Made an adjustment for the cost of the insurance that expired in 2020.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 24CE

Related questions

Question

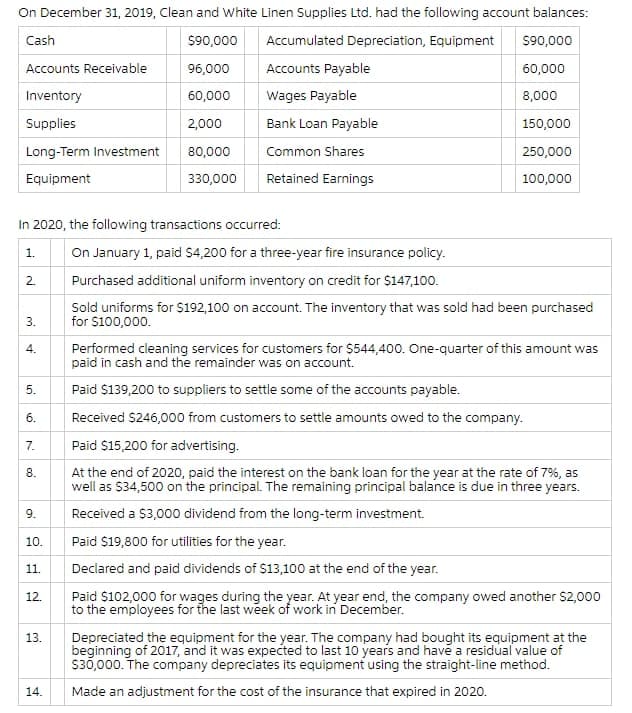

Transcribed Image Text:On December 31, 2019, Clean and White Linen Supplies Ltd. had the following account balances:

Cash

S90,000

Accumulated Depreciation, Equipment

S90,000

Accounts Receivable

96,000

Accounts Payable

60,000

Inventory

60,000

Wages Payable

8,000

Supplies

2,000

Bank Loan Payable

150,000

Long-Term Investment

80,000

Common Shares

250,000

Equipment

330,000

Retained Earnings

100,000

In 2020, the following transactions occurred:

On January 1, paid S4,200 for a three-year fire insurance policy.

1.

2.

Purchased additional uniform inventory on credit for $147,10o.

Sold uniforms for S192,100 on account. The inventory that was sold had been purchased

for $100,000.

3.

Performed cleaning services for customers for $544,40o. One-quarter of this amount was

paid in cash and the remainder was on account.

4.

Paid $139,200 to suppliers to settle some of the accounts payable.

Received $246,000 from customers to settle amounts owed to the company.

7.

Paid $15,200 for advertising.

At the end of 2020, paid the interest on the bank loan for the year at the rate of 7%, as

well as $34,500 on the principal. The remaining principal balance is due in three years.

8.

9.

Received a $3,000 dividend from the long-term investment.

10.

Paid $19,800 for utilities for the year.

Declared and paid dividends of $13,100 at the end of the year.

11.

12.

Paid $102,000 for wages during the year. At year end, the company owed another $2,000

to the employees for the last week of work in December.

Depreciated the equipment for the year. The company had bought its equipment at the

beginning of 2017, and it was expected to last 10 years and have a residual value of

S30,000. The company depreciates its equipment using the straight-line method.

13.

14.

Made an adjustment for the cost of the insurance that expired in 2020.

5.

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning