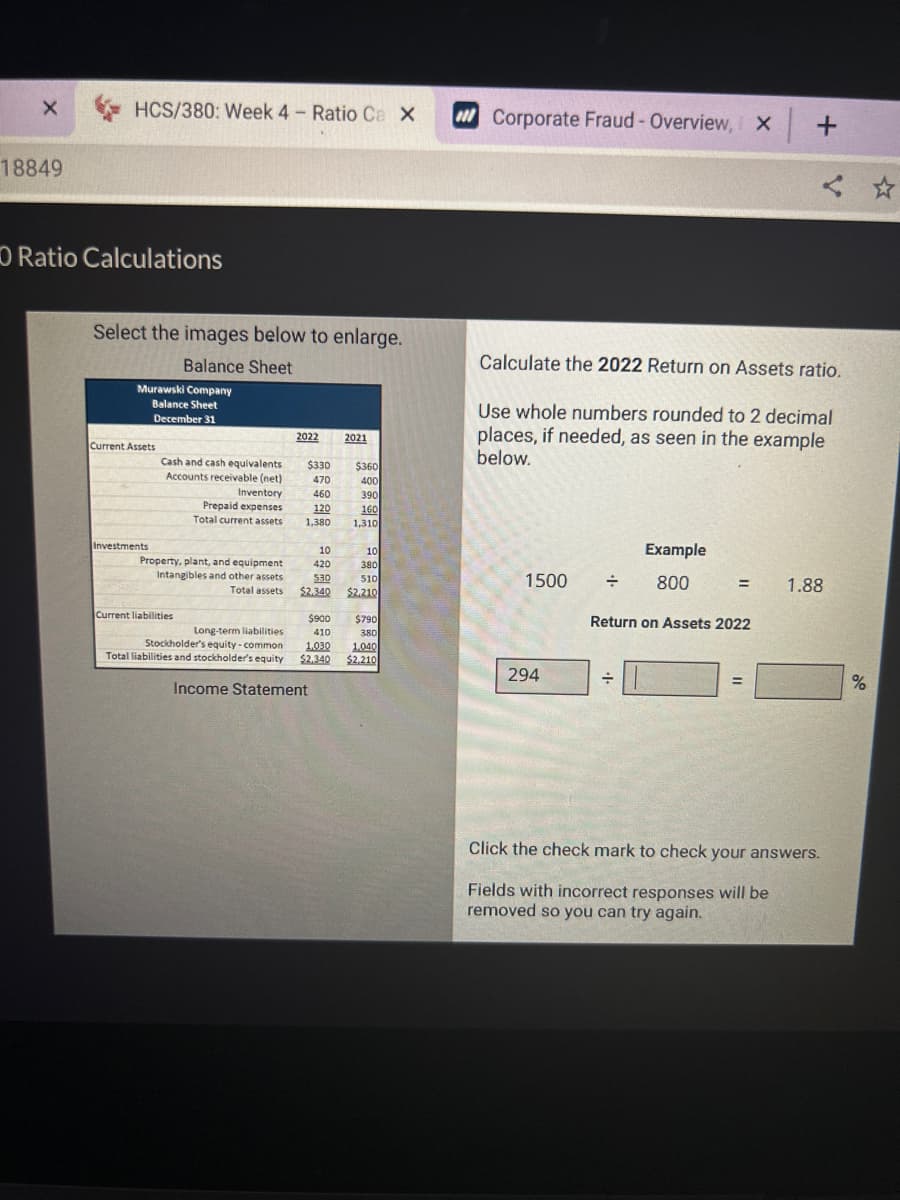

O Ratio Calculations Select the images below to enlarge. Balance Sheet Murawski Company Balance Sheet December 31 Current Assets Investments Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses Total current assets Property, plant, and equipment Intangibles and other assets Total assets Current liabilities 2022 $330 470 460 120 1,380 2021 $360 400 390 160 1,310 10 10 420 380 530 510 $2.340 $2.210 $900 410 $790 Long-term liabilities 380 Stockholder's equity-common 1.030 1,040 Total liabilities and stockholder's equity $2,340 $2,210 Income Statement Calculate the 2022 Return on Assets ratio. Use whole numbers rounded to 2 decimal places, if needed, as seen in the example below. 1500 294 Example ÷ 800 = 1.88 Return on Assets 2022 11 Click the check mark to check your answers. Fields with incorrect responses will be removed so you can try again. %

O Ratio Calculations Select the images below to enlarge. Balance Sheet Murawski Company Balance Sheet December 31 Current Assets Investments Cash and cash equivalents Accounts receivable (net) Inventory Prepaid expenses Total current assets Property, plant, and equipment Intangibles and other assets Total assets Current liabilities 2022 $330 470 460 120 1,380 2021 $360 400 390 160 1,310 10 10 420 380 530 510 $2.340 $2.210 $900 410 $790 Long-term liabilities 380 Stockholder's equity-common 1.030 1,040 Total liabilities and stockholder's equity $2,340 $2,210 Income Statement Calculate the 2022 Return on Assets ratio. Use whole numbers rounded to 2 decimal places, if needed, as seen in the example below. 1500 294 Example ÷ 800 = 1.88 Return on Assets 2022 11 Click the check mark to check your answers. Fields with incorrect responses will be removed so you can try again. %

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.17E: Profitability metrics The following selected data were taken from the financial statements of The...

Related questions

Question

Can you please help solve this

Transcribed Image Text:X

18849

HCS/380: Week 4 - Ratio Ca X

O Ratio Calculations

Select the images below to enlarge.

Balance Sheet

Murawski Company

Balance Sheet

December 31

Current Assets

Investments

Cash and cash equivalents

Accounts receivable (net)

Inventory

Prepaid expenses

Total current assets

Property, plant, and equipment

Intangibles and other assets

Total assets

2022

Current liabilities

2021

$330

470

460

120

$360

400

390

160

1,380 1,310

10

10

420

380

530

510

$2.340 $2,210

$790

$900

410

380

Long-term liabilities

Stockholder's equity-common 1.030

1,040

Total liabilities and stockholder's equity $2,340 $2,210

Income Statement

Corporate Fraud - Overview, X

1500

Calculate the 2022 Return on Assets ratio.

Use whole numbers rounded to 2 decimal

places, if needed, as seen in the example

below.

294

=÷

Example

800

÷

=

Return on Assets 2022

x |

| +

=

1.88

V

Click the check mark to check your answers.

Fields with incorrect responses will be

removed so you can try again.

%

Expert Solution

Step 1: Explain return on assets

Return on investment is a ratio that indicates the profitability of the firm with respect to assets. It indicates the profit earned by the company for each dollar invested in the assets. The ratio is very useful in assessing the profitability of the company and comparing the same with its peers.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning