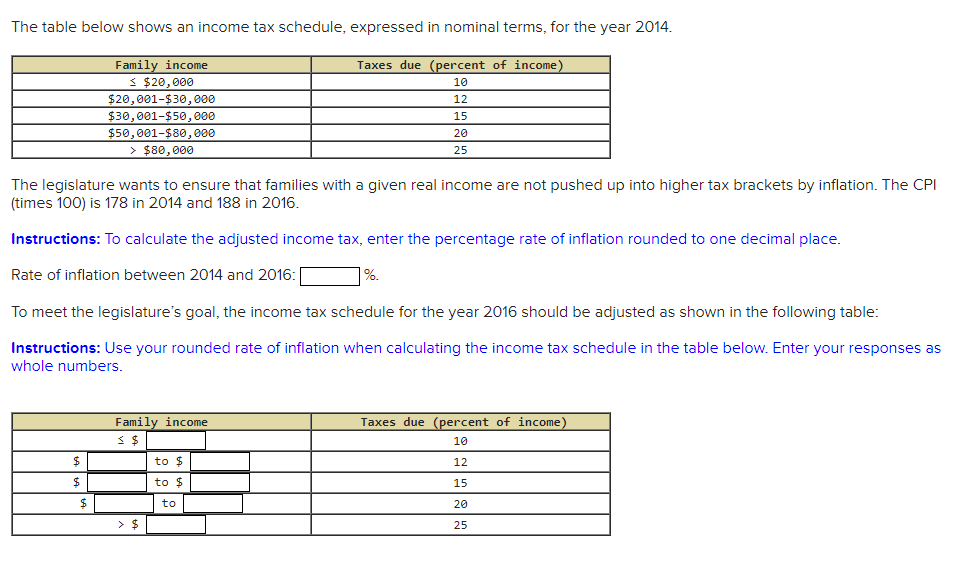

The table below shows an income tax schedule, expressed in nominal terms, for the year 2014. Taxes due (percent of income) 10 Family income ≤ $20,000 $20,001-$30,000 $30,001-$50,000 12 15 $50,001-$80,000 20 > $80,000 25 The legislature wants to ensure that families with a given real income are not pushed up into higher tax brackets by inflation. The CPI (times 100) is 178 in 2014 and 188 in 2016. Instructions: To calculate the adjusted income tax, enter the percentage rate of inflation rounded to one decimal place. Rate of inflation between 2014 and 2016: [ %. To meet the legislature's goal, the income tax schedule for the year 2016 should be adjusted as shown in the following table: Instructions: Use your rounded rate of inflation when calculating the income tax schedule in the table below. Enter your responses as whole numbers. $ $ Family income 5 $ > $ to $ to $ to Taxes due (percent of income) 10 12 15 20 25

The table below shows an income tax schedule, expressed in nominal terms, for the year 2014. Taxes due (percent of income) 10 Family income ≤ $20,000 $20,001-$30,000 $30,001-$50,000 12 15 $50,001-$80,000 20 > $80,000 25 The legislature wants to ensure that families with a given real income are not pushed up into higher tax brackets by inflation. The CPI (times 100) is 178 in 2014 and 188 in 2016. Instructions: To calculate the adjusted income tax, enter the percentage rate of inflation rounded to one decimal place. Rate of inflation between 2014 and 2016: [ %. To meet the legislature's goal, the income tax schedule for the year 2016 should be adjusted as shown in the following table: Instructions: Use your rounded rate of inflation when calculating the income tax schedule in the table below. Enter your responses as whole numbers. $ $ Family income 5 $ > $ to $ to $ to Taxes due (percent of income) 10 12 15 20 25

Chapter17: Inflation

Section: Chapter Questions

Problem 5SQ

Related questions

Question

Transcribed Image Text:The table below shows an income tax schedule, expressed in nominal terms, for the year 2014.

Family income

≤ $20,000

$20,001-$30,000

$30,001-$50,000

$50,001-$80,000

> $80,000

The legislature wants to ensure that families with a given real income are not pushed up into higher tax brackets by inflation. The CPI

(times 100) is 178 in 2014 and 188 in 2016.

Instructions: To calculate the adjusted income tax, enter the percentage rate of inflation rounded to one decimal place.

Rate of inflation between 2014 and 2016:

$

$

$

To meet the legislature's goal, the income tax schedule for the year 2016 should be adjusted as shown in the following table:

Instructions: Use your rounded rate of inflation when calculating the income tax schedule in the table below. Enter your responses as

whole numbers.

Taxes due (percent of income)

10

12

15

20

25

Family income

5 $

> $

to $

to $

to

%.

Taxes due (percent of income)

10

12

15

20

25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you