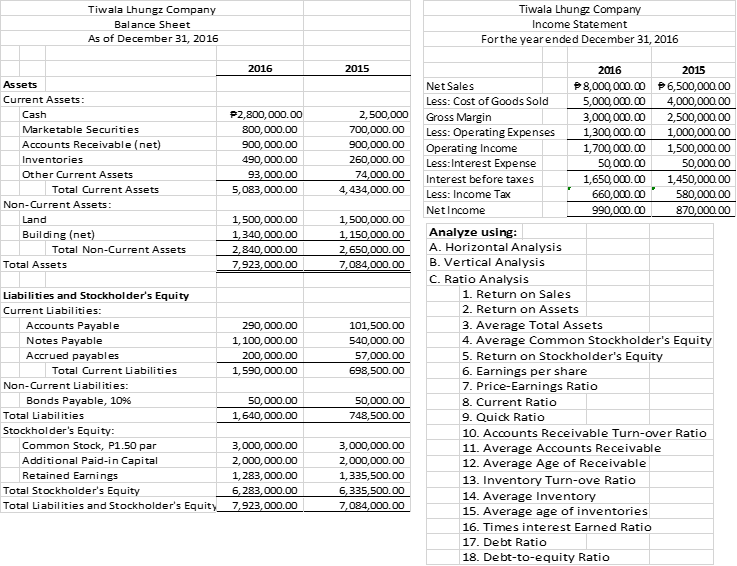

Tiwala Lhungz Company Tiwala Lhung Company Balance Sheet Income Statement As of December 31, 2016 Forthe yearended December 31, 2016 2016 2015 2016 2015 Assets Net Sales P8,000,000.00 P6,500,000.0 5,000,000.00 3,000, 000. 00 1,300,000. 00 1,700, 000.00 50,000.00 1,650,000.00 660,000.00 Current Assets: Less: Cost of Goods Sold 4,000,000.0 2,500,000.0 Cash P2,800,000.00 2,500,000 Gross Margin Less: Operating Expenses Marketable Securities 800,000.00 700,000.00 1,000,000.0 1,500,000.0 Accounts Receivable (net) 900,000.00 490,000.00 93,000.00 5,083,000.00 900,000.00 260,000.00 74,000.00 4,434,000.00 Operati ng Income Less:Interest Expense Inventories 50,000.0 1,450,000.0 580,000.0 Other Current Assets Interest before taxes Total Current Assets Less: Income Tax Non-Current Assets: NetIncome 990,000.00 870,000.0 1, 500, 000.00 1,340,000.00 1, 500,000.00 1,150,000.00 2,650,000.00 7,084,000.00 Land Analyze using: A. Horizontal Analysis B. Vertical Analysis Building (net) Total Non-Current Assets 2,840,000.00 7,923,000.00 Total Assets C. Ratio Analysis 1. Return on Sales Liabilities and Stockholder's Equity Current Liabilities: 2. Return on Assets Accounts Payable Notes Payable Accrued payables 3. Average Total Assets 4. Average Common Stockholder's Equity 5. Return on Stockholder's Equity 6. Earnings per share 7. Price-Earnings Ratio 290,000.00 1, 100,000.00 101,500.00 540,000.00 200,000.00 57,000.00 698,500.00 Total Current Liabilities 1,590,000.00 Non-Current Liabilities: Bonds Payable, 10% 50,000. 00 50,000.00 1,640, 000.00 8. Current Ratio 9. Quick Ratio Total Liabilities 748,500.00 Stockholder's Equity: Common Stock, P1.50 par 10. Accounts Receivable Turn-over Ratio 3,000, 000.00 3,000,000.00 2,000,000.00 11. Average Accounts Receivable 12. Average Age of Receivable Additional Paid-in Capital Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 2,000,000.00 1,283,000.00 1,335,500.00 13. Inventory Turn-ove Ratio 14. Average Inventory 15. Average age of inventories 6,283,000.00 6,335,500.00 7,084,000.00 7,923,000.00 16. Times interest Earned Ratio 17. Debt Ratio 18 Deht-to-equity Ratio

Tiwala Lhungz Company Tiwala Lhung Company Balance Sheet Income Statement As of December 31, 2016 Forthe yearended December 31, 2016 2016 2015 2016 2015 Assets Net Sales P8,000,000.00 P6,500,000.0 5,000,000.00 3,000, 000. 00 1,300,000. 00 1,700, 000.00 50,000.00 1,650,000.00 660,000.00 Current Assets: Less: Cost of Goods Sold 4,000,000.0 2,500,000.0 Cash P2,800,000.00 2,500,000 Gross Margin Less: Operating Expenses Marketable Securities 800,000.00 700,000.00 1,000,000.0 1,500,000.0 Accounts Receivable (net) 900,000.00 490,000.00 93,000.00 5,083,000.00 900,000.00 260,000.00 74,000.00 4,434,000.00 Operati ng Income Less:Interest Expense Inventories 50,000.0 1,450,000.0 580,000.0 Other Current Assets Interest before taxes Total Current Assets Less: Income Tax Non-Current Assets: NetIncome 990,000.00 870,000.0 1, 500, 000.00 1,340,000.00 1, 500,000.00 1,150,000.00 2,650,000.00 7,084,000.00 Land Analyze using: A. Horizontal Analysis B. Vertical Analysis Building (net) Total Non-Current Assets 2,840,000.00 7,923,000.00 Total Assets C. Ratio Analysis 1. Return on Sales Liabilities and Stockholder's Equity Current Liabilities: 2. Return on Assets Accounts Payable Notes Payable Accrued payables 3. Average Total Assets 4. Average Common Stockholder's Equity 5. Return on Stockholder's Equity 6. Earnings per share 7. Price-Earnings Ratio 290,000.00 1, 100,000.00 101,500.00 540,000.00 200,000.00 57,000.00 698,500.00 Total Current Liabilities 1,590,000.00 Non-Current Liabilities: Bonds Payable, 10% 50,000. 00 50,000.00 1,640, 000.00 8. Current Ratio 9. Quick Ratio Total Liabilities 748,500.00 Stockholder's Equity: Common Stock, P1.50 par 10. Accounts Receivable Turn-over Ratio 3,000, 000.00 3,000,000.00 2,000,000.00 11. Average Accounts Receivable 12. Average Age of Receivable Additional Paid-in Capital Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 2,000,000.00 1,283,000.00 1,335,500.00 13. Inventory Turn-ove Ratio 14. Average Inventory 15. Average age of inventories 6,283,000.00 6,335,500.00 7,084,000.00 7,923,000.00 16. Times interest Earned Ratio 17. Debt Ratio 18 Deht-to-equity Ratio

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 15.1APR: Horizontal analysis of income statement For 2016, Clapton Company reported a decline in net income....

Related questions

Question

100%

Requirements:

Prepare a Summary of Ratio Analysis

Transcribed Image Text:Tiwala Lhungz Company

Tiwala Lhung Company

Balance Sheet

Income Statement

As of December 31, 2016

Forthe yearended December 31, 2016

2016

2015

2016

2015

Assets

Net Sales

P8,000,000.00 P6,500,000.00

5,000,000.00

3,000,000.00

Current Assets:

Less: Cost of Goods Sold

4,000,000.00

2,500,000.00

Cash

P2,800,000.00

2,500,000

Gross Margin

Less: Operating Expenses

Marketable Securities

800,000.00

700,000.00

1,300,000.00

900,000.00

490, 000.00

1,000,000.00

1,500,000.00

Accounts Receivable (net)

900,000.00

Operating Income

Less:Interest Expense

1,700,000.00

50,000.00

1,650, 000.00

Inventories

260,000.00

50,000.00

1,450,000.00

580,000.00

Other Current Assets

93,000.00

5,083,000.00

74,000.00

Interest before taxes

Total Current Assets

4,434,000.00

Less: Income Tax

660,000.00

Non-Current Assets:

NetIncome

990,000.00

870,000.00

Land

1,500,000.00

1,500,000.00

Analyze using:

A. Horizontal Analysis

Building (net)

1,340,000.00

2,840,000.00

7,923,000.00

1,150,000.00

2,650,000.00

7,084,000.00

Total Non-Current Assets

Total Assets

B. Vertical Analysis

C. Ratio Analysis

Liabilities and Stockholder's Equity

1. Return on Sales

Current Liabilities:

2. Return on Assets

3. Average Total Assets

4. Average Common Stockholder's Equity

5. Return on Stockholder's Equity

Accounts Payable

290, 000.00

101,500.00

Notes Payable

1, 100,000.00

540,000.00

Accrued payables

200,000.00

57,000.00

Total Current Liabilities

1,590,000.00

698,500.00

6. Earnings per share

7. Price-Earnings Ratio

8. Current Ratio

9. Quick Ratio

Non-Current Liabilities:

Bonds Payable, 10%

50,000.00

50,000.00

Total Liabilities

1,640,000.00

748,500.00

Stockholder's Equity:

10. Accounts Receivable Turn-over Ratio

Common Stock, P1.50 par

3,000,000.00

3,000,000.00

11. Average Accounts Receivable

Additional Paid-in Capital

2,000,000.00

2,000,000.00

12. Average Age of Receivable

Retained Earnings

1,283,000.00

1,335,500.00

13. Inventory Turn-ove Ratio

Total Stockholder's Equity

6,283,000.00

7,923,000.00

6,335,500.00

14. Average Inventory

Total Liabilities and Stockholder's Equity

7,084,000.00

15. Average age of inventories

16. Times interest Earned Ratio

17. Debt Ratio

18. Debt-to-equity Ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning