The Polaris Company uses a job-order costing system. The following transactions occurred in October. a. Raw materials purchased on account, $209,000. b. Raw materials used in production, $189,000 ($151,200 direct materials and $37,800 indirect materials). c Accrued direct labor cost of $50,000 and indirect labor cost of $21,000. d. Depreciation recorded on factory equipment, $105,000. e. Other manufacturing overhead costs accrued during October, $129,000. E The company applies manufacturing overhead cost to production using a predetermined rate of $10 per machine-hour. A total of 76,300 machine-hours were used in October. g Jobs costing $10,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $450,000 to complete according to their job cost sheets were shipped to customers during the month. These Jobs were sold on account at 26% above cost Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $37,000.

The Polaris Company uses a job-order costing system. The following transactions occurred in October. a. Raw materials purchased on account, $209,000. b. Raw materials used in production, $189,000 ($151,200 direct materials and $37,800 indirect materials). c Accrued direct labor cost of $50,000 and indirect labor cost of $21,000. d. Depreciation recorded on factory equipment, $105,000. e. Other manufacturing overhead costs accrued during October, $129,000. E The company applies manufacturing overhead cost to production using a predetermined rate of $10 per machine-hour. A total of 76,300 machine-hours were used in October. g Jobs costing $10,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $450,000 to complete according to their job cost sheets were shipped to customers during the month. These Jobs were sold on account at 26% above cost Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $37,000.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter2: Job Order Costing

Section: Chapter Questions

Problem 1PA: Barnes Company uses a job order cost system. The following data summarize the operations related to...

Related questions

Question

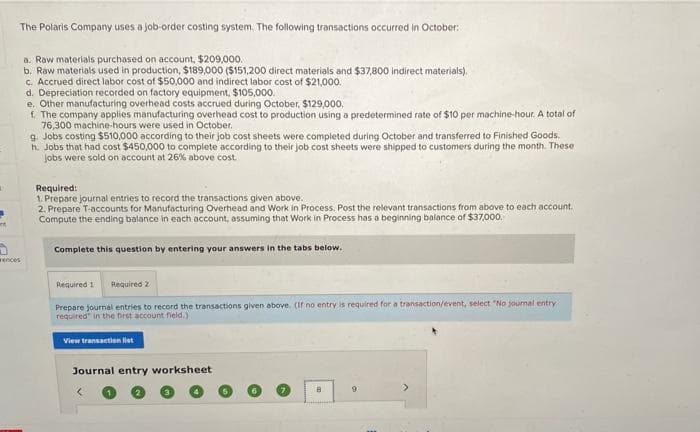

Transcribed Image Text:The Polaris Company uses a job-order costing system. The following transactions occurred in October:

a. Raw materials purchased on account, $209,000.

b. Raw materials used in production, $189,000 ($151,200 direct materials and $37,800 indirect materials).

C. Accrued direct labor cost of $50,000 and indirect labor cost of $21,000.

d. Depreciation recorded on factory equipment, $105,000.

e. Other manufacturing overhead costs accrued during October, $129,000,

f. The company applies manufacturing overhead cost to production using a predetermined rate of $10 per machine-hour. A total of

76,300 machine-hours were used in October.

9 Jobs costing $510,000 according to their job cost sheets were completed during October and transferred to Finished Goods.

h. Jobs that had cost $450,000 to complete according to their job cost sheets were shipped to customers during the month. These

Jobs were sold on account at 26% above cost

Required:

1. Prepare journal entries to record the transactions given above.

2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account.

Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $37,000.

nt.

Complete this question by entering your answers in the tabs below.

wences

Required 1

Required 2

Prepare journal entries to record the transactions given above. (if no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

View transaction liet

Journal entry worksheet

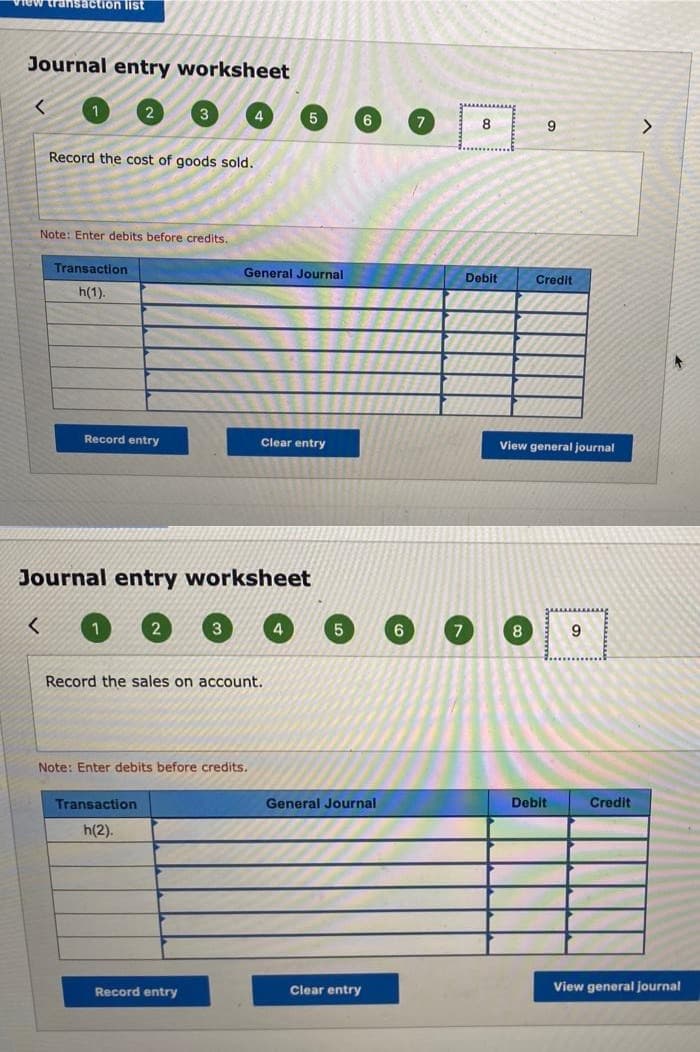

Transcribed Image Text:View transaction list

Journal entry worksheet

1

3

7

8

Record the cost of goods sold.

Note: Enter debits before credits.

Transaction

General Journal

Dobit

Credit

h(1).

Record entry

Clear entry

View general journal

Journal entry worksheet

2

3

4

6.

7

8

9.

Record the sales on account.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

h(2).

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,