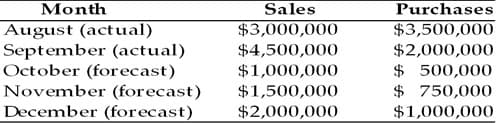

In preparation for the quarterly cash budget, the following revenue and cost information have been compiled. Prepare and evaluate a cash budget for the months of October, November, and December based on the information shown below. ∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later. ∙ Interest income of $50,000 on marketable securities will be received in December. ∙ The firm pays cash for 40 percent of its purchases. ∙ The firm pays for 60 percent of its purchases the following month. ∙ Salaries and wages amount to 15 percent of the preceding month's sales. ∙ Sales commissions amount to 2 percent of the preceding month's sales. ∙ Lease payments of $100,000 must be made each month. ∙ A principal and interest payment on an outstanding loan is due in December of $150,000. ∙ The firm pays dividends of $50,000 at the end of the quarter. ∙ Fixed assets costing $600,000 will be purchased in December. ∙ Depreciation expense each month of $45,000. ∙ The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

FIN 3004 Business Finance

Homework

In preparation for the quarterly

∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

∙ Interest income of $50,000 on marketable securities will be received in December.

∙ The firm pays cash for 40 percent of its purchases.

∙ The firm pays for 60 percent of its purchases the following month.

∙ Salaries and wages amount to 15 percent of the preceding month's sales.

∙ Sales commissions amount to 2 percent of the preceding month's sales.

∙ Lease payments of $100,000 must be made each month.

∙ A principal and interest payment on an outstanding loan is due in December of $150,000.

∙ The firm pays dividends of $50,000 at the end of the quarter.

∙ Fixed assets costing $600,000 will be purchased in December.

∙

∙ The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

The total cash receipts have to be put in the final part?