currently uses to…

A: Net present value is helpful in determining whether the project is to be acceptable or not. It is…

Q: What is the formula used for the questions without using excel?

A: Daily Withdrawals = $175 Time Period of Withdrawal = 21 Days Interest Rate on Withdrawals = 28%

Q: The real risk-free rate is 2%, and inflation is expected to be 2% for the next 2 years. A 2-year…

A: Given, The real risk-free rate is 2%. Inflation is 2% Treasury security yield is 5.0%

Q: 01 %, compound monthly for three years. d 300000 Mexican Peso, compound interest of 4%, compounded…

A: Interest earned on the investment depends on the interest rate and period of interest and…

Q: What exactly are the effects of choosing the wrong indexing strategy?

A: Answer - What is the Indexing strategy - Index investment can be defined as a passive investment…

Q: Find the numerical value of the factor (A/P, 30%,22).

A: We have; Capital Recovery function (A/P,30%,22) To Find: Numerical Value of the Function

Q: (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation) Fingen's 14-year, $1,000 par value…

A: A Bond refers to a concept that is defined as an instrument that represents the loan being made by…

Q: Calculate the net asset value (in $) and number of shares purchased for the mutual fund. Round…

A: Net Asset value = (Total Asset – Total Liabilities) / no of shares outstanding Shares Purchased =…

Q: The degree of operating leverage (DOL) is interpreted as the ratio of the percentage change in net…

A:

Q: 1. Write the Ratio/ Equation to be used, IF REQUIRED 2. Substitute the given 3. Solution (Solve for…

A: Dividend is the distribution of the company’s earnings to the shareholders of the company. A…

Q: The Gordon growth model (only one possible answer) uses earnings, but not the dividends for…

A: The Gordon Growth Model, often known as the dividend discount model, is a stock valuation technique…

Q: Currently, your credit card has a balance of $14,000. The credit card has an effective monthly…

A: The number of monthly payments may be calculated through following formula Present value =…

Q: What is the market price of a $1,000, 5 percent bond paying a semiannual coupon if comparable market…

A: Par Value = $1,000 Time Period = 15 Years Coupon Rate = 5% (Semi-annual) Yield = 4%

E4

Step by step

Solved in 3 steps

- You are the lucky winner of the Ohio Lottery ! Congratulations. The Lottery tells you that you have won a $20,000,000 prize that will be paid in annual installments of $1,000,000 for 20 years. If interest rates on alternative investments in the market are 8%, what is the actual value (PV) of your prize? Round to the nearest 1,000, and show your work.You just won a $625,000 lottery prize! You will receive $25,000 per year for the next 25 years, starting today, a total of $625,000. If the current interest rate is 1.9% compounded annually, what is the cash value of this prize?Assume you win a lottery, and you are offered the following stream of payments by the lottery commission: $25,000 today, $32,000 one year from now, another $32,000 two years from now, and a final payment of $55,000 three years from now. You accept the offer. If you invest all of these proceeds at 6% compounded annually and extract nothing from the investment, how much will you have at the end of the fourth year?

- Assume you win a lottery, and you are offered the following stream of payments by the lottery commission: $25,000 today, $32,000 one year from now, another $32,000 two years from now, and a final payment of $55,000 three years from now. You accept the offer. If you invest all of these proceeds at 6% compounded annually and extract nothing from the investment, how much will you have at the end of the fourth year? Excel Formula PleaseYou have just won 50 million in the lottery, payable in equal yearly installments over the next 20 years (first payment to be made immediately). Instead of taking the annual payments, you also have the option of receiving a lump sum amount immediately. If the interest rate is 6% per year, what is the minimum lump sum amount you would except in place for the payments? What if the interest rate is 10% per year? Please show the formula and answer.You have just won a large lottery prize. The Lottery Company says the prize will be paid to you in 8 instalments of $70000, with the first payment occurring today (beginning of year 1), and subsequent payments occurring at the beginning of each year. If the typical market interest rates suggest that you can invest money and earn an interest rate of 9%, compounded annually, then how much is the lottery actually worth today? The solution, please. The correct answer is 422307.

- To give you a start, here is something you can compute and discuss among yourselves: Play-2-Win is the latest lottery game in your country, and you happen to be the latest winner of $10.5 million. Your government has a guarantee on the funds and will not be paid before 3 years from today. You can however sell your claim today at a rate of 8 percent for a lump sum cash payment. What is the least amount you will sell your claim? Beginning this year, Mary is planning to save $800 each year for the next six years to take a vacation to commemorate the seventh year of her career. Assuming the interest rate offered by her bank is 9 percent annually, how much will Mary have in the account at the end of seven years? If Mary increases her savings to $1,500 annually, will this be enough to take care of her vacation which is estimated to cost $15,000. Suggested Answers that you should arrive at after computing and discussing. Give the questions a try when you are ready. Question 1:…The prize in last week’s lottery was estimated to be worth $90 million. If you were lucky enough to win, the payment will be $3.6 million per year over the next 25 years. Assume that the first installment is received immediately. If interest rates are 6%, what is the present value of the prize? If interest rates are 6%, what is the future value after 25 years? How would your answers change if the payments were received at the end of each year? How would your answers change if the interest rate was higher?Alicia is considering two offers-to-purchase that she has received on a residential building lot she wishes to sell. One is a cash offer of $145,000. The other offer consists of three payments of $49,000-one now, one in six months, and one in twelve months. Which offer has the larger economic value if Alicia can earn 4.4% compounded quarterly on low-risk investments? How much more (in current dollars) is the better offer worth?

- You have won a state lottery prize quoted as “$12 million dollar lottery”, what this really mean is that if you take the monthly payments of $50,000 for 20 years, you will have a total payout of $12 million. If the appropriate interest (discount) rate is 6.6% APR, what would be the cash payout on this lottery today?Sima has won the Wisconsin lottery with a jackpot of $10,000,000. She will be paid out in 20 equal annual installments with the first payment made immediately. If she had the money now she could invest it in an account that generates 9% compounded annually. What is the present value of the stream of payments? Present value of the lottery winnings (round up to the nearest dollar):you have just won the lottery and will receive $460,000 in one year. you will receive payments for 21 years, and the payments will increase 4 percent per year. if the appropriate discount rate is 11 percent, what is the present value of your winnings? Please explain how to solve using the financial calculator to show and explain steps thanks