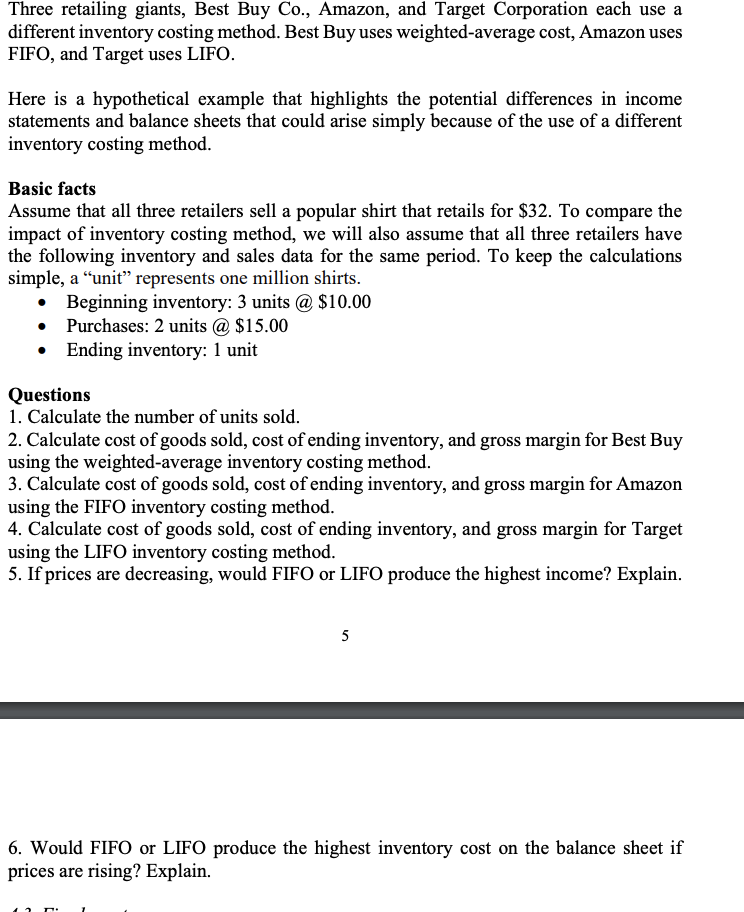

Three retailing giants, Best Buy Co., Amazon, and Target Corporation each use a different inventory costing method. Best Buy uses weighted-average cost, Amazon uses FIFO, and Target uses LIFO. Here is a hypothetical example that highlights the potential differences in income statements and balance sheets that could arise simply because of the use of a different inventory costing method. Basic facts Assume that all three retailers sell a popular shirt that retails for $32. To compare the impact of inventory costing method, we will also assume that all three retailers have the following inventory and sales data for the same period. To keep the calculations simple, a “unit" represents one million shirts. Beginning inventory: 3 units @ $10.00 • Purchases: 2 units @ $15.00 Ending inventory: 1 unit Questions 1. Calculate the number of units sold. 2. Calculate cost of goods sold, cost of ending inventory, and gross margin for Best Buy using the weighted-average inventory costing method. 3. Calculate cost of goods sold, cost of ending inventory, and gross margin for Amazon using the FIFO inventory costing method. 4. Calculate cost of goods sold, cost of ending inventory, and gross margin for Target using the LIFO inventory costing method. 5. If prices are decreasing, would FIFO or LIFO produce the highest income? Explain. 5 6. Would FIFO or LIFO produce the highest inventory cost on the balance sheet if prices are rising? Explain.

Three retailing giants, Best Buy Co., Amazon, and Target Corporation each use a different inventory costing method. Best Buy uses weighted-average cost, Amazon uses FIFO, and Target uses LIFO. Here is a hypothetical example that highlights the potential differences in income statements and balance sheets that could arise simply because of the use of a different inventory costing method. Basic facts Assume that all three retailers sell a popular shirt that retails for $32. To compare the impact of inventory costing method, we will also assume that all three retailers have the following inventory and sales data for the same period. To keep the calculations simple, a “unit" represents one million shirts. Beginning inventory: 3 units @ $10.00 • Purchases: 2 units @ $15.00 Ending inventory: 1 unit Questions 1. Calculate the number of units sold. 2. Calculate cost of goods sold, cost of ending inventory, and gross margin for Best Buy using the weighted-average inventory costing method. 3. Calculate cost of goods sold, cost of ending inventory, and gross margin for Amazon using the FIFO inventory costing method. 4. Calculate cost of goods sold, cost of ending inventory, and gross margin for Target using the LIFO inventory costing method. 5. If prices are decreasing, would FIFO or LIFO produce the highest income? Explain. 5 6. Would FIFO or LIFO produce the highest inventory cost on the balance sheet if prices are rising? Explain.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 57E: Lower of Cost or Market Shaw Systems sells a limited line of specially made products, using...

Related questions

Question

Dear Baterlby,

Could you help me with question 3 to 6 please

I want to check my answers and make sure that I understand

Thanks

Transcribed Image Text:Three retailing giants, Best Buy Co., Amazon, and Target Corporation each use a

different inventory costing method. Best Buy uses weighted-average cost, Amazon uses

FIFO, and Target uses LIFO.

Here is a hypothetical example that highlights the potential differences in income

statements and balance sheets that could arise simply because of the use of a different

inventory costing method.

Basic facts

Assume that all three retailers sell a popular shirt that retails for $32. To compare the

impact of inventory costing method, we will also assume that all three retailers have

the following inventory and sales data for the same period. To keep the calculations

simple, a “unit" represents one million shirts.

• Beginning inventory: 3 units @ $10.00

• Purchases: 2 units @ $15.00

• Ending inventory: 1 unit

Questions

1. Calculate the number of units sold.

2. Calculate cost of goods sold, cost of ending inventory, and gross margin for Best Buy

using the weighted-average inventory costing method.

3. Calculate cost of goods sold, cost of ending inventory, and gross margin for Amazon

using the FIFO inventory costing method.

4. Calculate cost of goods sold, cost of ending inventory, and gross margin for Target

using the LIFO inventory costing method.

5. If prices are decreasing, would FIFO or LIFO produce the highest income? Explain.

5

6. Would FIFO or LIFO produce the highest inventory cost on the balance sheet if

prices are rising? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning