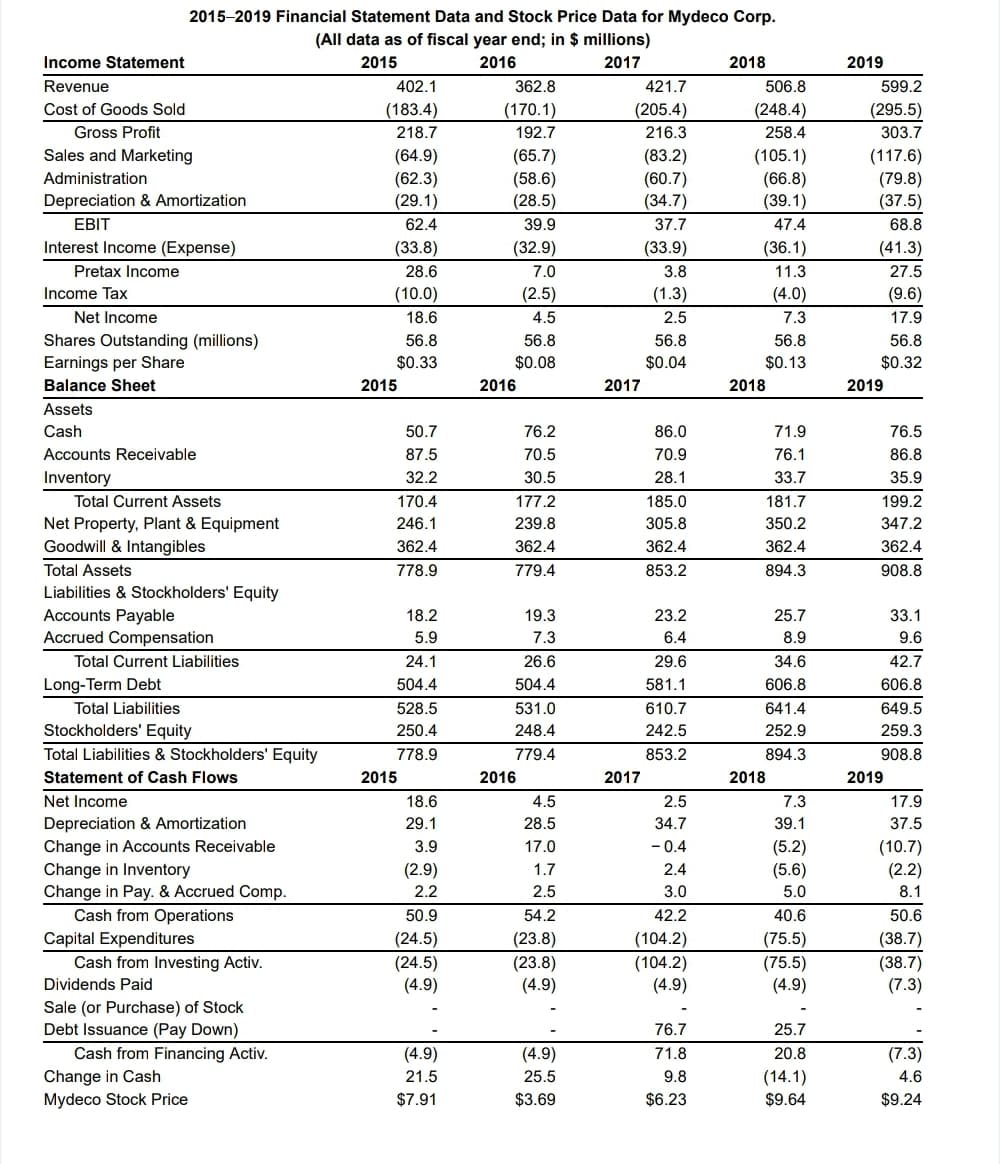

2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2015 2016 2017 2018 2019 Revenue 402.1 362.8 421.7 506.8 599.2 Cost of Goods Sold (183.4) (170.1) (205.4) (248.4) (295.5) Gross Profit 218.7 192.7 216.3 258.4 303.7 Sales and Marketing (64.9) (62.3) (29.1) (83.2) (60.7) (34.7) (65.7) (105.1) (66.8) (39.1) (117.6) (79.8) (37.5) Administration (58.6) (28.5) Depreciation & Amortization EBIT 62.4 39.9 37.7 47.4 68.8 Interest Income (Expense) (33.8) (32.9) (33.9) (36.1) (41.3) Pretax Income 28.6 7.0 3.8 11.3 27.5 Income Tax (10.0) (2.5) (1.3) (4.0) (9.6) Net Income 18.6 4.5 2.5 7.3 17.9 Shares Outstanding (millions) Earnings per Share 56.8 56.8 56.8 56.8 56.8 $0.33 $0.08 $0.04 $0.13 $0.32 Balance Sheet 2015 2016 2017 2018 2019 Assets Cash 50.7 76.2 86.0 71.9 76.5 Accounts Receivable 87.5 70.5 70.9 76.1 86.8 32.2 35.9 199.2 Inventory 30.5 28.1 33.7 Total Current Assets 170.4 177.2 185.0 181.7 Net Property, Plant & Equipment Goodwill & Intangibles 246.1 239.8 305.8 350.2 347.2 362.4 362.4 362.4 362.4 362.4 Total Assets 778.9 779.4 853.2 894.3 908.8 Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation 18.2 19.3 23.2 25.7 33.1 5.9 7.3 6.4 8.9 9.6 Total Current Liabilities 24.1 26.6 29.6 34.6 42.7 Long-Term Debt 504.4 504.4 581.1 606.8 606.8 Total Liabilities 528.5 531.0 610.7 641.4 649.5 Stockholders' Equity 250.4 248.4 242.5 252.9 259.3 Total Liabilities & Stockholders' Equity 778.9 779.4 853.2 894.3 908.8 Statement of Cash Flows 2015 2016 2017 2018 2019 Net Income 18.6 4.5 2.5 7.3 17.9 Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay. & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ. 29.1 28.5 34.7 39.1 37.5 3.9 - 0.4 (5.2) (5.6) (10.7) (2.2) 17.0 (2.9) 1.7 2.4 2.2 2.5 3.0 5.0 8.1 50.9 54.2 42.2 40.6 50.6 (24.5) (24.5) (4.9) (23.8) (23.8) (4.9) (104.2) (104.2) (4.9) (75.5) (75.5) (4.9) (38.7) (38.7) (7.3) Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. Change in Cash Mydeco Stock Price 76.7 25.7 (4.9) (4.9) 71.8 20.8 (7.3) (14.1) $9.64 21.5 25.5 9.8 4.6 $7.91 $3.69 $6.23 $9.24

2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; in $ millions) Income Statement 2015 2016 2017 2018 2019 Revenue 402.1 362.8 421.7 506.8 599.2 Cost of Goods Sold (183.4) (170.1) (205.4) (248.4) (295.5) Gross Profit 218.7 192.7 216.3 258.4 303.7 Sales and Marketing (64.9) (62.3) (29.1) (83.2) (60.7) (34.7) (65.7) (105.1) (66.8) (39.1) (117.6) (79.8) (37.5) Administration (58.6) (28.5) Depreciation & Amortization EBIT 62.4 39.9 37.7 47.4 68.8 Interest Income (Expense) (33.8) (32.9) (33.9) (36.1) (41.3) Pretax Income 28.6 7.0 3.8 11.3 27.5 Income Tax (10.0) (2.5) (1.3) (4.0) (9.6) Net Income 18.6 4.5 2.5 7.3 17.9 Shares Outstanding (millions) Earnings per Share 56.8 56.8 56.8 56.8 56.8 $0.33 $0.08 $0.04 $0.13 $0.32 Balance Sheet 2015 2016 2017 2018 2019 Assets Cash 50.7 76.2 86.0 71.9 76.5 Accounts Receivable 87.5 70.5 70.9 76.1 86.8 32.2 35.9 199.2 Inventory 30.5 28.1 33.7 Total Current Assets 170.4 177.2 185.0 181.7 Net Property, Plant & Equipment Goodwill & Intangibles 246.1 239.8 305.8 350.2 347.2 362.4 362.4 362.4 362.4 362.4 Total Assets 778.9 779.4 853.2 894.3 908.8 Liabilities & Stockholders' Equity Accounts Payable Accrued Compensation 18.2 19.3 23.2 25.7 33.1 5.9 7.3 6.4 8.9 9.6 Total Current Liabilities 24.1 26.6 29.6 34.6 42.7 Long-Term Debt 504.4 504.4 581.1 606.8 606.8 Total Liabilities 528.5 531.0 610.7 641.4 649.5 Stockholders' Equity 250.4 248.4 242.5 252.9 259.3 Total Liabilities & Stockholders' Equity 778.9 779.4 853.2 894.3 908.8 Statement of Cash Flows 2015 2016 2017 2018 2019 Net Income 18.6 4.5 2.5 7.3 17.9 Depreciation & Amortization Change in Accounts Receivable Change in Inventory Change in Pay. & Accrued Comp. Cash from Operations Capital Expenditures Cash from Investing Activ. 29.1 28.5 34.7 39.1 37.5 3.9 - 0.4 (5.2) (5.6) (10.7) (2.2) 17.0 (2.9) 1.7 2.4 2.2 2.5 3.0 5.0 8.1 50.9 54.2 42.2 40.6 50.6 (24.5) (24.5) (4.9) (23.8) (23.8) (4.9) (104.2) (104.2) (4.9) (75.5) (75.5) (4.9) (38.7) (38.7) (7.3) Dividends Paid Sale (or Purchase) of Stock Debt Issuance (Pay Down) Cash from Financing Activ. Change in Cash Mydeco Stock Price 76.7 25.7 (4.9) (4.9) 71.8 20.8 (7.3) (14.1) $9.64 21.5 25.5 9.8 4.6 $7.91 $3.69 $6.23 $9.24

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 55CE

Related questions

Question

- By what percentage did Mydeco's revenues grow each year from 2016 to 2019? (Round to two decimal places.)

- By what percentage did net income grow each year? (Round to two decimal places.)

- Why might the growth rates of revenues and net income differ? (Round to two decimal places.)

Transcribed Image Text:2015-2019 Financial Statement Data and Stock Price Data for Mydeco Corp.

(All data as of fiscal year end; in $ millions)

Income Statement

2015

2016

2017

2018

2019

Revenue

402.1

362.8

421.7

506.8

599.2

Cost of Goods Sold

(183.4)

(170.1)

(205.4)

(295.5)

(248.4)

258.4

Gross Profit

218.7

192.7

216.3

303.7

Sales and Marketing

(64.9)

(62.3)

(29.1)

(65.7)

(58.6)

(28.5)

(83.2)

(60.7)

(34.7)

(105.1)

(66.8)

(39.1)

47.4

(117.6)

(79.8)

(37.5)

Administration

Depreciation & Amortization

EBIT

62.4

39.9

37.7

68.8

Interest Income (Expense)

(33.8)

(32.9)

(33.9)

(36.1)

(41.3)

Pretax Income

28.6

7.0

3.8

11.3

27.5

Income Tax

(10.0)

(2.5)

(1.3)

(4.0)

(9.6)

Net Income

18.6

4.5

2.5

7.3

17.9

Shares Outstanding (millions)

Earnings per Share

56.8

56.8

56.8

56.8

56.8

$0.33

$0.08

$0.04

$0.13

$0.32

Balance Sheet

2015

2016

2017

2018

2019

Assets

Cash

50.7

76.2

86.0

71.9

76.5

Accounts Receivable

87.5

70.5

70.9

76.1

86.8

Inventory

32.2

30.5

28.1

33.7

35.9

Total Current Assets

170.4

177.2

185.0

181.7

199.2

Net Property, Plant & Equipment

Goodwill & Intangibles

246.1

239.8

305.8

350.2

347.2

362.4

362.4

362.4

362.4

362.4

Total Assets

778.9

779.4

853.2

894.3

908.8

Liabilities & Stockholders' Equity

Accounts Payable

Accrued Compensation

18.2

19.3

23.2

25.7

33.1

5.9

7.3

6.4

8.9

9.6

Total Current Liabilities

24.1

26.6

29.6

34.6

42.7

Long-Term Debt

504.4

504.4

581.1

606.8

606.8

Total Liabilities

528.5

531.0

610.7

641.4

649.5

Stockholders' Equity

250.4

248.4

242.5

252.9

259.3

Total Liabilities & Stockholders' Equity

778.9

779.4

853.2

894.3

908.8

Statement of Cash Flows

2015

2016

2017

2018

2019

Net Income

18.6

4.5

2.5

7.3

17.9

Depreciation & Amortization

Change in Accounts Receivable

Change in Inventory

Change in Pay. & Accrued Comp.

Cash from Operations

29.1

28.5

34.7

39.1

37.5

(10.7)

(2.2)

3.9

17.0

- 0.4

(5.2)

(5.6)

(2.9)

1.7

2.4

2.2

2.5

3.0

5.0

8.1

50.9

54.2

42.2

40.6

50.6

(104.2)

(104.2)

(4.9)

Capital Expenditures

(24.5)

(24.5)

(4.9)

(23.8)

(23.8)

(4.9)

(75.5)

(75.5)

(4.9)

(38.7)

(38.7)

(7.3)

Cash from Investing Activ.

Dividends Paid

Sale (or Purchase) of Stock

Debt Issuance (Pay Down)

76.7

25.7

Cash from Financing Activ.

Change in Cash

Mydeco Stock Price

(4.9)

(4.9)

71.8

20.8

(7.3)

21.5

25.5

9.8

(14.1)

4.6

$7.91

$3.69

$6.23

$9.64

$9.24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning