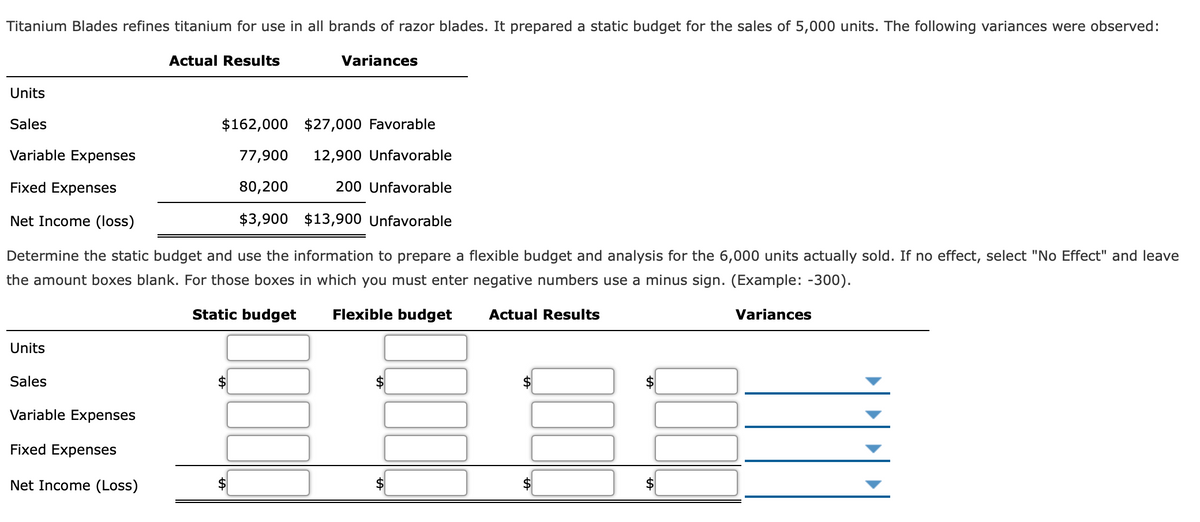

itanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,000 units. The following variances were observed: Actual Results Variances Units Sales $162,000 $27,000 Favorable Variable Expenses 77,900 12,900 Unfavorable Fixed Expenses 80,200 200 Unfavorable Net Income (loss) $3,900 $13,900 Unfavorable Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,000 units actually sold. If no effect, select "No Effect" and leave the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300). Static budget Flexible budget Actual Results Variances Units fill in the blank 1 fill in the blank 2 Sales $fill in the blank 3 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Variable Expenses fill in the blank 8 fill in the blank 9 fill in the blank 10 fill in the blank 11 Fixed Expenses fill in the blank 13 fill in the blank 14 fill in the blank 15 fill in the blank 16 Net Income (Loss) $fill in the blank 18 $fill in the blank 19 $fill in the blank 20 $fill in the blank 21

itanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,000 units. The following variances were observed: Actual Results Variances Units Sales $162,000 $27,000 Favorable Variable Expenses 77,900 12,900 Unfavorable Fixed Expenses 80,200 200 Unfavorable Net Income (loss) $3,900 $13,900 Unfavorable Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,000 units actually sold. If no effect, select "No Effect" and leave the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300). Static budget Flexible budget Actual Results Variances Units fill in the blank 1 fill in the blank 2 Sales $fill in the blank 3 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Variable Expenses fill in the blank 8 fill in the blank 9 fill in the blank 10 fill in the blank 11 Fixed Expenses fill in the blank 13 fill in the blank 14 fill in the blank 15 fill in the blank 16 Net Income (Loss) $fill in the blank 18 $fill in the blank 19 $fill in the blank 20 $fill in the blank 21

Chapter7: Budgeting

Section: Chapter Questions

Problem 16PA: Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget...

Related questions

Question

Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,000 units. The following variances were observed:

| Actual Results | Variances | ||

| Units | |||

| Sales | $162,000 | $27,000 | Favorable |

| Variable Expenses | 77,900 | 12,900 | Unfavorable |

| Fixed Expenses | 80,200 | 200 | Unfavorable |

| Net Income (loss) | $3,900 | $13,900 | Unfavorable |

Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,000 units actually sold. If no effect, select "No Effect" and leave the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300).

| Static budget | Flexible budget | Actual Results | Variances | ||

| Units | fill in the blank 1 | fill in the blank 2 | |||

| Sales | $fill in the blank 3 | $fill in the blank 4 | $fill in the blank 5 | $fill in the blank 6 | |

| Variable Expenses | fill in the blank 8 | fill in the blank 9 | fill in the blank 10 | fill in the blank 11 | |

| Fixed Expenses | fill in the blank 13 | fill in the blank 14 | fill in the blank 15 | fill in the blank 16 | |

| Net Income (Loss) | $fill in the blank 18 | $fill in the blank 19 | $fill in the blank 20 | $fill in the blank 21 |

Transcribed Image Text:Titanium Blades refines titanium for use in all brands of razor blades. It prepared a static budget for the sales of 5,000 units. The following variances were observed:

Actual Results

Variances

Units

Sales

$162,000

$27,000 Favorable

Variable Expenses

77,900

12,900 Unfavorable

Fixed Expenses

80,200

200 Unfavorable

Net Income (Iloss)

$3,900

$13,900 Unfavorable

Determine the static budget and use the information to prepare a flexible budget and analysis for the 6,000 units actually sold. If no effect, select "No Effect" and leave

the amount boxes blank. For those boxes in which you must enter negative numbers use a minus sign. (Example: -300).

Static budget

Flexible budget

Actual Results

Variances

Units

Sales

$

Variable Expenses

Fixed Expenses

Net Income (Loss)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning