Total Manufacturing Overhead at the beginning of the year $105,840 Total direct labour costs estimated at the beginning of the year $186,000 Total direct labour hours estimated at the beginning of the year 3,600 DLH Actual manufacturing overhead costs for the year $99,760 Actual direct labour costs for the year $142,000 Actual direct labou hours for th eyear 2,950 DLH The company bases its manufacturing overhead allocation on direct labour hours. What was the predetermined manufacturing overhead allocation rate for 2012? 2. Halcyon Company just completed Job #22. See details below. Direct labor cost: $2,040 Direct materials cost: $90 Direct labor hours: 75 Predetermined manufacturing overhead allocation rate: $34.00 per direct labor hour Number of units of finished product: 200 units. What was cost per unit of finished product? 3. Use Picture 1 to answer the following: A. After these transactions have been recorded, the balance in the Work in process account B. After these transactions have been recorded, the balance in the Finished Goods Inventory is C. After these transactions have been recorded, the preliminary balance in the Manufacturing overhead account is a 4. Use Picture 2 to answer the following After recording all these transactions, the adjusted Cost of Goods Sold account is a As a result of these transactions, how much gross profit will Conway report?

|

Total Manufacturing Overhead at the beginning of the year |

$105,840 |

|

Total direct labour costs estimated at the beginning of the year |

$186,000 |

|

Total direct labour hours estimated at the beginning of the year |

3,600 DLH |

|

Actual |

$99,760 |

|

Actual direct labour costs for the year |

$142,000 |

|

Actual direct labou hours for th eyear |

2,950 DLH |

The company bases its manufacturing overhead allocation on direct labour hours. What was the predetermined manufacturing overhead allocation rate for 2012?

2. Halcyon Company just completed Job #22. See details below.

Direct labor cost: $2,040

Direct materials cost: $90

Direct labor hours: 75

Predetermined manufacturing overhead allocation rate: $34.00 per direct labor hour

Number of units of finished product: 200 units. What was cost per unit of finished product?

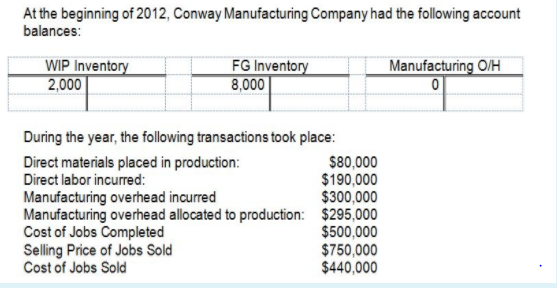

3. Use Picture 1 to answer the following:

A. After these transactions have been recorded, the balance in the Work in process account

B. After these transactions have been recorded, the balance in the Finished Goods Inventory is

C. After these transactions have been recorded, the preliminary balance in the Manufacturing overhead account is a

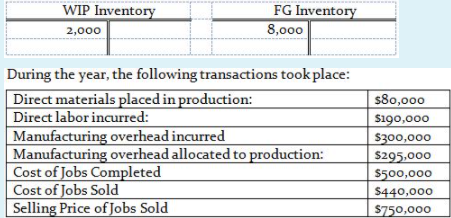

4. Use Picture 2 to answer the following

After recording all these transactions, the adjusted Cost of Goods Sold account is a

As a result of these transactions, how much gross profit will Conway report?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps