The price per share of stock for a sample of 25 companies was recorded at the beginning of the first financial quarter and then again at the end of the first financial quarter. How stocks perform during the f quarter is an indicator of what is ahead for the stock market and the economy. Use the sample data in the file StockQuarter to answer the following. Click on the datafile logo to reference the data. DATA file Company Bank of New York Mellon Kraft Foods E.I. du Pont de Nemours and Company Consolidated Edison Johnson & Johnson Union Pacific Comcast Applied Materials Pfizer , 7.46) (to 3 decimals) General Electric AT&T Cisco Systems Home Depot JP Morgan Chase Procter & Gamble Verizon Devon Energy Lilly Microsoft Coca Cola Qualcomm Exxon Mobil Corporation PG&E Corporation Oracle Corporation Chevron a. Let di denote the percentage change in price per share for company i where Beginning End of 1st of 1st d₁ = ! Quarter 53.82 77.02 109.00 83.58 139.23 135.78 41.07 53.04 36.44 17.98 38.54 38.86 188.03 107.95 90.65 53.53 42.23 84.68 85.95 45.59 65.20 85.03 44.49 46.63 127.58 Quarter 54.19 55.70 102.57 79.95 126.01 132.73 32.06 50.91 35.40 14.05 32.54 44.83 184.63 108.78 71.96 48.82 36.20 79.07 95.00 42.59 50.82 76.95 end of 1" quarter price per share - beginning of 1" quarter price per share beginning of 1 quarter price per share Use the sample mean of these values to estimate the percentage change in the stock price over the first quarter. Do not round intermediate calculations. Enter negative value as negative number, if any. (to 3 decimals) 46.27 45.95 129.86 b. What is the 95% confidence interval estimate of the population mean percentage change in the price per share of stock during the first quarter? Do not round intermediate calculations. Enter negative va megative numbers, if any. Confidence interval (

The price per share of stock for a sample of 25 companies was recorded at the beginning of the first financial quarter and then again at the end of the first financial quarter. How stocks perform during the f quarter is an indicator of what is ahead for the stock market and the economy. Use the sample data in the file StockQuarter to answer the following. Click on the datafile logo to reference the data. DATA file Company Bank of New York Mellon Kraft Foods E.I. du Pont de Nemours and Company Consolidated Edison Johnson & Johnson Union Pacific Comcast Applied Materials Pfizer , 7.46) (to 3 decimals) General Electric AT&T Cisco Systems Home Depot JP Morgan Chase Procter & Gamble Verizon Devon Energy Lilly Microsoft Coca Cola Qualcomm Exxon Mobil Corporation PG&E Corporation Oracle Corporation Chevron a. Let di denote the percentage change in price per share for company i where Beginning End of 1st of 1st d₁ = ! Quarter 53.82 77.02 109.00 83.58 139.23 135.78 41.07 53.04 36.44 17.98 38.54 38.86 188.03 107.95 90.65 53.53 42.23 84.68 85.95 45.59 65.20 85.03 44.49 46.63 127.58 Quarter 54.19 55.70 102.57 79.95 126.01 132.73 32.06 50.91 35.40 14.05 32.54 44.83 184.63 108.78 71.96 48.82 36.20 79.07 95.00 42.59 50.82 76.95 end of 1" quarter price per share - beginning of 1" quarter price per share beginning of 1 quarter price per share Use the sample mean of these values to estimate the percentage change in the stock price over the first quarter. Do not round intermediate calculations. Enter negative value as negative number, if any. (to 3 decimals) 46.27 45.95 129.86 b. What is the 95% confidence interval estimate of the population mean percentage change in the price per share of stock during the first quarter? Do not round intermediate calculations. Enter negative va megative numbers, if any. Confidence interval (

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.5: Comparing Sets Of Data

Problem 26PFA

Related questions

Question

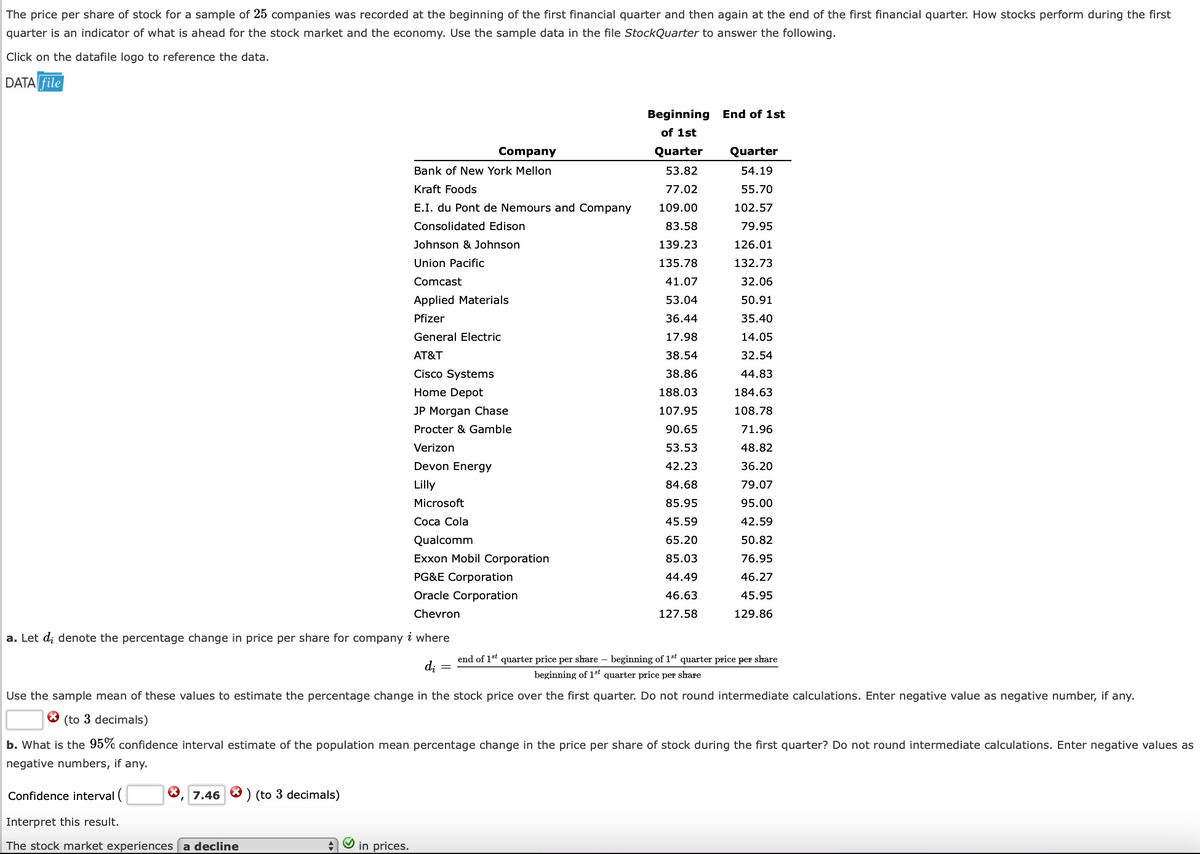

Transcribed Image Text:The price per share of stock for a sample of 25 companies was recorded at the beginning of the first financial quarter and then again at the end of the first financial quarter. How stocks perform during the first

quarter is an indicator of what is ahead for the stock market and the economy. Use the sample data in the file StockQuarter to answer the following.

Click on the datafile logo to reference the data.

DATA file

a. Let di denote the percentage change in price per share for company i where

7.46

Confidence interval

Interpret this result.

The stock market experiences a decline

Company

Bank of New York Mellon

Kraft Foods

E.I. du Pont de Nemours and Company

Consolidated Edison

) (to 3 decimals)

Johnson & Johnson

Union Pacific

Comcast

Applied Materials.

Pfizer

General Electric

AT&T

Cisco Systems

Home Depot

✔

JP Morgan Chase

Procter & Gamble

Verizon

Devon Energy

Lilly

Microsoft

Coca Cola

Qualcomm

Exxon Mobil Corporation

PG&E Corporation

Oracle Corporation

Chevron

end of 1st quarter price per share - beginning of 1st quarter price per share

beginning of 1st quarter price per share

Use the sample mean of these values to estimate the percentage change in the stock price over the first quarter. Do not round intermediate calculations. Enter negative value as negative number, if any.

(to 3 decimals)

in prices.

di

b. What is the 95% confidence interval estimate of the population mean percentage change in the price per share of stock during the first quarter? Do not round intermediate calculations. Enter negative values as

negative numbers, if any.

Beginning End of 1st

of 1st

=

Quarter

53.82

77.02

109.00

83.58

139.23

135.78

41.07

53.04

36.44

17.98

38.54

38.86

188.03

107.95

90.65

53.53

42.23

84.68

85.95

45.59

65.20

85.03

44.49

46.63

127.58

Quarter

54.19

55.70

102.57

79.95

126.01

132.73

32.06

50.91

35.40

14.05

32.54

44.83

184.63

108.78

71.96

48.82

36.20

79.07

95.00

42.59

50.82

76.95

46.27

45.95

129.86

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt