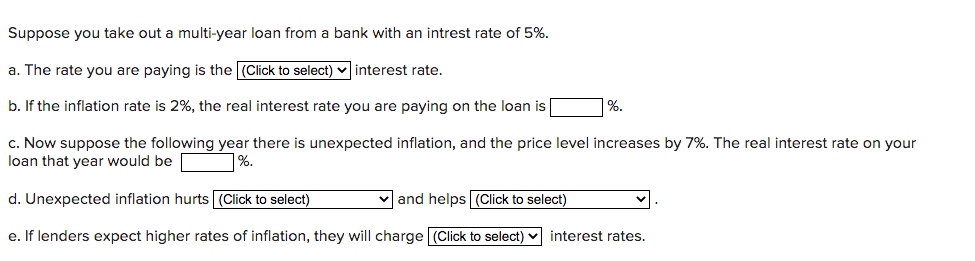

Suppose you take out a multi-year loan from a bank with an intrest rate of 5%. a. The rate you are paying is the (Click to select) |interest rate. b. If the inflation rate is 2%, the real interest rate you are paying on the loan is |%. c. Now suppose the following year there is unexpected inflation, and the price level increases by 7%. The real interest rate on your loan that year would be |%. d. Unexpected inflation hurts (Click to select) |and helps (Click to select) e. If lenders expect higher rates of inflation, they will charge (Click to select) ♥ interest rates.

Suppose you take out a multi-year loan from a bank with an intrest rate of 5%. a. The rate you are paying is the (Click to select) |interest rate. b. If the inflation rate is 2%, the real interest rate you are paying on the loan is |%. c. Now suppose the following year there is unexpected inflation, and the price level increases by 7%. The real interest rate on your loan that year would be |%. d. Unexpected inflation hurts (Click to select) |and helps (Click to select) e. If lenders expect higher rates of inflation, they will charge (Click to select) ♥ interest rates.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter12: Money Growth And Intlation

Section: Chapter Questions

Problem 6PA

Related questions

Question

Transcribed Image Text:Suppose you take out a multi-year loan from a bank with an intrest rate of 5%.

a. The rate you are paying is the (Click to select) v interest rate.

b. If the inflation rate is 2%, the real interest rate you are paying on the loan is

%.

c. Now suppose the following year there is unexpected inflation, and the price level increases by 7%. The real interest rate on your

loan that year would be

%.

d. Unexpected inflation hurts (Click to select)

v and helps (Click to select)

e. If lenders expect higher rates of inflation, they will charge (Click to select)

interest rates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax