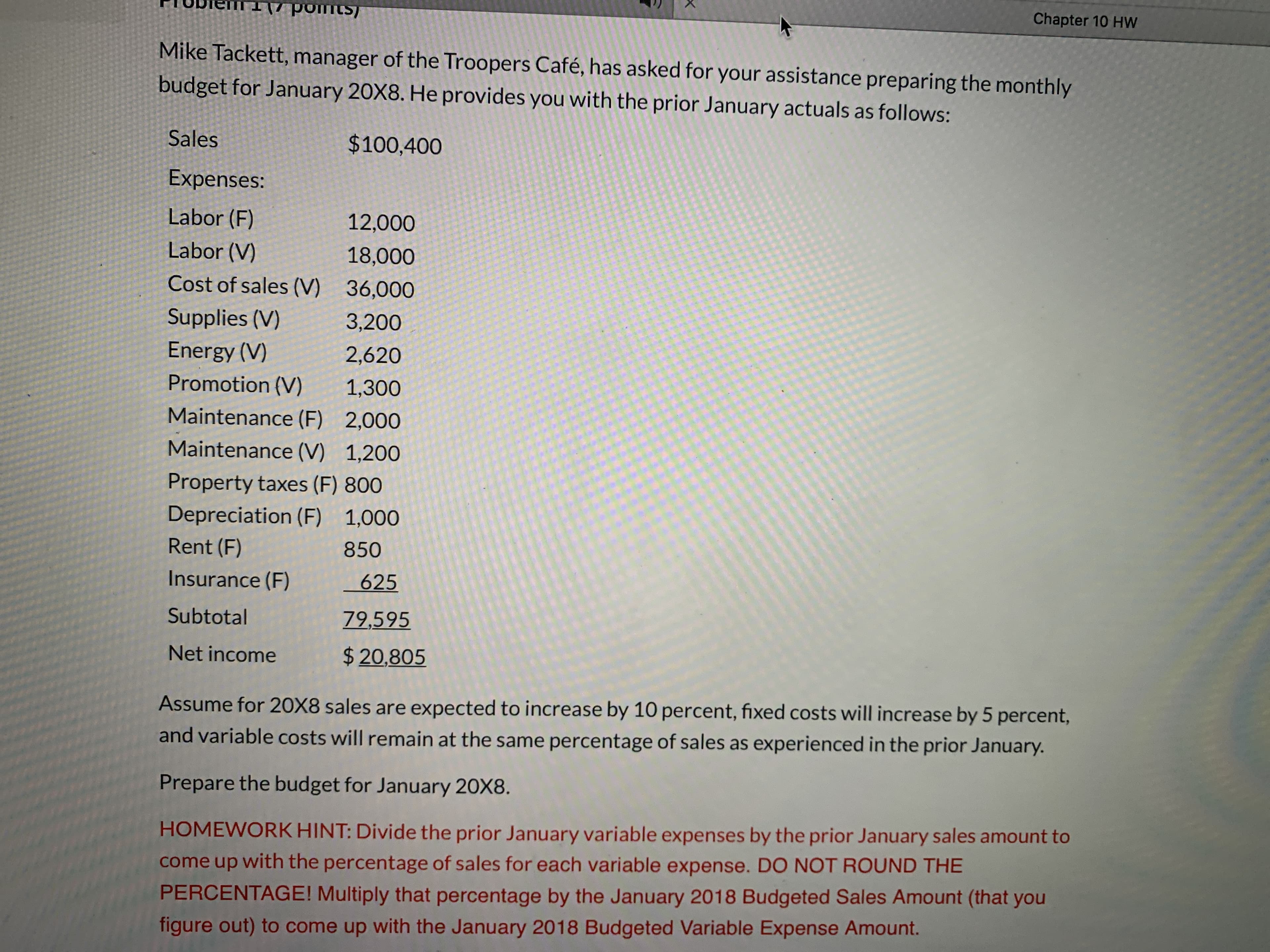

omts) Chapter 10 HW Mike Tackett, manager of the Troopers Café, has asked for your assistance preparing the monthly budget for January 20X8. He provides you with the prior January actuals as follows: Sales $100,400 Expenses: Labor (F) 12,000 Labor (V) 18,000 Cost of sales (V) 36,000 Supplies (V) 3,200 Energy (V) 2,620 Promotion (V) 1,300 Maintenance (F) 2,000 Maintenance (V) 1,200 Property taxes (F) 800 Depreciation (F) 1,000 Rent (F) 850 Insurance (F) 625 Subtotal 79,595 Net income $ 20,805 Assume for 20X8 sales are expected to increase by 10 percent, fixed costs will increase by 5 percent, and variable costs will remain at the same percentage of sales as experienced in the prior January. Prepare the budget for January 20X8. HOMEWORK HINT: Divide the prior January variable expenses by the prior January sales amount to come up with the percentage of sales for each variable expense. DO NOT ROUND THE PERCENTAGE! Multiply that percentage by the January 2018 Budgeted Sales Amount (that you figure out) to come up with the January 2018 Budgeted Variable Expense Amount.

omts) Chapter 10 HW Mike Tackett, manager of the Troopers Café, has asked for your assistance preparing the monthly budget for January 20X8. He provides you with the prior January actuals as follows: Sales $100,400 Expenses: Labor (F) 12,000 Labor (V) 18,000 Cost of sales (V) 36,000 Supplies (V) 3,200 Energy (V) 2,620 Promotion (V) 1,300 Maintenance (F) 2,000 Maintenance (V) 1,200 Property taxes (F) 800 Depreciation (F) 1,000 Rent (F) 850 Insurance (F) 625 Subtotal 79,595 Net income $ 20,805 Assume for 20X8 sales are expected to increase by 10 percent, fixed costs will increase by 5 percent, and variable costs will remain at the same percentage of sales as experienced in the prior January. Prepare the budget for January 20X8. HOMEWORK HINT: Divide the prior January variable expenses by the prior January sales amount to come up with the percentage of sales for each variable expense. DO NOT ROUND THE PERCENTAGE! Multiply that percentage by the January 2018 Budgeted Sales Amount (that you figure out) to come up with the January 2018 Budgeted Variable Expense Amount.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 4CE: Refer to Cornerstone Exercises 2.2 and 2.3. Next year, Pietro expects to produce 50,000 units and...

Related questions

Question

Help

Transcribed Image Text:omts)

Chapter 10 HW

Mike Tackett, manager of the Troopers Café, has asked for your assistance preparing the monthly

budget for January 20X8. He provides you with the prior January actuals as follows:

Sales

$100,400

Expenses:

Labor (F)

12,000

Labor (V)

18,000

Cost of sales (V) 36,000

Supplies (V)

3,200

Energy (V)

2,620

Promotion (V)

1,300

Maintenance (F) 2,000

Maintenance (V) 1,200

Property taxes (F) 800

Depreciation (F) 1,000

Rent (F)

850

Insurance (F)

625

Subtotal

79,595

Net income

$ 20,805

Assume for 20X8 sales are expected to increase by 10 percent, fixed costs will increase by 5 percent,

and variable costs will remain at the same percentage of sales as experienced in the prior January.

Prepare the budget for January 20X8.

HOMEWORK HINT: Divide the prior January variable expenses by the prior January sales amount to

come up with the percentage of sales for each variable expense. DO NOT ROUND THE

PERCENTAGE! Multiply that percentage by the January 2018 Budgeted Sales Amount (that you

figure out) to come up with the January 2018 Budgeted Variable Expense Amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College