HALLORAN COMPANY Comparative Income Statements For Years Ended December 31, 2017-2013 (S thousands) 2013 2017 2016 2015 2014 $ 1,271 $ 1,122 $ 1,028 $ 774 $ 948 $ 890 602 $ 564 347 $ 326 128 $ 110 219 $ 216 Sales Cost of goods sold 935 $ 677 $ Gross profit Operating expenses 336 $ 351 $ 348 $ 192 $ 248 $ 176 Net income $ 89 $ 156 $ 176 $ HALLORAN COMPANY Comparative Balance Sheets December 31, 2017-2013 ($ thousands) 2017 2016 2015 2014 2013 Assets Cash 58 $ 368 $ 59 $ 386 $ 62 $ 350 $ 63 $ 270 $ 239 774 $ 702 66 Accounts receivable, net $ $ 1,379 $ 1,023 $ 903 $ Merchand ise inventory Other current assets $ 27 $ 24 $ 11 $ 26 $ 21 110 $ 708 $ 734 $ 3,346 $ 3,002 $ 2,639 $ 1,950 $ 1,871 Long-term investments $ 110 Plant assets, net $ 1,515 $ 1,511 $ 1,314 $ Total assets Liabilities and Equity Current liabilities $ 915 $ 782 $ 539 $ 461 $ 410 428 $ 435 $ 971 $ 750 $ 750 $ 855 $ 834 $ 750 $ Long-term liabilities Common stock 638 $ 638 Other paid-in capital 202 $ 188 $ 188 $ 329 $ 128 $ 128 Retained earnings 509 $ 428 $ 297 $ 261 Total liabilities and equity $ 3,346 $ 3,002 $ 2,639 $ 1,950 $ 1,871

HALLORAN COMPANY Comparative Income Statements For Years Ended December 31, 2017-2013 (S thousands) 2013 2017 2016 2015 2014 $ 1,271 $ 1,122 $ 1,028 $ 774 $ 948 $ 890 602 $ 564 347 $ 326 128 $ 110 219 $ 216 Sales Cost of goods sold 935 $ 677 $ Gross profit Operating expenses 336 $ 351 $ 348 $ 192 $ 248 $ 176 Net income $ 89 $ 156 $ 176 $ HALLORAN COMPANY Comparative Balance Sheets December 31, 2017-2013 ($ thousands) 2017 2016 2015 2014 2013 Assets Cash 58 $ 368 $ 59 $ 386 $ 62 $ 350 $ 63 $ 270 $ 239 774 $ 702 66 Accounts receivable, net $ $ 1,379 $ 1,023 $ 903 $ Merchand ise inventory Other current assets $ 27 $ 24 $ 11 $ 26 $ 21 110 $ 708 $ 734 $ 3,346 $ 3,002 $ 2,639 $ 1,950 $ 1,871 Long-term investments $ 110 Plant assets, net $ 1,515 $ 1,511 $ 1,314 $ Total assets Liabilities and Equity Current liabilities $ 915 $ 782 $ 539 $ 461 $ 410 428 $ 435 $ 971 $ 750 $ 750 $ 855 $ 834 $ 750 $ Long-term liabilities Common stock 638 $ 638 Other paid-in capital 202 $ 188 $ 188 $ 329 $ 128 $ 128 Retained earnings 509 $ 428 $ 297 $ 261 Total liabilities and equity $ 3,346 $ 3,002 $ 2,639 $ 1,950 $ 1,871

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

100%

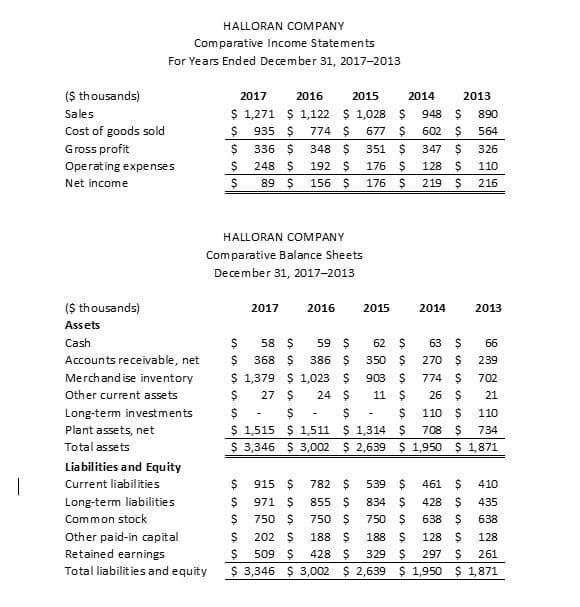

Use the statements to calculate trend percentages for all components of both statements using 2013 as the base year and summarizing your findings about the financial health of the company, using the calculations as evidence to support your conclusions.

Transcribed Image Text:HALLORAN COMPANY

Comparative Income Statements

For Years Ended December 31, 2017-2013

($ thousands)

2017

2016

2015

2014

2013

$ 1,271 $ 1,122 $ 1,028 $

774 $

Sales

948

890

Cost of goods sold

935 $

677 $

602 $

564

Gross profit

336 $

348 $

351 $

347 $

326

Operating expenses

248 $

192 $

176 $

128

110

Net income

89 $

156 $

176

219

216

HALLORAN COMPANY

Comparative Balance Sheets

December 31, 2017-2013

($ thousands)

2017

2016

2015

2014

2013

Assets

Cash

58 $

59 $

62 $

63 $

66

Accounts receivable, net

368 $

386 $

350 $

270

239

Merchandise inventory

$ 1,379 $ 1,023 $

903

774 $

702

Other current assets

27 $

24 $

11

26

21

Long-term investments

$4

110

110

$ 1,515 $ 1,511 $ 1,314 $

$ 3,346 $ 3,002 $ 2,639 $ 1,950 $ 1,871

Plant assets, net

708

734

Total assets

Liabilities and Equity

Current liabilities

915

782

539

461

410

Long-term liabilities

971 $

855 $

834 $

428

435

Common stock

750 $

750 $

750 $

638 $

638

Other paid-in capital

188 $

428 $ 329s

$ 3,346 $ 3,002 $ 2,639 $ 1,950 $ 1,871

202 $

188 $

128

128

Retained earnings

Total liabilities and equity

509 $

297

261

SSS SSS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning