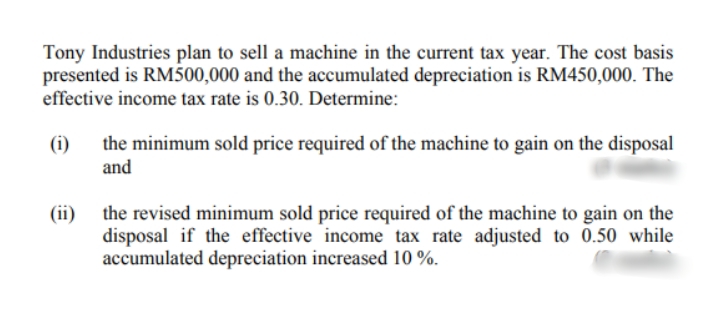

Tony Industries plan to sell a machine in the current tax year. The cost basis presented is RM500,000 and the accumulated depreciation is RM450,000. The effective income tax rate is 0.30. Determine: (i) the minimum sold price required of the machine to gain on the disposal and (ii) the revised minimum sold price required of the machine to gain on the disposal if the effective income tax rate adjusted to 0.50 while accumulated depreciation increased 10 %.

Tony Industries plan to sell a machine in the current tax year. The cost basis presented is RM500,000 and the accumulated depreciation is RM450,000. The effective income tax rate is 0.30. Determine: (i) the minimum sold price required of the machine to gain on the disposal and (ii) the revised minimum sold price required of the machine to gain on the disposal if the effective income tax rate adjusted to 0.50 while accumulated depreciation increased 10 %.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.2P

Related questions

Question

Transcribed Image Text:Tony Industries plan to sell a machine in the current tax year. The cost basis

presented is RM500,000 and the accumulated depreciation is RM450,000. The

effective income tax rate is 0.30. Determine:

the minimum sold price required of the machine to gain on the disposal

and

(i)

(ii)

the revised minimum sold price required of the machine to gain on the

disposal if the effective income tax rate adjusted to 0.50 while

accumulated depreciation increased 10 %.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College