depreciation expense

Q: On 1st Jan 2020 the cost of furniture was OMR 15000 and depreciation is charged at 12% per year.…

A: All fixed assets loses their value over the period of time. Depreciation is charged in books of…

Q: 1. What amount of depreciation should be reported in the historical cost income statement for 2021?…

A: 1. Depreciation Expense based on Historical Cost = P5,000,000/5years = P1,000,000 2.…

Q: 2. A building is purchased on June 1, 2019, and has a value of $360,000. Assume that the Declining…

A: Double declining balance method is one of the depreciation method which provides more depreciation…

Q: Depreciation of equipment during 2021 was overstated by P 16,000. What would be the adjusting entry…

A: An adjusting journal entry is a journal entry made in a company's general ledger at the end of an…

Q: Compute the annual depreciation to be charged, beginning with 2019. Annual depreciation…

A: Depreciation is recorded on the cost of fixed assets to record a reduction in value. It can be…

Q: 6. What is the depreciation expense for the year ended December 31, 2021?

A: Depreciation refers to the reduction in the value of asset due to its normal use and tear and wear.…

Q: What is the loss on repossession for the year ended December 31, 2022?

A: Loss on repossession is the loss on the sale of goods that are taken back because of non-payment of…

Q: Calculate the depreciation expense by double-declining balance for 2021.

A:

Q: a.) At what amount should Prince of Wales record the building on July 1,2020? b.) What is the annual…

A: Calculation of lease liability, this the amount which Prince of Wales should record. Lease Term…

Q: a. Prepare journal entry to record the revaluation on January 1, 2020. b. Prepare journal entry to…

A: Calculation for revaluation amount of assets Asset Cost as on 1 Jan 17 (A) Revalued % of Assets…

Q: For each asset, calculate its accumulated depreciation and carrying amount at December 31, 2021.…

A: Depreciation refers to the reduction in the value of asset due to its normal use and tear and wear.…

Q: Determine the Depreciation Expense for the calendar year 2019 on the following non - current assets…

A: Lets understand the basics. In straight line basis, depreciation is calculated in equal installment…

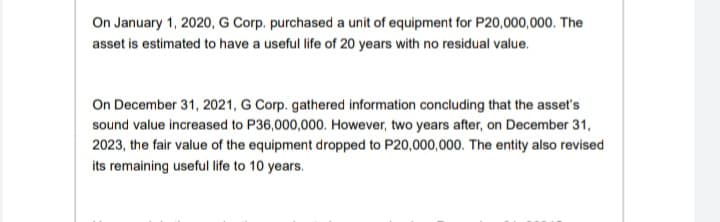

Q: What is the impairment loss for 2021 and 2022? What is the depreciation for 2023?

A: Impairment loss is a situation when carrying value of the asset is more than the fair value of the…

Q: Assume the company had used straight-line depreciation during 2020 and 2021. During 2022, the…

A: Straight-line depreciation expenses = (Cost of equipment - Residual Value) / Life of assets…

Q: What will be the Book value of asset on 1stt July 2021 if its original cost is Rs. 500,000 and its…

A: Book value of the assets is the original cost less accumulated depreciation. Accumulated…

Q: Assume on December 1, 2017, a company borrows funds to purchase equipment. The company will make the…

A: Solution: On Dec 31, 2018, the long term liabilities will be = Principal amount due in 2020 and 2021

Q: Your answer is incorrect. Compute the annual depreciation to be charged, beginning with 2022. (Round…

A: Depreciation is a reduction in value of asset due to wear and tear, technological advancement and…

Q: Using the formulas, determine the depreciation charge for year 2 and the book value at the end of…

A: The term depreciation refers to an accounting method which is used to allocate the cost of asset…

Q: The depreciation for 2022 and 2021 was P550,000 and P500,000, respectively. What amount was debited…

A: Depreciation refers to the reduction in the value of asset due to its normal use and tear and wear.…

Q: What amount should be recorded as depreciation for 2021? a. 287200 b. 384000 c. 460000

A: Depreciation represents the reduction in the value of an asset over a useful life of the asset. It…

Q: How much is the total carrying amount of the property as of June 30, 2021? Show the solutions…

A: Depreciation Cost The purpose of using the depreciation method to know the actual cost of the assets…

Q: a. Prepare journal entry to record the revaluation on January 1, 2020. b. Prepare journal entry to…

A: Hello. Since your question has multiple sub-parts, we will solve the first three sub-parts for you.…

Q: Sabrina's Fabric Land bought$5,000of equipment at the beginning of 2019. Amortization expense on the…

A: Given that: Cost of Equipment purchase = $5000 Amortization Expense in 2019 income statement = $400

Q: The market value of the property on the 31st of June 2026 is: The book value of the property on the…

A: Depreciation is the permanent and gradual decrease in the value of the asset over a period…

Q: In the preparation of Proton's statement of financial position as of December 31, 2022, what should…

A: Notes on Intangible Assets Amount Copyrights (Note 1) P30000 Excess of Cost over Fair value…

Q: What is the depreciation expense of the equipment for 2023? what is the recoverable amount of the…

A: An asset is said to be impaired if carrying amount of an asset is higher than the recoverable…

Q: year life and $10500 salvage value at the end of its useful life. What is the depreciation expense…

A: Straight line method of depreciation is the easiest method of depreciation where depreciation for…

Q: Show Depreciation entry for 2018 year

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: The 2020 financial statements for Leggett & Platt, Inc. report the following information: Year ended…

A: Computation of depreciation adjustments due to change in useful life of assets Total Cost of…

Q: Q1. What will be the value of accumulated depreciation in the year of 2021?

A: Depreciation refers to the loss in the value of a tangible asset over a period of time. There are…

Q: 2. Complete the natural resources section of the balance sheet on December 31, 2019, 2020, and 2021,…

A: 1 2019 Depletion deducted from income $66,080 Depletion included in inventory $22,420…

Q: Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a…

A: Year Depreciation expenses 2021 $4,280 2022 $5,840

Q: Depreciation has not been calculated. Can you please calculate the depreciation up to 31/03/2022…

A: Straight line Method: The technique of calculating depreciation and amortization known as the…

Q: Can you please show me the solution? Thank you so much in advance! For the year ended, December 31,…

A: Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: Compute the depreciation expense for the years indicated using the following methods. Depreciation…

A: Price of the machine = $112,200 The credit terms offered on the machine is 2/10, n/30 which means a…

Q: Compute the amount of accumulated depreciation on each bus at December 31, 2020. (I

A: Methods of Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset…

Q: Using the double-declining-balance method, depreciation for 2022 would be:

A: This is a method of Depreciation where Depreciation expense decreases with age of Asset. Higher…

Q: Assume on December 1, 2017, a company borrows funds to purchase equipment. The company will make the…

A: Answer: Long term liabilities are the liabilities which are overdue to be paid over the period of 12…

Q: Compute the revised annual depreciation on each asset in 2017.

A:

Q: how much is the depreciation expense for 2024 using SYD depreciation method?

A: Depreciation means allocation of cost of asset over the useful life of the asset.

Q: A) Prepare an amortization schedule for the lessor for 2021 and 2022. B) Prepare the journal entries…

A: A lease is an agreement describing the terms under which one business agrees to rent an asset or…

Q: Compute the depreciation for this asset for 2022 and 2023 using the double-declining-balance method.…

A:

Q: What is the depreciation of the building for 2021?

A: Depreciation is the reduction in the value of asset due to its normal use and tear and wear. It is…

Q: How much are the depreciation expenses for the year 2019

A: The depreciation expense is calculated on right to use of assets. The Right to use of assets…

Q: need help answering part D on total assets for 2022

A: Total assets is the total amount of asset side of the balance sheet. It includes both current assets…

Q: Compute the capital allowance, balancing charges and balancing allowance (if any) for each asset for…

A: Computation of balance of Lorry for each the relevant years of assessment up to the year of…

Q: At December 31, 2023, what will be the truck's adjusted book value reflecting the change in…

A: Given information is: Cost of Truck = $100,000 Useful life = 10 years Salvage value = $10,000…

Q: The correct percentage to use to calculate the depreciation allowance for a MACRS 3-year property…

A: Depreciation: It refers to a gradual decrease in the fixed asset’s value because of obsolescence,…

Q: What is the total contributed capital as of December 31, 2020?

A: Contributed capital is total amount received by company from investors for acquiring their rights in…

Step by step

Solved in 3 steps

- Petes Petroleum, Inc., an SEC registrant with a calendar year-end, is in the business of constructing and operating offs] lore oil platforms. Petes Petroleum is required legally to dismantle and remove the platforms at the end of their useful lives, which is estimated to be 10 years. On January 1, 2019, Pete constructed and began operating an offshore oil platform off the coast of Brazil. The total capitalized cost to construct the platform was 3,700,000. In addition, while the future cost of dismantling the oil platform is difficult to estimate, Pete believes there is a 40% chance that the future cost will be 1,425,000, a 40% chance it will be 1,650,000, and a 20% chance that it will cost 2,125,000. The appropriate discount rate is 12%, and Pete uses the straight-line method of depreciation. Required: 1. Prepare the journal entries that Pete should record in 2019 related to the oil platform. 2. Prepare an amortization schedule for the asset retirement obligation. 3. Next Level Prepare a table showing the effect of accounting for the asset retirement obligation on assets, liabilities, shareholders equity, and net income relative to accounting for the associated costs at the end of the assets service life when the expenditure is made.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.