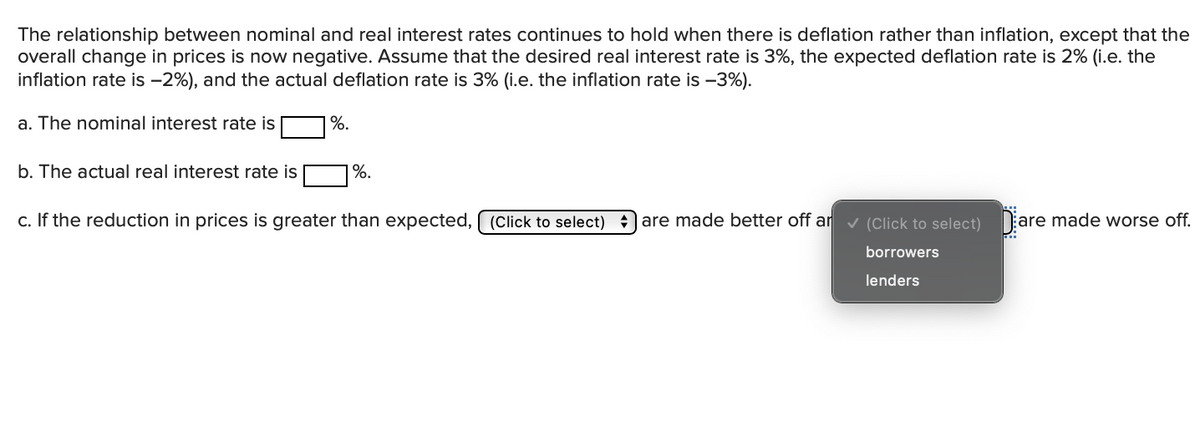

The relationship between nominal and real interest rates continues to hold when there is deflation rather than inflation, except that the overall change in prices is now negative. Assume that the desired real interest rate is 3%, the expected deflation rate is 2% (i.e. the inflation rate is -2%), and the actual deflation rate is 3% (i.e. the inflation rate is –3%). a. The nominal interest rate is %. b. The actual real interest rate is |%. c. If the reduction in prices is greater than expected, (Click to select) + are made better off ar v (Click to select) Djare made worse off. borrowers lenders

The relationship between nominal and real interest rates continues to hold when there is deflation rather than inflation, except that the overall change in prices is now negative. Assume that the desired real interest rate is 3%, the expected deflation rate is 2% (i.e. the inflation rate is -2%), and the actual deflation rate is 3% (i.e. the inflation rate is –3%). a. The nominal interest rate is %. b. The actual real interest rate is |%. c. If the reduction in prices is greater than expected, (Click to select) + are made better off ar v (Click to select) Djare made worse off. borrowers lenders

Chapter18: Introduction To Macroeconomics: Unemployment, Inflation, And Economic Fluctuations

Section: Chapter Questions

Problem 13P

Related questions

Question

Please answer asap! (4)

Transcribed Image Text:The relationship between nominal and real interest rates continues to hold when there is deflation rather than inflation, except that the

overall change in prices is now negative. Assume that the desired real interest rate is 3%, the expected deflation rate is 2% (i.e. the

inflation rate is -2%), and the actual deflation rate is 3% (i.e. the inflation rate is -3%).

a. The nominal interest rate is

%.

b. The actual real interest rate is

%.

c. If the reduction in prices is greater than expected, (Click to select)

|are made better off ar v (Click to select) are made worse off.

borrowers

lenders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax