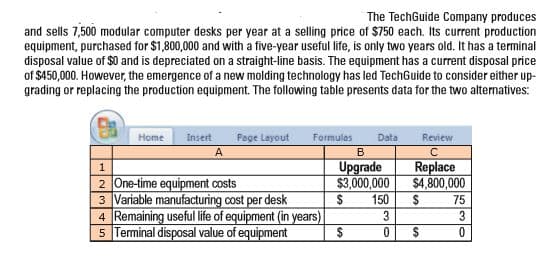

The TechGuide Company produces and sells 7,500 modular computer desks per year at a selling price of $750 each. Its current production equipment, purchased for $1,800,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $450,000. However, the emergence of a new molding technology has led TechGuide to consider either up- grading or replacing the production equipment. The following table presents data for the two alternatives: Home Insert Page Layout Formulas Data Review Upgrade $3,000,000 Replace $4,800,000 2 One-time equipment costs 3 Variable manufacturing cost per desk 4 Remaining useful life of equipment (in years) 5 Terminal disposal value of equipment 150 75 3 3 24 24

The TechGuide Company produces and sells 7,500 modular computer desks per year at a selling price of $750 each. Its current production equipment, purchased for $1,800,000 and with a five-year useful life, is only two years old. It has a terminal disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price of $450,000. However, the emergence of a new molding technology has led TechGuide to consider either up- grading or replacing the production equipment. The following table presents data for the two alternatives: Home Insert Page Layout Formulas Data Review Upgrade $3,000,000 Replace $4,800,000 2 One-time equipment costs 3 Variable manufacturing cost per desk 4 Remaining useful life of equipment (in years) 5 Terminal disposal value of equipment 150 75 3 3 24 24

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 9P

Related questions

Question

All equipment costs will continue to be

Q. Now suppose the one-time equipment cost to replace the production equipment is somewhat negotiable. All other data are as given previously. What is the maximum one-time equipment cost that TechGuide would be willing to pay to replace rather than upgrade the old equipment?

Transcribed Image Text:The TechGuide Company produces

and sells 7,500 modular computer desks per year at a selling price of $750 each. Its current production

equipment, purchased for $1,800,000 and with a five-year useful life, is only two years old. It has a terminal

disposal value of $0 and is depreciated on a straight-line basis. The equipment has a current disposal price

of $450,000. However, the emergence of a new molding technology has led TechGuide to consider either up-

grading or replacing the production equipment. The following table presents data for the two alternatives:

Home

Insert

Page Layout

Formulas

Data

Review

Upgrade

$3,000,000

Replace

$4,800,000

2 One-time equipment costs

3 Variable manufacturing cost per desk

4 Remaining useful life of equipment (in years)

5 Terminal disposal value of equipment

150

75

3

3

24

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning