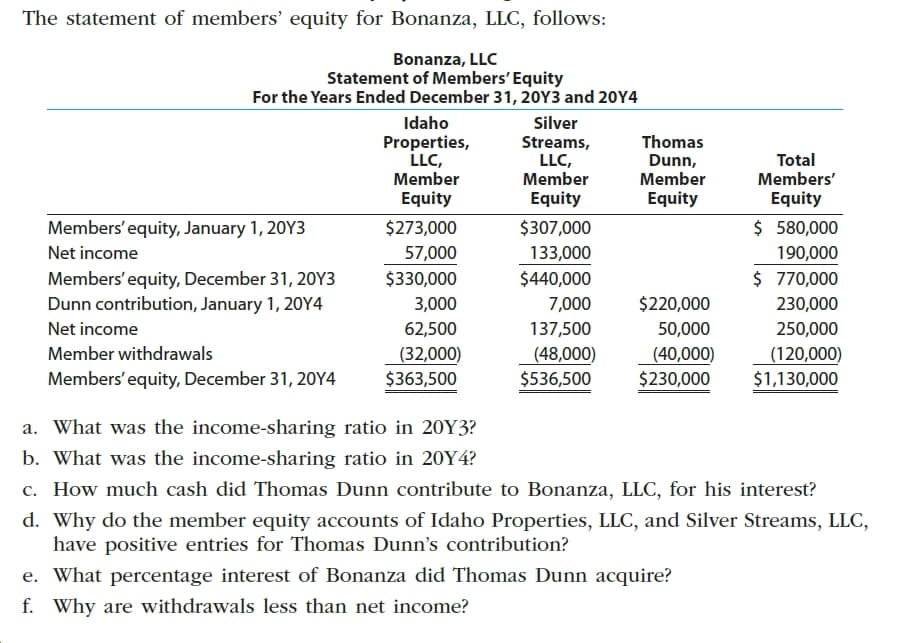

The statement of members' equity for Bonanza, LLC, follows: Bonanza, LLC Statement of Members' Equity For the Years Ended December 31, 20Y3 and 20Y4 Idaho Silver Properties, LLC, Member Equity Thomas Streams, LLC, Member Equity Total Members' Dunn, Member Equity Equity $ 580,000 Members' equity, January 1, 20Y3 $273,000 $307,000 Net income 57,000 133,000 190,000 $ 770,000 Members' equity, December 31, 20Y3 Dunn contribution, January 1, 20OY4 $330,000 $440,000 $220,000 3,000 7,000 230,000 137,500 250,000 Net income 62,500 50,000 Member withdrawals (32,000) $363,500 (48,000) (40,000) $230,000 (120,000) $1,130,000 $536,500 Members'equity, December 31, 20Y4 a. What was the income-sharing ratio in 20Y3? b. What was the income-sharing ratio in 20Y4? c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC, have positive entries for Thomas Dunn's contribution? e. What percentage interest of Bonanza did Thomas Dunn acquire? f. Why are withdrawals less than net income?

The statement of members' equity for Bonanza, LLC, follows: Bonanza, LLC Statement of Members' Equity For the Years Ended December 31, 20Y3 and 20Y4 Idaho Silver Properties, LLC, Member Equity Thomas Streams, LLC, Member Equity Total Members' Dunn, Member Equity Equity $ 580,000 Members' equity, January 1, 20Y3 $273,000 $307,000 Net income 57,000 133,000 190,000 $ 770,000 Members' equity, December 31, 20Y3 Dunn contribution, January 1, 20OY4 $330,000 $440,000 $220,000 3,000 7,000 230,000 137,500 250,000 Net income 62,500 50,000 Member withdrawals (32,000) $363,500 (48,000) (40,000) $230,000 (120,000) $1,130,000 $536,500 Members'equity, December 31, 20Y4 a. What was the income-sharing ratio in 20Y3? b. What was the income-sharing ratio in 20Y4? c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC, have positive entries for Thomas Dunn's contribution? e. What percentage interest of Bonanza did Thomas Dunn acquire? f. Why are withdrawals less than net income?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 7E: Basic Income Statement The following are selected account balances of Rule Corporation at the end of...

Related questions

Question

Transcribed Image Text:The statement of members' equity for Bonanza, LLC, follows:

Bonanza, LLC

Statement of Members' Equity

For the Years Ended December 31, 20Y3 and 20Y4

Idaho

Silver

Properties,

LLC,

Member

Equity

Thomas

Streams,

LLC,

Member

Equity

Total

Members'

Dunn,

Member

Equity

Equity

$ 580,000

Members' equity, January 1, 20Y3

$273,000

$307,000

Net income

57,000

133,000

190,000

$ 770,000

Members' equity, December 31, 20Y3

Dunn contribution, January 1, 20OY4

$330,000

$440,000

$220,000

3,000

7,000

230,000

137,500

250,000

Net income

62,500

50,000

Member withdrawals

(32,000)

$363,500

(48,000)

(40,000)

$230,000

(120,000)

$1,130,000

$536,500

Members'equity, December 31, 20Y4

a. What was the income-sharing ratio in 20Y3?

b. What was the income-sharing ratio in 20Y4?

c. How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest?

d. Why do the member equity accounts of Idaho Properties, LLC, and Silver Streams, LLC,

have positive entries for Thomas Dunn's contribution?

e. What percentage interest of Bonanza did Thomas Dunn acquire?

f. Why are withdrawals less than net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning