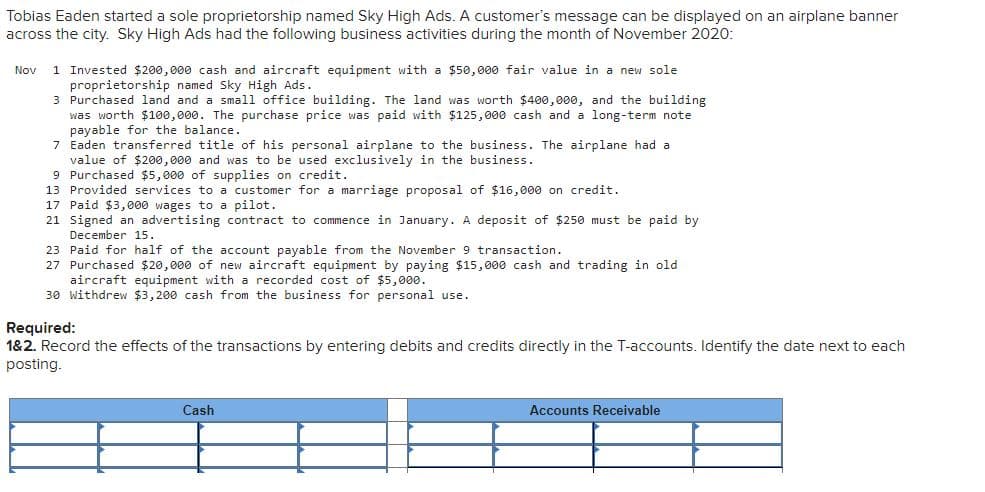

Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on an airplane banner across the city. Sky High Ads had the following business activities during the month of November 2020: Nov 1 Invested $200,000 cash and aircraft equipment with a $50, 000 fair value in a new sole proprietorship named Sky High Ads. 3 Purchased land and a small office building. The land was worth $400,000, and the building was worth $100, 000. The purchase price was paid with $125,000 cash and a long-term note payable for the balance. 7 Eaden transferred title of his personal airplane to the business. The airplane had a value of $200,000 and was to be used exclusively in the business. 9 Purchased $5,000 of supplies on credit. 13 Provided services to a customer for a marriage proposal of $16,000 on credit. 17 Paid $3,000 wages to a pilot. 21 Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. 23 Paid for half of the account payable from the November 9 transaction. 27 Purchased $20,000 of new aircraft equipment by paying $15, 000 cash and trading in old aircraft equipment with a recorded cost of $5,000. 30 withdrew $3,200 cash from the business for personal use. Required: 1&2. Record the effects of the transactions by entering debits and credits directly in the T-accounts. Identify the date next to each posting.

Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on an airplane banner across the city. Sky High Ads had the following business activities during the month of November 2020: Nov 1 Invested $200,000 cash and aircraft equipment with a $50, 000 fair value in a new sole proprietorship named Sky High Ads. 3 Purchased land and a small office building. The land was worth $400,000, and the building was worth $100, 000. The purchase price was paid with $125,000 cash and a long-term note payable for the balance. 7 Eaden transferred title of his personal airplane to the business. The airplane had a value of $200,000 and was to be used exclusively in the business. 9 Purchased $5,000 of supplies on credit. 13 Provided services to a customer for a marriage proposal of $16,000 on credit. 17 Paid $3,000 wages to a pilot. 21 Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. 23 Paid for half of the account payable from the November 9 transaction. 27 Purchased $20,000 of new aircraft equipment by paying $15, 000 cash and trading in old aircraft equipment with a recorded cost of $5,000. 30 withdrew $3,200 cash from the business for personal use. Required: 1&2. Record the effects of the transactions by entering debits and credits directly in the T-accounts. Identify the date next to each posting.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 2Q: State the accounting equation, and explain what each part represents.

Related questions

Question

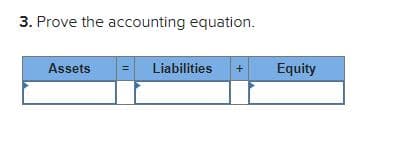

Transcribed Image Text:3. Prove the accounting equation.

Assets

= Liabilities

Equity

+

Transcribed Image Text:Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on an airplane banner

across the city. Sky High Ads had the following business activities during the month of November 2020:

Nov 1 Invested $200,000 cash and aircraft equipment with a $50, 000 fair value in a new sole

proprietorship named Sky High Ads.

3 Purchased land and a small office building. The land was worth $400,000, and the building

was worth $100,000. The purchase price was paid with $125,000 cash and a long-term note

payable for the balance.

7 Eaden transferred title of his personal airplane to the business. The airplane had a

value of $200,000 and was to be used exclusively in the business.

9 Purchased $5,000 of supplies on credit.

13 Provided services to a customer for a marriage proposal of $16,000 on credit.

17 Paid $3, 000 wages to a pilot.

21 Signed an advertising contract to commence in January. A deposit of $250 must be paid by

December 15.

23 Paid for half of the account payable from the November 9 transaction.

27 Purchased $20,000 of new aircraft equipment by paying $15,000 cash and trading in old

aircraft equipment with a recorded cost of $5,000.

30 Withdrew $3,200 cash from the business for personal use.

Required:

1&2. Record the effects of the transactions by entering debits and credits directly in the T-accounts. Identify the date next to each

posting.

Cash

Accounts Receivable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning