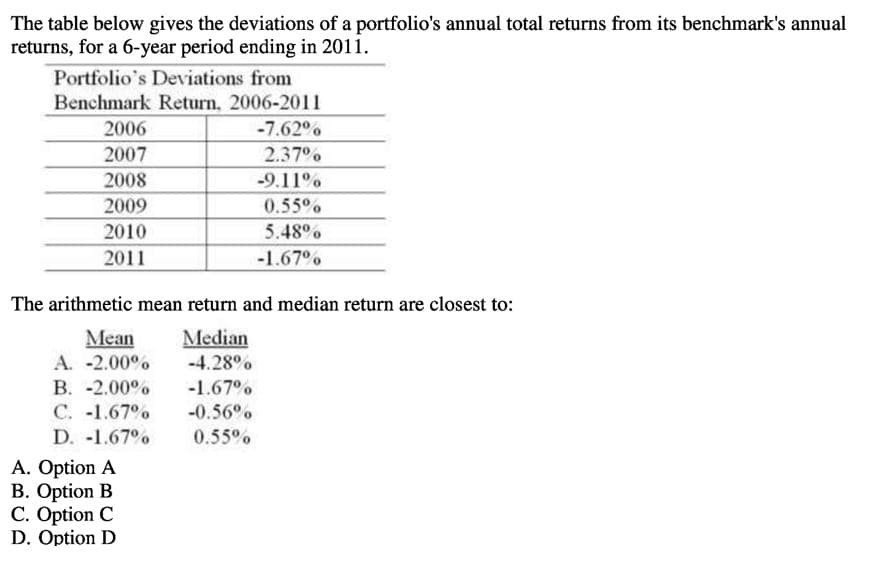

The table below gives the deviations of a portfolio's annual total returns from its benchmark's annual returns, for a 6-year period ending in 2011. Portfolio's Deviations from Benchmark Return, 2006-2011 2006 -7.62% 2007 2.37% 2008 -9.11% 2009 0.55 % 2010 5.48°% 2011 -1.67%

The table below gives the deviations of a portfolio's annual total returns from its benchmark's annual returns, for a 6-year period ending in 2011. Portfolio's Deviations from Benchmark Return, 2006-2011 2006 -7.62% 2007 2.37% 2008 -9.11% 2009 0.55 % 2010 5.48°% 2011 -1.67%

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Transcribed Image Text:The table below gives the deviations of a portfolio's annual total returns from its benchmark's annual

returns, for a 6-year period ending in 2011.

Portfolio's Deviations from

Benchmark Return, 2006-2011

2006

-7.62%

2007

2.37%

2008

-9.11%

2009

0.55 %

2010

5.48 %

2011

-1.67%

The arithmetic mean return and median return are closest to:

Mean

A. -2.00%

В. -2.00°

C. -1.67%

D. -1.67%

Median

-4.28%

-1.67°

-0.56°.

0.55%

A. Option A

B. Option B

C. Option C

D. Option D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, probability and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill