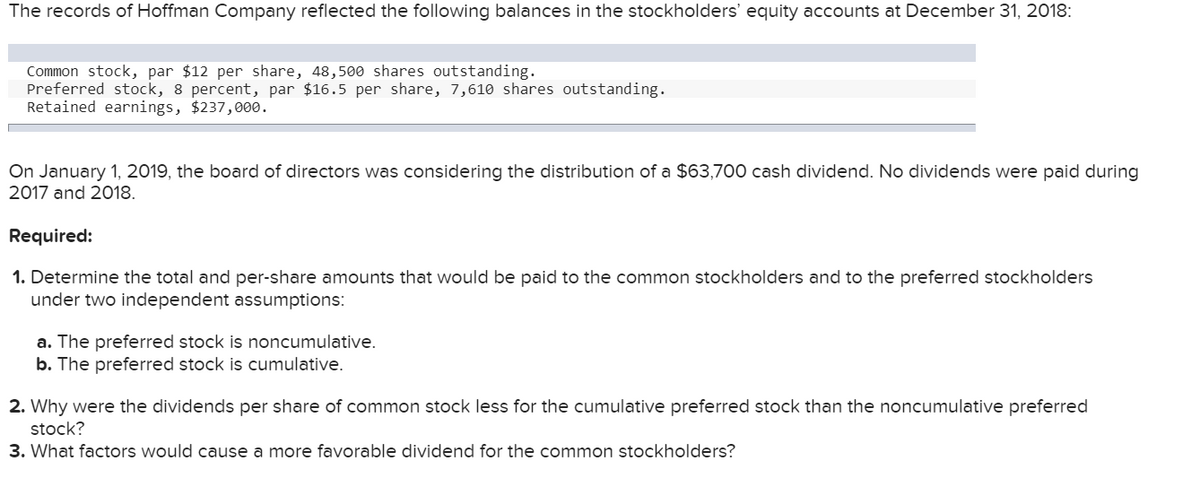

The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2018: Common stock, par $12 per share, 48,500 shares outstanding. Preferred stock, 8 percent, par $16.5 per share, 7,610 shares outstanding. Retained earnings, $237,000. On January 1, 2019, the board of directors was considering the distribution of a $63,700 cash dividend. No dividends were paid during 2017 and 2018. Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favorable dividend for the common stockholders?

The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2018: Common stock, par $12 per share, 48,500 shares outstanding. Preferred stock, 8 percent, par $16.5 per share, 7,610 shares outstanding. Retained earnings, $237,000. On January 1, 2019, the board of directors was considering the distribution of a $63,700 cash dividend. No dividends were paid during 2017 and 2018. Required: 1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. 2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred stock? 3. What factors would cause a more favorable dividend for the common stockholders?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

Transcribed Image Text:The records of Hoffman Company reflected the following balances in the stockholders' equity accounts at December 31, 2018:

Common stock, par $12 per share, 48,500 shares outstanding.

Preferred stock, 8 percent, par $16.5 per share, 7,610 shares outstanding.

Retained earnings, $237,000.

On January 1, 2019, the board of directors was considering the distribution of a $63,700 cash dividend. No dividends were paid during

2017 and 2018.

Required:

1. Determine the total and per-share amounts that would be paid to the common stockholders and to the preferred stockholders

under two independent assumptions:

a. The preferred stock is noncumulative.

b. The preferred stock is cumulative.

2. Why were the dividends per share of common stock less for the cumulative preferred stock than the noncumulative preferred

stock?

3. What factors would cause a more favorable dividend for the common stockholders?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning