The total consideration received from share issuances was $4,000,000. A flat sum payment of $800,000 was used to purchase a plot of land and a structure. On the land and building, a $200,000 mortgage was assumed. Throughout the year, instalments totaling $160,000 were made on the mortgage that was taken out on the land and structure. The instalments include interest in the amount of 20,000. Bank loans enabled the additional capital of £400,000 to be acquired. Throughout the year, none of the bank loans were paid back. A second mortgage on the land and building was necessary for 50% of the bank loans. As of the year's conclusion, no interest had accumulated. There were 120,000 in declared but unpaid dividends for the year. No other business dealings during the year had an impact on liabilities. As of December 31, 2021, retained earnings were $240,000. What amount will the assets total as of December 31, 2021?

The total consideration received from share issuances was $4,000,000. A flat sum payment of $800,000 was used to purchase a plot of land and a structure. On the land and building, a $200,000 mortgage was assumed. Throughout the year, instalments totaling $160,000 were made on the mortgage that was taken out on the land and structure. The instalments include interest in the amount of 20,000. Bank loans enabled the additional capital of £400,000 to be acquired. Throughout the year, none of the bank loans were paid back. A second mortgage on the land and building was necessary for 50% of the bank loans. As of the year's conclusion, no interest had accumulated. There were 120,000 in declared but unpaid dividends for the year. No other business dealings during the year had an impact on liabilities. As of December 31, 2021, retained earnings were $240,000. What amount will the assets total as of December 31, 2021?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: During 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds...

Related questions

Question

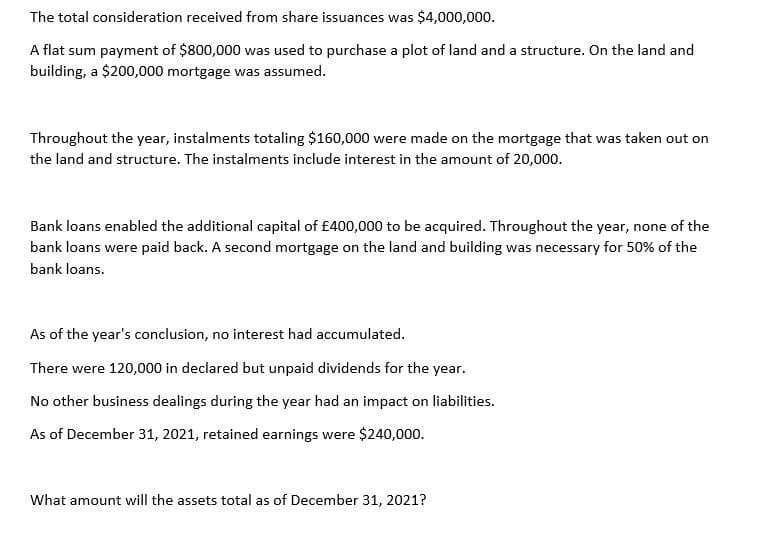

Transcribed Image Text:The total consideration received from share issuances was $4,000,000.

A flat sum payment of $800,000 was used to purchase a plot of land and a structure. On the land and

building, a $200,000 mortgage was assumed.

Throughout the year, instalments totaling $160,000 were made on the mortgage that was taken out on

the land and structure. The instalments include interest in the amount of 20,000.

Bank loans enabled the additional capital of £400,000 to be acquired. Throughout the year, none of the

bank loans were paid back. A second mortgage on the land and building was necessary for 50% of the

bank loans.

As of the year's conclusion, no interest had accumulated.

There were 120,000 in declared but unpaid dividends for the year.

No other business dealings during the year had an impact on liabilities.

As of December 31, 2021, retained earnings were $240,000.

What amount will the assets total as of December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning