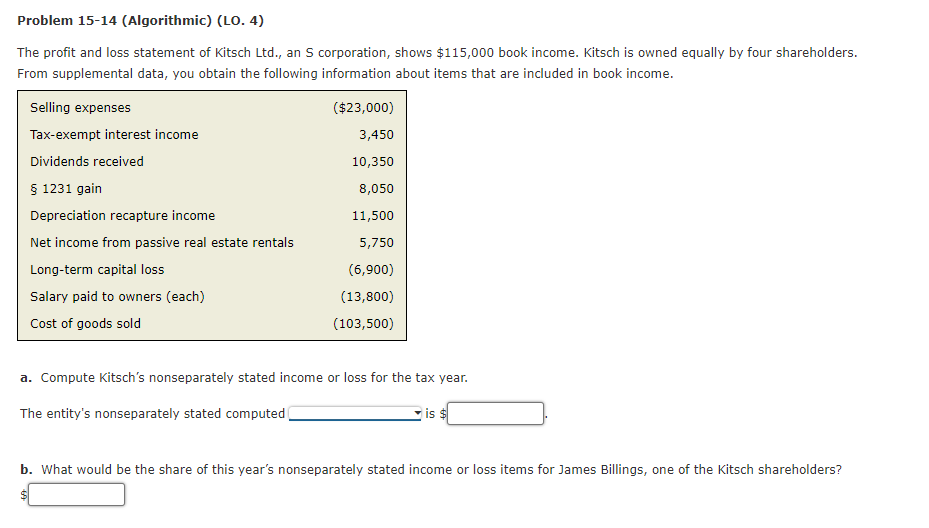

The profit and loss statement of Kitsch Ltd., an S corporation, shows $115,000 book income. Kitsch is owned equally by four shareholders. From supplemental data, you obtain the following information about items that are included in book income. Selling expenses ($23,000) Tax-exempt interest income 3,450 Dividends received 10,350 5 1231 gain 8,050 Depreciation recapture income 11,500 Net income from passive real estate rentals 5,750 Long-term capital loss (6,900) Salary paid to owners (each) (13,800) Cost of goods sold (103,500) a. Compute Kitsch's nonseparately stated income or loss for the tax year. The entity's nonseparately stated computed is s b. What would be the share of this year's nonseparately stated income or loss items for James Billings, one of the Kitsch shareholders?

The profit and loss statement of Kitsch Ltd., an S corporation, shows $115,000 book income. Kitsch is owned equally by four shareholders. From supplemental data, you obtain the following information about items that are included in book income. Selling expenses ($23,000) Tax-exempt interest income 3,450 Dividends received 10,350 5 1231 gain 8,050 Depreciation recapture income 11,500 Net income from passive real estate rentals 5,750 Long-term capital loss (6,900) Salary paid to owners (each) (13,800) Cost of goods sold (103,500) a. Compute Kitsch's nonseparately stated income or loss for the tax year. The entity's nonseparately stated computed is s b. What would be the share of this year's nonseparately stated income or loss items for James Billings, one of the Kitsch shareholders?

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 56P

Related questions

Question

Transcribed Image Text:Problem 15-14 (Algorithmic) (LO. 4)

The profit and loss statement of Kitsch Ltd., an S corporation, shows $115,000 book income. Kitsch is owned equally by four shareholders.

From supplemental data, you obtain the following information about items that are included in book income.

Selling expenses

($23,000)

Tax-exempt interest income

3,450

Dividends received

10,350

5 1231 gain

8,050

Depreciation recapture income

11,500

Net income from passive real estate rentals

5,750

Long-term capital loss

(6,900)

Salary paid to owners (each)

(13,800)

Cost of goods sold

(103,500)

a. Compute Kitsch's nonseparately stated income or loss for the tax year.

The entity's nonseparately stated computed

is $

b. What would be the share of this year's nonseparately stated income or loss items for James Billings, one of the Kitsch shareholders?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you