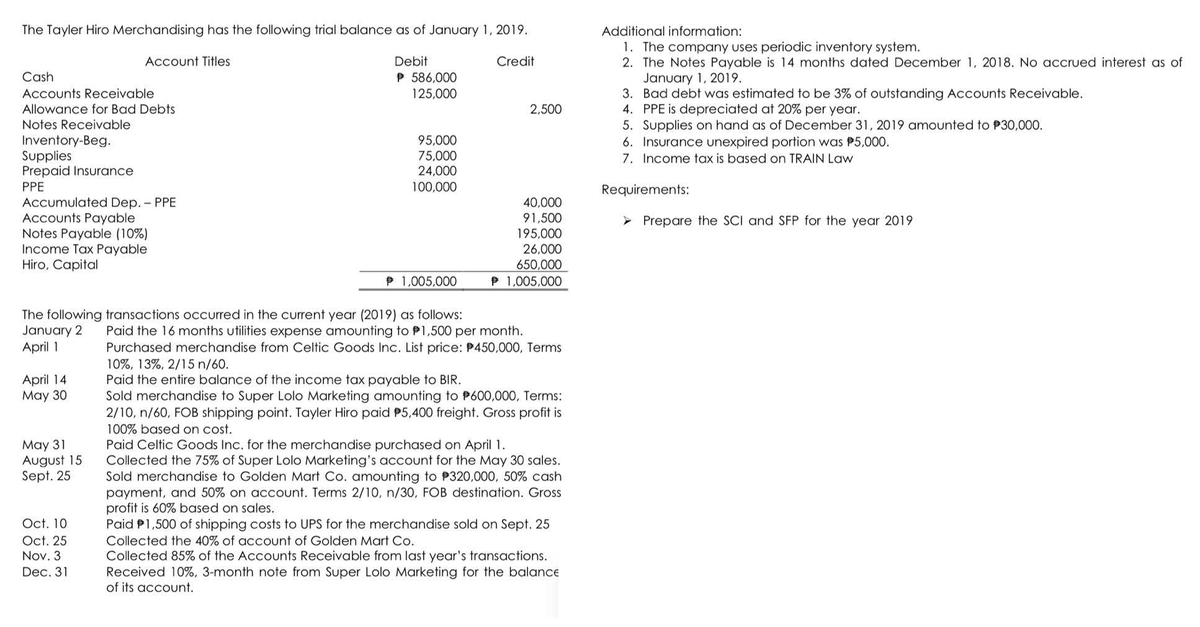

The Tayler Hiro Merchandising has the following trial balance as of January 1, 2019. Account Titles Credit Debit P 586,000 125,000 Cash Accounts Receivable Allowance for Bad Debts Notes Receivable Inventory-Beg. Supplies Prepaid Insurance PPE Accumulated Dep. - PPE Accounts Payable Notes Payable (10%) Income Tax Payable Hiro, Capital April 14 May 30 May 31 August 15 Sept. 25 95,000 75,000 24,000 100,000 ℗ 1,005,000 The following transactions occurred in the current year (2019) as follows: January 2 Paid the 16 months utilities expense amounting to P1,500 per month. April 1 Purchased merchandise from Celtic Goods Inc. List price: P450,000, Terms 10%, 13%, 2/15 n/60. Paid the entire balance of the income tax payable to BIR. Sold merchandise to Super Lolo Marketing amounting to P600,000, Terms: 2/10, n/60, FOB shipping point. Tayler Hiro paid $5,400 freight. Gross profit is 100% based on cost. Paid Celtic Goods Inc. for the merchandise purchased on April 1. Collected the 75% of Super Lolo Marketing's account for the May 30 sales. Sold merchandise to Golden Mart Co. amounting to P320,000, 50% cash payment, and 50% on account. Terms 2/10, n/30, FOB destination. Gross profit is 60% based on sales. Deides Paid P1,500 of shipping costs to UPS for the merchandise sold on Sept. 25 Collected the 40% of account of Golden Mart Co. Collected 85% of the Accounts Receivable from last year's transactions. Received 10%, 3-month note from Super Lolo Marketing for the balance of its account. Oct. 10 Oct. 25 Nov. 3 Dec. 31 2,500 40,000 91,500 195,000 26,000 650,000 P 1.005.000 Additional information: 1. The company uses periodic inventory system. 2. The Notes Payable is 14 months dated December 1, 2018. No accrued interest as of January 1, 2019. 3. Bad debt was estimated to be 3% of outstanding Accounts Receivable. 4. PPE is depreciated at 20% per year. 5. Supplies on hand as of December 31, 2019 amounted to P30,000. 6. Insurance unexpired portion was $5,000. 7. Income tax is based on TRAIN Law Requirements: Prepare the SCI and SFP for the year 2019

The Tayler Hiro Merchandising has the following trial balance as of January 1, 2019. Account Titles Credit Debit P 586,000 125,000 Cash Accounts Receivable Allowance for Bad Debts Notes Receivable Inventory-Beg. Supplies Prepaid Insurance PPE Accumulated Dep. - PPE Accounts Payable Notes Payable (10%) Income Tax Payable Hiro, Capital April 14 May 30 May 31 August 15 Sept. 25 95,000 75,000 24,000 100,000 ℗ 1,005,000 The following transactions occurred in the current year (2019) as follows: January 2 Paid the 16 months utilities expense amounting to P1,500 per month. April 1 Purchased merchandise from Celtic Goods Inc. List price: P450,000, Terms 10%, 13%, 2/15 n/60. Paid the entire balance of the income tax payable to BIR. Sold merchandise to Super Lolo Marketing amounting to P600,000, Terms: 2/10, n/60, FOB shipping point. Tayler Hiro paid $5,400 freight. Gross profit is 100% based on cost. Paid Celtic Goods Inc. for the merchandise purchased on April 1. Collected the 75% of Super Lolo Marketing's account for the May 30 sales. Sold merchandise to Golden Mart Co. amounting to P320,000, 50% cash payment, and 50% on account. Terms 2/10, n/30, FOB destination. Gross profit is 60% based on sales. Deides Paid P1,500 of shipping costs to UPS for the merchandise sold on Sept. 25 Collected the 40% of account of Golden Mart Co. Collected 85% of the Accounts Receivable from last year's transactions. Received 10%, 3-month note from Super Lolo Marketing for the balance of its account. Oct. 10 Oct. 25 Nov. 3 Dec. 31 2,500 40,000 91,500 195,000 26,000 650,000 P 1.005.000 Additional information: 1. The company uses periodic inventory system. 2. The Notes Payable is 14 months dated December 1, 2018. No accrued interest as of January 1, 2019. 3. Bad debt was estimated to be 3% of outstanding Accounts Receivable. 4. PPE is depreciated at 20% per year. 5. Supplies on hand as of December 31, 2019 amounted to P30,000. 6. Insurance unexpired portion was $5,000. 7. Income tax is based on TRAIN Law Requirements: Prepare the SCI and SFP for the year 2019

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 5C: Receivables Issues Magrath Company has an operating cycle of less than one year and provides credit...

Related questions

Question

100%

PLEASE SKIP IF YOU ALREADY DID THIS OTHERWISE DOWNVOTE. THANK YOU. I WILL UPVOTE

Transcribed Image Text:The Tayler Hiro Merchandising has the following trial balance as of January 1, 2019.

Debit

P 586,000

125,000

Cash

Accounts Receivable

Allowance for Bad Debts

Notes Receivable

Inventory-Beg.

Supplies

Prepaid Insurance

PPE

Accumulated Dep. - PPE

Accounts Payable

Notes Payable (10%)

Income Tax Payable

Hiro, Capital

Account Titles

April 14

May 30

May 31

August 15

Sept. 25

Oct. 10

Oct. 25

Nov. 3

Dec. 31

95,000

75,000

24,000

100,000

P 1,005,000

Credit

The following transactions occurred in the current year (2019) as follows:

January 2 Paid the 16 months utilities expense amounting to $1,500 per month.

April 1

Purchased merchandise from Celtic Goods Inc. List price: 450,000, Terms

10%, 13%, 2/15 n/60.

Paid the entire balance of the income tax payable to BIR.

Sold merchandise to Super Lolo Marketing amounting to P600,000, Terms:

2/10, n/60, FOB shipping point. Tayler Hiro paid $5,400 freight. Gross profit is

100% based on cost.

2,500

40,000

91,500

195,000

26,000

650,000

℗ 1,005,000

Paid Celtic Goods Inc. for the merchandise purchased on April 1.

Collected the 75% of Super Lolo Marketing's account for the May 30 sales.

Sold merchandise to Golden Mart Co. amounting to $320,000, 50% cash

payment, and 50% on account. Terms 2/10, n/30, FOB destination. Gross

profit is 60% based on sales.

Paid P1,500 of shipping costs to UPS for the merchandise sold on Sept. 25

Collected the 40% of account of Golden Mart Co.

Collected 85% of the Accounts Receivable from last year's transactions.

Received 10%, 3-month note from Super Lolo Marketing for the balance

of its account.

Additional information:

1. The company uses periodic inventory system.

2. The Notes Payable is 14 months dated December 1, 2018. No accrued interest as of

January 1, 2019.

3. Bad debt was estimated to be 3% of outstanding Accounts Receivable.

4. PPE is depreciated at 20% per year.

5. Supplies on hand as of December 31, 2019 amounted to $30,000.

6. Insurance unexpired portion was $5,000.

7. Income tax is based on TRAIN Law

Requirements:

> Prepare the SCI and SFP for the year 2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning