The /S equation is determined to be Y= 1506.77-2869.23i. The LM equation is given as i = 0.05 Initial equilibrium values of Y, C, I, and the real money supply are calculated as Y = 1,363 C = 723 / = 309 MIP = 2,488 Now suppose that the central bank hikes the interest rate to 6%. In a graph of the IS-LM model, this causes the LM curve to shift Following the change in the interest rate to 6%, the value of equilibrium real output becomes [ Following the change in the interest rate to 6%, the values of the new equilibrium C and / are: C= (Round your responses to the nearest integer.) | = (Round your responses to the nearest integer.) (Round your response to the nearest integer.)

The /S equation is determined to be Y= 1506.77-2869.23i. The LM equation is given as i = 0.05 Initial equilibrium values of Y, C, I, and the real money supply are calculated as Y = 1,363 C = 723 / = 309 MIP = 2,488 Now suppose that the central bank hikes the interest rate to 6%. In a graph of the IS-LM model, this causes the LM curve to shift Following the change in the interest rate to 6%, the value of equilibrium real output becomes [ Following the change in the interest rate to 6%, the values of the new equilibrium C and / are: C= (Round your responses to the nearest integer.) | = (Round your responses to the nearest integer.) (Round your response to the nearest integer.)

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter5: Business And Economic Forecasting

Section: Chapter Questions

Problem 9E: Savings-Mart (a chain of discount department stores) sells patio and lawn furniture. Sales are...

Related questions

Question

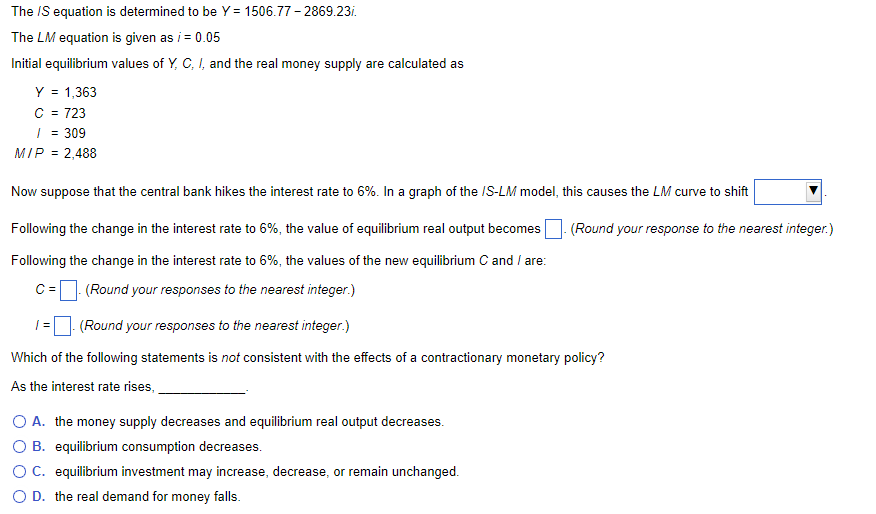

Transcribed Image Text:The /S equation is determined to be Y= 1506.77-2869.23/.

The LM equation is given as i = 0.05

Initial equilibrium values of Y, C, I, and the real money supply are calculated as

Y = 1,363

C = 723

/ = 309

MIP = 2,488

Now suppose that the central bank hikes the interest rate to 6%. In a graph of the IS-LM model, this causes the LM curve to shift

Following the change in the interest rate to 6%, the value of equilibrium real output becomes

Following the change in the interest rate to 6%, the values of the new equilibrium C and / are:

C =

(Round your responses to the nearest integer.)

1 =

(Round your responses to the nearest integer.)

Which of the following statements is not consistent with the effects of a contractionary monetary policy?

As the interest rate rises,

O A. the money supply decreases and equilibrium real output decreases.

O B. equilibrium consumption decreases.

O C. equilibrium investment may increase, decrease, or remain unchanged.

O D. the real demand for money falls.

(Round your response to the nearest integer.)

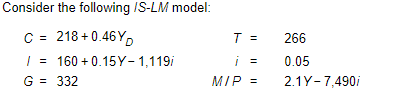

Transcribed Image Text:Consider the following /S-LM model:

C = 218 +0.46YD

/ = 160+ 0.15Y-1,119/

G = 332

T =

=

MIP =

266

0.05

2.1Y-7,490/

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning