The

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

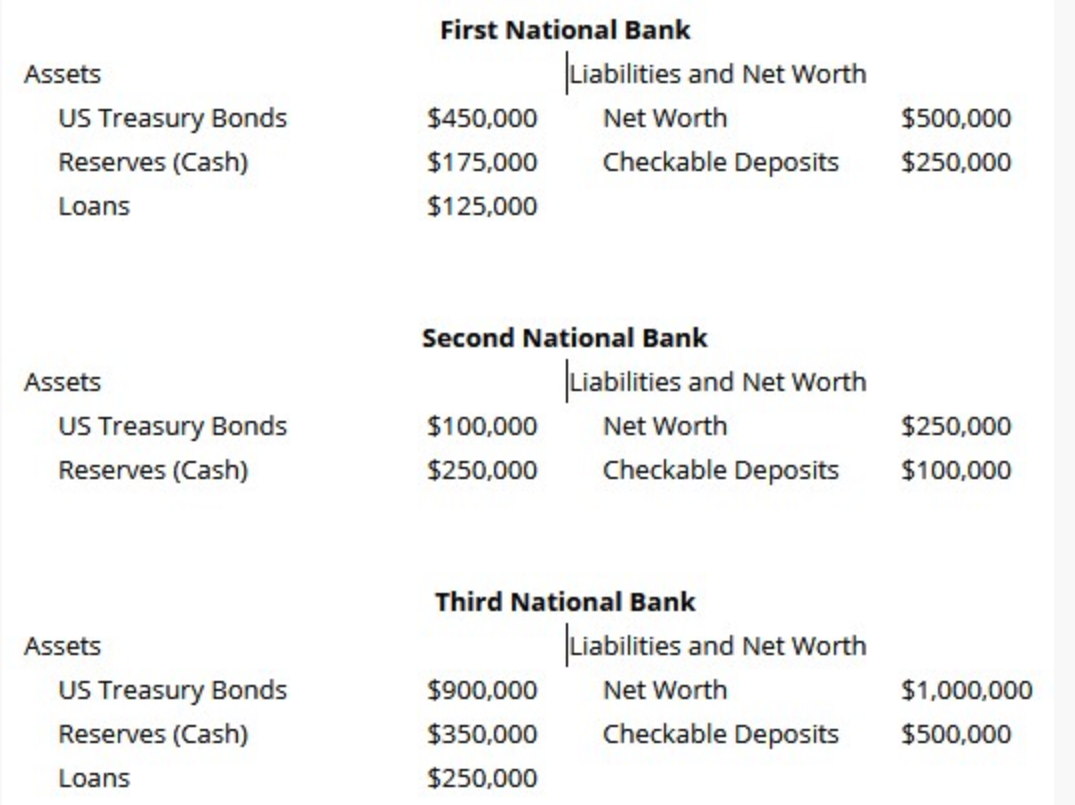

So based on the question asked, we just focus on the change in loan potential creation of the additional deposited $400,000 in the Second National Bank, rather than the new loan can be created from all three banks, is it correct? Please explain further.

Thank you so much in advance.

Will the amount of new loan be affected if the additional $400,000 was deposited in the Second National Bank?

Will the additional $400,000 which was deposited in the Second National Bank affect the new loan?