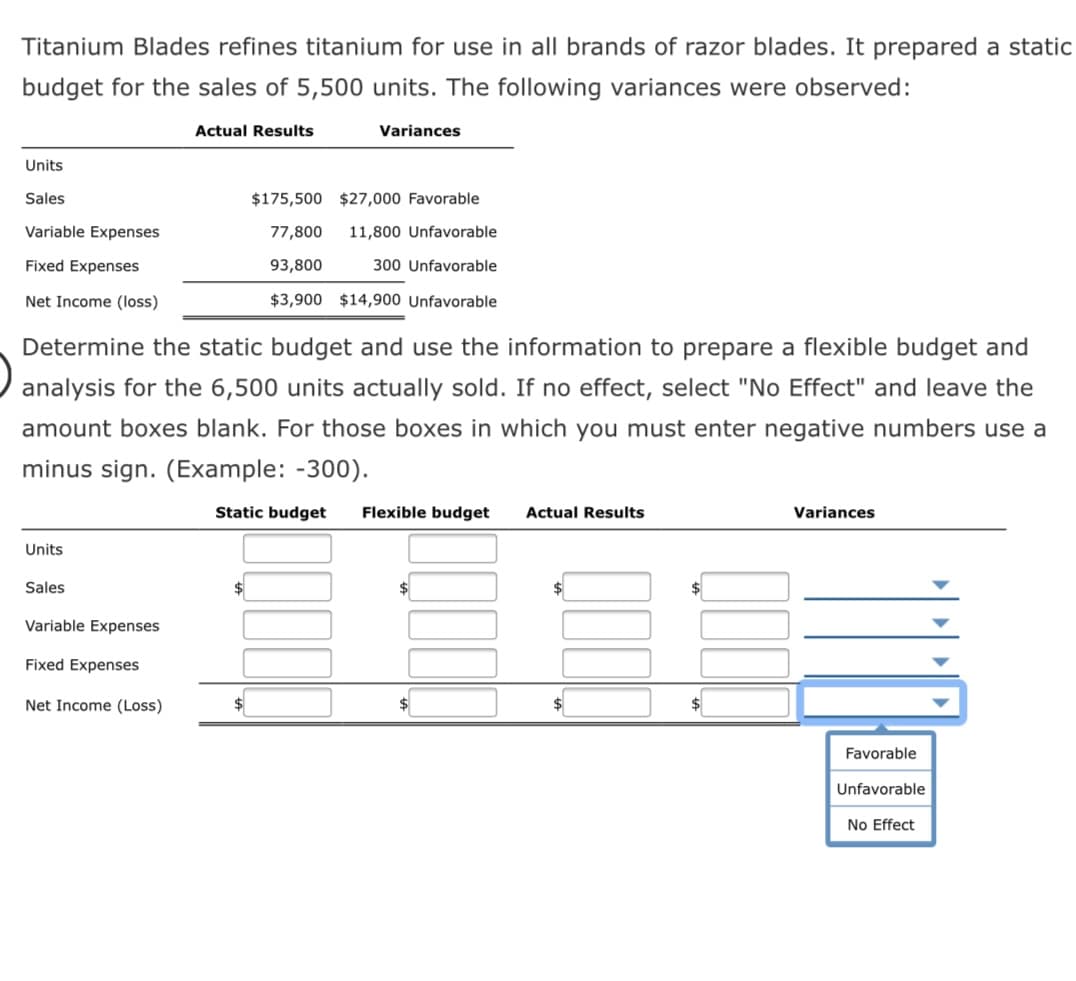

Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,500 units. The following variances were observed: Actual Results Variances Units Sales $175,500 $27,000 Favorable Variable Expenses 77,800 11,800 Unfavorable Fixed Expenses 93,800 300 Unfavorable Net Income (loss) $3,900 $14,900 Unfavorable Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,500 units actually sold. If no effect, select "No Effect" and leave the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300). Static budget Flexible budget Actual Results Variances Units Sales $ Variable Expenses Fixed Expenses Net Income (Loss) Favorable Unfavorable No Effect

Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,500 units. The following variances were observed: Actual Results Variances Units Sales $175,500 $27,000 Favorable Variable Expenses 77,800 11,800 Unfavorable Fixed Expenses 93,800 300 Unfavorable Net Income (loss) $3,900 $14,900 Unfavorable Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,500 units actually sold. If no effect, select "No Effect" and leave the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300). Static budget Flexible budget Actual Results Variances Units Sales $ Variable Expenses Fixed Expenses Net Income (Loss) Favorable Unfavorable No Effect

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 3CMA

Related questions

Question

Transcribed Image Text:Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static

budget for the sales of 5,500 units. The following variances were observed:

Actual Results

Variances

Units

Sales

$175,500 $27,000 Favorable

Variable Expenses

77,800

11,800 Unfavorable

Fixed Expenses

93,800

300 Unfavorable

Net Income (loss)

$3,900 $14,900 Unfavorable

Determine the static budget and use the information to prepare a flexible budget and

analysis for the 6,500 units actually sold. If no effect, select "No Effect" and leave the

amount boxes blank. For those boxes in which you must enter negative numbers use a

minus sign. (Example: -300).

Static budget

Flexible budget

Actual Results

Variances

Units

Sales

Variable Expenses

Fixed Expenses

Net Income (Loss)

Favorable

Unfavorable

No Effect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning