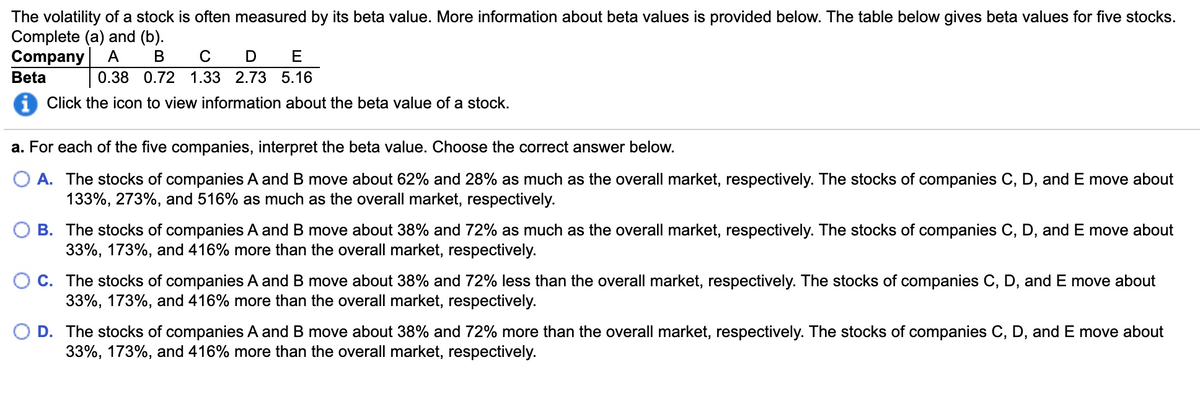

The volatility of a stock is often measured by its beta value. More information about beta values is provided below. The table below gives beta values for five stocks. Complete (a) and (b). Company Beta A 0.38 0.72 1.33 2.73 5.16 Click the icon to view information about the beta value of a stock. a. For each of the five companies, interpret the beta value. Choose the correct answer below. O A. The stocks of companies A and B move about 62% and 28% as much as the overall market, respectively. The stocks of companies C, D, and E move about 133%, 273%, and 516% as much as the overall market, respectively. O B. The stocks of companies A and B move about 38% and 72% as much as the overall market, respectively. The stocks of companies C, D, and E move about 33%, 173%, and 416% more than the overall market, respectively. O C. The stocks of companies A and B move about 38% and 72% less than the overall market, respectively. The stocks of companies C, D, and E move about 33%, 173%, and 416% more than the overall market, respectively. O D. The stocks of companies A and B move about 38% and 72% more than the overall market, respectively. The stocks of companies C, D, and E move about 33%, 173%, and 416% more than the overall market, respectively.

The volatility of a stock is often measured by its beta value. More information about beta values is provided below. The table below gives beta values for five stocks. Complete (a) and (b). Company Beta A 0.38 0.72 1.33 2.73 5.16 Click the icon to view information about the beta value of a stock. a. For each of the five companies, interpret the beta value. Choose the correct answer below. O A. The stocks of companies A and B move about 62% and 28% as much as the overall market, respectively. The stocks of companies C, D, and E move about 133%, 273%, and 516% as much as the overall market, respectively. O B. The stocks of companies A and B move about 38% and 72% as much as the overall market, respectively. The stocks of companies C, D, and E move about 33%, 173%, and 416% more than the overall market, respectively. O C. The stocks of companies A and B move about 38% and 72% less than the overall market, respectively. The stocks of companies C, D, and E move about 33%, 173%, and 416% more than the overall market, respectively. O D. The stocks of companies A and B move about 38% and 72% more than the overall market, respectively. The stocks of companies C, D, and E move about 33%, 173%, and 416% more than the overall market, respectively.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter4: Equations Of Linear Functions

Section4.5: Correlation And Causation

Problem 15PPS

Related questions

Question

Please see attached

Transcribed Image Text:The volatility of a stock is often measured by its beta value. More information about beta values is provided below. The table below gives beta values for five stocks.

Complete (a) and (b).

A

Company

В

C

E

Beta

0.38 0.72 1.33 2.73 5.16

Click the icon to view information about the beta value of a stock.

a. For each of the five companies, interpret the beta value. Choose the correct answer below.

A. The stocks of companies A and B move about 62% and 28% as much as the overall market, respectively. The stocks of companies C, D, and E move about

133%, 273%, and 516% as much as the overall market, respectively.

O B. The stocks of companies A and B move about 38% and 72% as much as the overall market, respectively. The stocks of companies C, D, and E move about

33%, 173%, and 416% more than the overall market, respectively.

C. The stocks of companies A and B move about 38% and 72% less than the overall market, respectively. The stocks of companies C, D, and E move about

33%, 173%, and 416% more than the overall market, respectively.

O D. The stocks of companies A and B move about 38% and 72% more than the overall market, respectively. The stocks of companies C, D, and E move about

33%, 173%, and 416% more than the overall market, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt