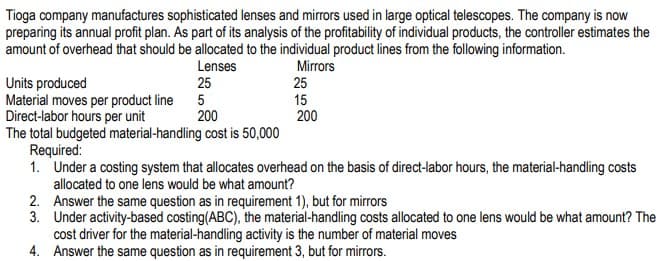

Tioga company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information. Mirrors Lenses Units produced Material moves per product line 5 Direct-labor hours per unit The total budgeted material-handling cost is 50,000 Required: 1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2. Answer the same question as in requirement 1), but for mirrors 3. Under activity-based costing(ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling activity is the number of material moves 4. Answer the same question as in requirement 3, but for mirrors. 25 25 15 200 200

Tioga company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information. Mirrors Lenses Units produced Material moves per product line 5 Direct-labor hours per unit The total budgeted material-handling cost is 50,000 Required: 1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2. Answer the same question as in requirement 1), but for mirrors 3. Under activity-based costing(ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling activity is the number of material moves 4. Answer the same question as in requirement 3, but for mirrors. 25 25 15 200 200

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter18: Activity-based Costing

Section: Chapter Questions

Problem 13E: Handbrain Inc. is considering a change to activity-based product costing. The company produces two...

Related questions

Question

Transcribed Image Text:Tioga company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now

preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the

amount of overhead that should be allocated to the individual product lines from the following information.

Lenses

Mirrors

Units produced

Material moves per product line 5

Direct-labor hours per unit

The total budgeted material-handling cost is 50,000

Required:

1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs

allocated to one lens would be what amount?

2. Answer the same question as in requirement 1), but for mirrors

3. Under activity-based costing(ABC), the material-handling costs allocated to one lens would be what amount? The

cost driver for the material-handling activity is the number of material moves

4. Answer the same question as in requirement 3, but for mirrors.

25

25

15

200

200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning