The trial balance of Pacilio Security Services, Inc. as of January 1, Year 6, had the following normal balances: Cash Accounts Receivable Supplies Prepaid Rent Merchandise Inventory (24 @ $265; 1 @ $260) Land Accounts Payable Unearned Revenue Salaries Payable Common Stock Retained Earnings $74,210 13,500 200 3,200 6,620 4,000 1,950 900 1,000 50, e00 47,880 During Year 6, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 5. 2. On March 1, Year 6, Pacilio established a $100 petty cash fund to handle small expenditures. 3. Paid $4,800 on March 1, Year 6, for a one-year lease on the company van in advance. 4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance. 5. Purchased $400 of supplies on account. 6. Purchased 100 alarm systems for $28,000 cash during the year. 7. Sold 102 alarm systems for $57,120. All sales were on account. 8. Record the cost of goods sold related to the sale from Event 7 using the FIFO method. 9. Paid $2,100 on accounts payable during the year. 10. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following receipts: office supplies expense, $23; cutting grass, $55; and miscellaneous expense, $14. 11. Billed $52,000 of monitoring services for the year. 12. Paid installers and other employees a total of $25,000 cash for salaries. 13. Collected $89,300 of accounts receivable during the year. 14. Paid $3,600 of advertising expense during the year. 15. Paid $2,500 of utilities expense for the year. 16. Pald a dividend of $10,000 to the shareholders. Adjustment 17. There was $160 of supplies on hand at the end of the year. 18. Recognized the expired rent for both the van and the office building for the year. (The rent for both the van and the office remaine the same for Year 5 and Year 6.)

The trial balance of Pacilio Security Services, Inc. as of January 1, Year 6, had the following normal balances: Cash Accounts Receivable Supplies Prepaid Rent Merchandise Inventory (24 @ $265; 1 @ $260) Land Accounts Payable Unearned Revenue Salaries Payable Common Stock Retained Earnings $74,210 13,500 200 3,200 6,620 4,000 1,950 900 1,000 50, e00 47,880 During Year 6, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 5. 2. On March 1, Year 6, Pacilio established a $100 petty cash fund to handle small expenditures. 3. Paid $4,800 on March 1, Year 6, for a one-year lease on the company van in advance. 4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance. 5. Purchased $400 of supplies on account. 6. Purchased 100 alarm systems for $28,000 cash during the year. 7. Sold 102 alarm systems for $57,120. All sales were on account. 8. Record the cost of goods sold related to the sale from Event 7 using the FIFO method. 9. Paid $2,100 on accounts payable during the year. 10. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following receipts: office supplies expense, $23; cutting grass, $55; and miscellaneous expense, $14. 11. Billed $52,000 of monitoring services for the year. 12. Paid installers and other employees a total of $25,000 cash for salaries. 13. Collected $89,300 of accounts receivable during the year. 14. Paid $3,600 of advertising expense during the year. 15. Paid $2,500 of utilities expense for the year. 16. Pald a dividend of $10,000 to the shareholders. Adjustment 17. There was $160 of supplies on hand at the end of the year. 18. Recognized the expired rent for both the van and the office building for the year. (The rent for both the van and the office remaine the same for Year 5 and Year 6.)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter4: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 2E: Classify each of the accounts listed below as assets (A), liabilities (L), owners equity (OE),...

Related questions

Question

Answer full question.

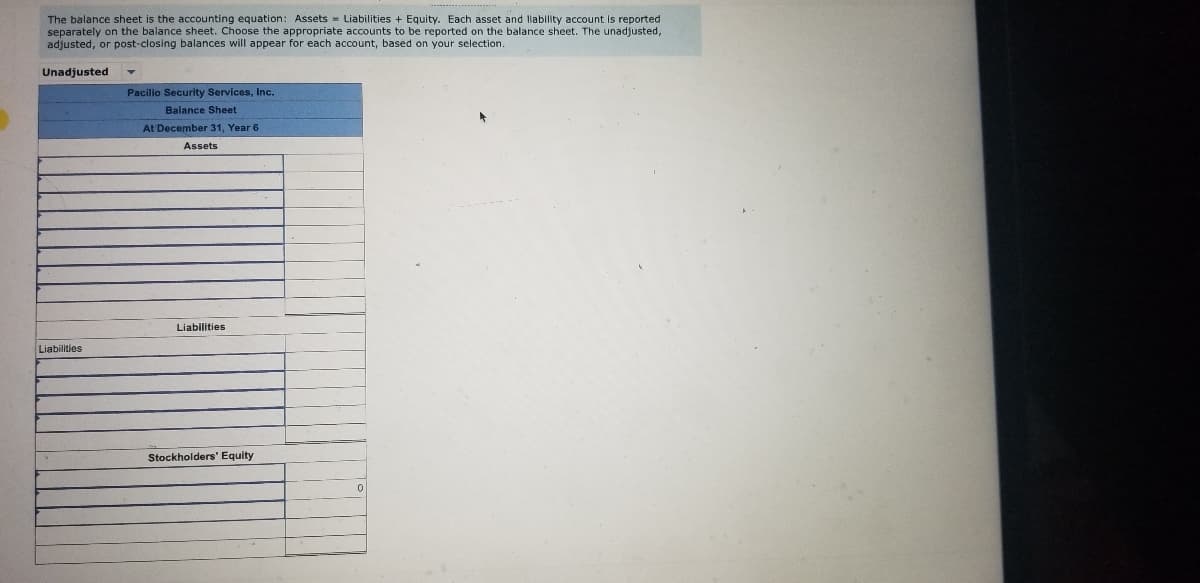

Transcribed Image Text:The balance sheet is the accounting equation: Assets = Liabilities + Equity. Each asset and liability account is reported

separately on the balance sheet. Choose the appropriate accounts to be reported on the balance sheet. The unadjusted,

adjusted, or post-closing balances will appear for each account, based on your selection.

Unadjusted

Pacilio Security Services, Inc.

Balance Sheet

At December 31, Year 6

Assets

Liabilities

Liabilities

Stockholders' Equity

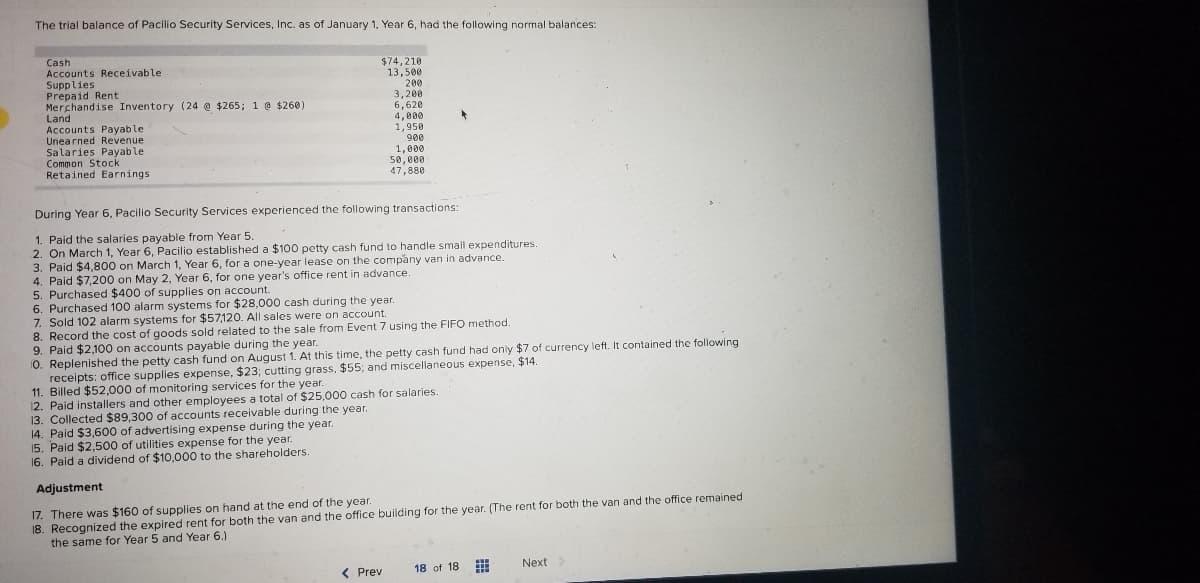

Transcribed Image Text:The trial balance of Pacilio Security Services, Inc. as of January 1, Year 6, had the following normal balances:

Cash

Accounts Receivable

Supplies

Prepaid Rent

Merchandise Inventory (24 @ $265; 1 @ $260)

Land

Accounts Payable

Unearned Revenue

Salaries Payable

Common Stock

Retained Earnings

$74,210

13,500

200

3,200

6,620

4, 000

1,950

900

1,000

50, eee

47,880

During Year 6, Pacilio Security Services experienced the following transactions:

1. Paid the salaries payable from Year 5.

2. On March 1, Year 6, Pacilio established a $100 petty cash fund to handle small expenditures.

3. Paid $4,800 on March 1, Year 6, for a one-year lease on the company van in advance.

4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance.

5. Purchased $400 of supplies on account.

6. Purchased 100 alarm systems for $28,000 cash during the year.

7. Sold 102 alarm systems for $57,120. All sales were on account.

8. Record the cost of goods sold related to the sale from Event 7 using the FIFO method.

9. Paid $2,100 on accounts payable during the year.

10. Replenished the petty cash fund on August 1. At this time, the petty cash fund had oniy $7 of currency left. It contained the following

receipts: office supplies expense, $23; cutting grass, $55; and miscellaneous expense, $14.

11. Billed $52,000 of monitoring services for the year

12. Paid installers and other employees a total of $25,000 cash for salaries.

13. Collected $89,300 of accounts receivable during the year.

14. Paid $3,600 of advertising expense during the year.

15. Paid $2,500 of utilities expense for the year.

16. Pald a dividend of $10,000 to the shareholders

Adjustment

17. There was $160 of supplies on hand at the end of the year.

18. Recognized the expired rent for both the van and the office building for the year. (The rent for both the van and the office remained

the same for Year 5 and Year 6.)

18 of 18

Next

ww.

( Prev

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning