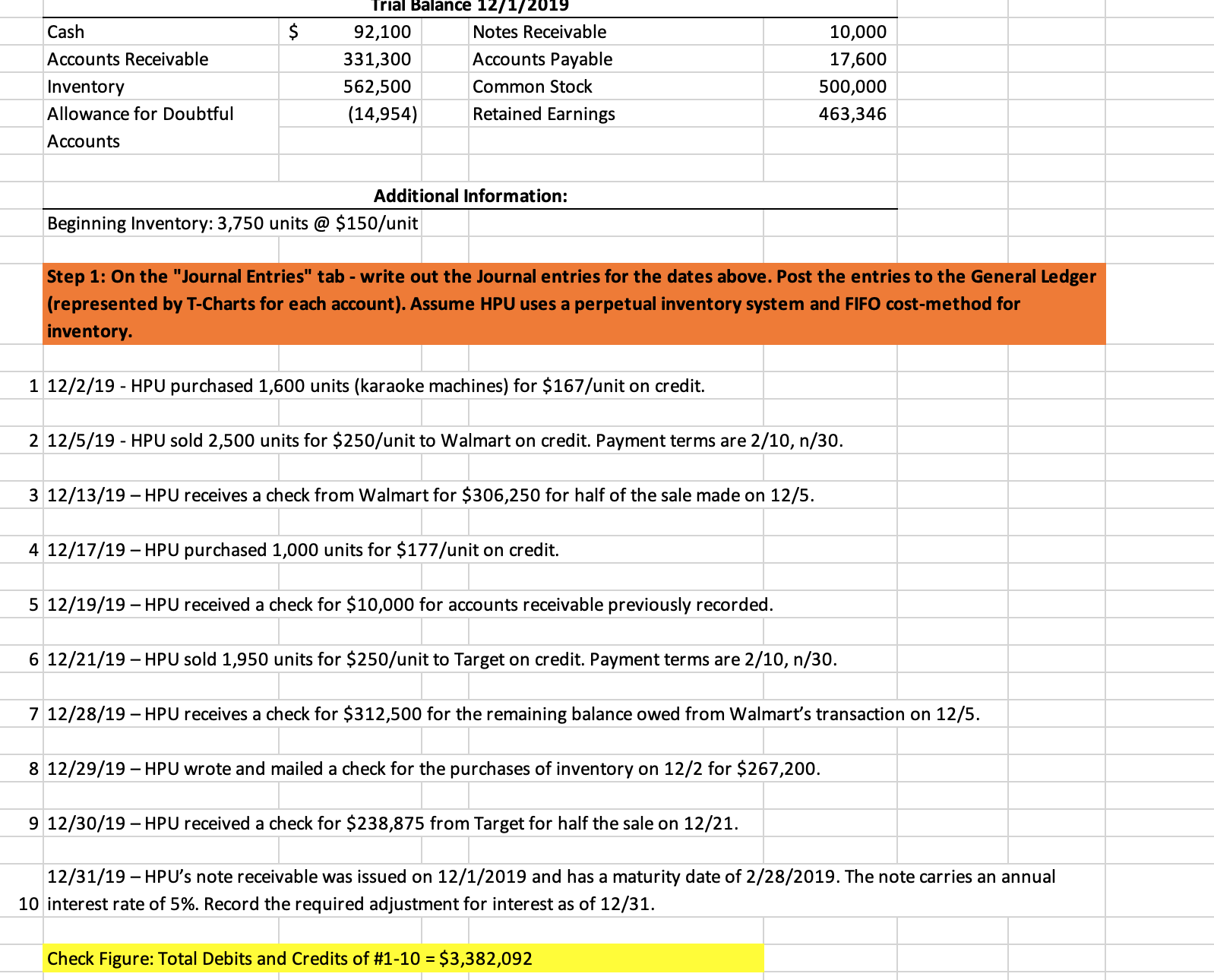

Trial Balance 12/1/2019 Cash 92,100 Notes Receivable 10,000 Accounts Receivable 331,300 Accounts Payable 17,600 Inventory 562,500 Common Stock 500,000 Allowance for Doubtful (14,954) Retained Earnings 463,346 Accounts Additional Information: Beginning Inventory: 3,750 units @ $150/unit Step 1: On the "Journal Entries" tab - write out the Journal entries for the dates above. Post the entries to the General Ledger |(represented by T-Charts for each account). Assume HPU uses a perpetual inventory system and FIFO cost-method for inventory. 1 12/2/19 - HPU purchased 1,600 units (karaoke machines) for $167/unit on credit. 2 12/5/19 - HPU sold 2,500 units for $250/unit to Walmart on credit. Payment terms are 2/10, n/30. 3 12/13/19 –HPU receives a check from Walmart for $306,250 for half of the sale made on 12/5. 4 12/17/19 – HPU purchased 1,000 units for $177/unit on credit. 5 12/19/19 – HPU received a check for $10,000 for accounts receivable previously recorded. 6 12/21/19 – HPU sold 1,950 units for $250/unit to Target on credit. Payment terms are 2/10, n/30. 7 12/28/19 -HPU receives a check for $312,500 for the remaining balance owed from Walmart's transaction on 12/5. 8 12/29/19 – HPU wrote and mailed a check for the purchases of inventory on 12/2 for $267,200. 9 12/30/19 – HPU received a check for $238,875 from Target for half the sale on 12/21. 12/31/19 – HPU's note receivable was issued on 12/1/2019 and has a maturity date of 2/28/2019. The note carries an annual 10 interest rate of 5%. Record the required adjustment for interest as of 12/31. Check Figure: Total Debits and Credits of #1-10 = $3,382,092 Step 2: COGS and Inventory If HPU used LIFO instead, how would that have changed your COGS and Ending Inventory Balances? (You don't need to do entries 1 for this, just math!) 2 If HPU used Average Cost? Step 3: Allowance for Doubtful Accounts and Bad Debt Expense: If HPU uses the Aging Method to record Bad Debt Expense- use the A/R aging below to calculate the ending ADA balance and BDE and record your entry. (NOTE: ADA has a BEGINNING BALANCE AND YOU MUST TAKE THAT INTO CONSIDERATION FOR YOUR 1 JOURNAL ENTRY!!) A/R Aging on 12/31/2019 Age Amount Default rate 0-30 days 243,750 0.01 31-60 days 118,000 0.03 61-90 days 105,650 0.1 91+ days 97,650 0.3 Step 4: Prepare a Bank Reconciliation using the following information (Note you get your bank balance from the General Ledger!): Bank Statement and Reconciliation Info Bank Balance 11/30/2019: 103,350 Checks cleared: (11,250) Deposits cleared: 628,750 Debit Memo: (13,397) Bank Service Fee: (450) Bank Balance 12/31/2019: 707,003 Outstanding Checks: 267,200 Deposits in Transit: 238,875

Trial Balance 12/1/2019 Cash 92,100 Notes Receivable 10,000 Accounts Receivable 331,300 Accounts Payable 17,600 Inventory 562,500 Common Stock 500,000 Allowance for Doubtful (14,954) Retained Earnings 463,346 Accounts Additional Information: Beginning Inventory: 3,750 units @ $150/unit Step 1: On the "Journal Entries" tab - write out the Journal entries for the dates above. Post the entries to the General Ledger |(represented by T-Charts for each account). Assume HPU uses a perpetual inventory system and FIFO cost-method for inventory. 1 12/2/19 - HPU purchased 1,600 units (karaoke machines) for $167/unit on credit. 2 12/5/19 - HPU sold 2,500 units for $250/unit to Walmart on credit. Payment terms are 2/10, n/30. 3 12/13/19 –HPU receives a check from Walmart for $306,250 for half of the sale made on 12/5. 4 12/17/19 – HPU purchased 1,000 units for $177/unit on credit. 5 12/19/19 – HPU received a check for $10,000 for accounts receivable previously recorded. 6 12/21/19 – HPU sold 1,950 units for $250/unit to Target on credit. Payment terms are 2/10, n/30. 7 12/28/19 -HPU receives a check for $312,500 for the remaining balance owed from Walmart's transaction on 12/5. 8 12/29/19 – HPU wrote and mailed a check for the purchases of inventory on 12/2 for $267,200. 9 12/30/19 – HPU received a check for $238,875 from Target for half the sale on 12/21. 12/31/19 – HPU's note receivable was issued on 12/1/2019 and has a maturity date of 2/28/2019. The note carries an annual 10 interest rate of 5%. Record the required adjustment for interest as of 12/31. Check Figure: Total Debits and Credits of #1-10 = $3,382,092 Step 2: COGS and Inventory If HPU used LIFO instead, how would that have changed your COGS and Ending Inventory Balances? (You don't need to do entries 1 for this, just math!) 2 If HPU used Average Cost? Step 3: Allowance for Doubtful Accounts and Bad Debt Expense: If HPU uses the Aging Method to record Bad Debt Expense- use the A/R aging below to calculate the ending ADA balance and BDE and record your entry. (NOTE: ADA has a BEGINNING BALANCE AND YOU MUST TAKE THAT INTO CONSIDERATION FOR YOUR 1 JOURNAL ENTRY!!) A/R Aging on 12/31/2019 Age Amount Default rate 0-30 days 243,750 0.01 31-60 days 118,000 0.03 61-90 days 105,650 0.1 91+ days 97,650 0.3 Step 4: Prepare a Bank Reconciliation using the following information (Note you get your bank balance from the General Ledger!): Bank Statement and Reconciliation Info Bank Balance 11/30/2019: 103,350 Checks cleared: (11,250) Deposits cleared: 628,750 Debit Memo: (13,397) Bank Service Fee: (450) Bank Balance 12/31/2019: 707,003 Outstanding Checks: 267,200 Deposits in Transit: 238,875

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 1RE: Rescue Sequences LLC purchased inventory by issuing a 30,000, 10%, 60-day note on October 1. Prepare...

Related questions

Question

I was wondering if someone could help me with this accounting problem

Transcribed Image Text:Trial Balance 12/1/2019

Cash

92,100

Notes Receivable

10,000

Accounts Receivable

331,300

Accounts Payable

17,600

Inventory

562,500

Common Stock

500,000

Allowance for Doubtful

(14,954)

Retained Earnings

463,346

Accounts

Additional Information:

Beginning Inventory: 3,750 units @ $150/unit

Step 1: On the "Journal Entries" tab - write out the Journal entries for the dates above. Post the entries to the General Ledger

|(represented by T-Charts for each account). Assume HPU uses a perpetual inventory system and FIFO cost-method for

inventory.

1 12/2/19 - HPU purchased 1,600 units (karaoke machines) for $167/unit on credit.

2 12/5/19 - HPU sold 2,500 units for $250/unit to Walmart on credit. Payment terms are 2/10, n/30.

3 12/13/19 –HPU receives a check from Walmart for $306,250 for half of the sale made on 12/5.

4 12/17/19 – HPU purchased 1,000 units for $177/unit on credit.

5 12/19/19 – HPU received a check for $10,000 for accounts receivable previously recorded.

6 12/21/19 – HPU sold 1,950 units for $250/unit to Target on credit. Payment terms are 2/10, n/30.

7 12/28/19 -HPU receives a check for $312,500 for the remaining balance owed from Walmart's transaction on 12/5.

8 12/29/19 – HPU wrote and mailed a check for the purchases of inventory on 12/2 for $267,200.

9 12/30/19 – HPU received a check for $238,875 from Target for half the sale on 12/21.

12/31/19 – HPU's note receivable was issued on 12/1/2019 and has a maturity date of 2/28/2019. The note carries an annual

10 interest rate of 5%. Record the required adjustment for interest as of 12/31.

Check Figure: Total Debits and Credits of #1-10 = $3,382,092

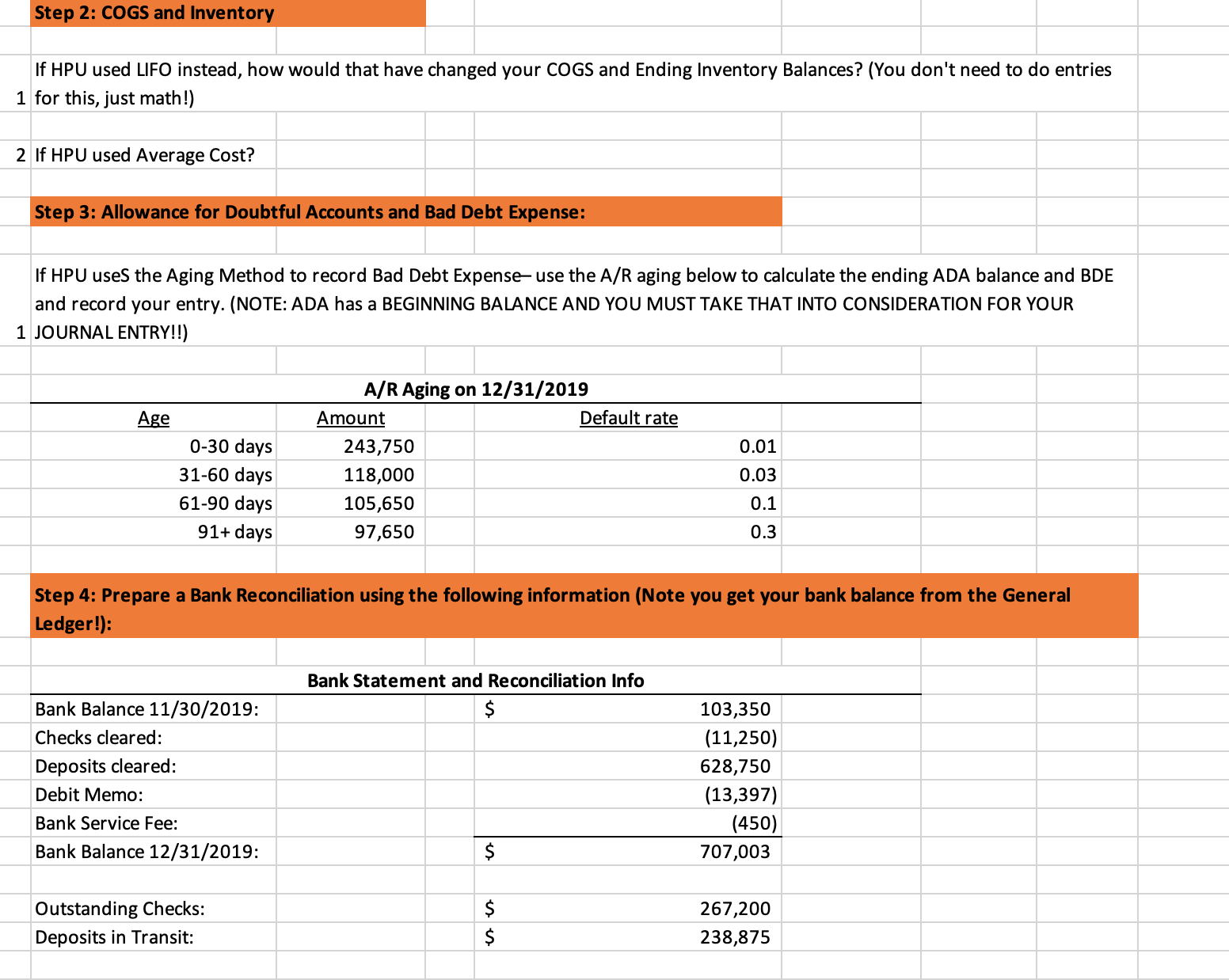

Transcribed Image Text:Step 2: COGS and Inventory

If HPU used LIFO instead, how would that have changed your COGS and Ending Inventory Balances? (You don't need to do entries

1 for this, just math!)

2 If HPU used Average Cost?

Step 3: Allowance for Doubtful Accounts and Bad Debt Expense:

If HPU uses the Aging Method to record Bad Debt Expense- use the A/R aging below to calculate the ending ADA balance and BDE

and record your entry. (NOTE: ADA has a BEGINNING BALANCE AND YOU MUST TAKE THAT INTO CONSIDERATION FOR YOUR

1 JOURNAL ENTRY!!)

A/R Aging on 12/31/2019

Age

Amount

Default rate

0-30 days

243,750

0.01

31-60 days

118,000

0.03

61-90 days

105,650

0.1

91+ days

97,650

0.3

Step 4: Prepare a Bank Reconciliation using the following information (Note you get your bank balance from the General

Ledger!):

Bank Statement and Reconciliation Info

Bank Balance 11/30/2019:

103,350

Checks cleared:

(11,250)

Deposits cleared:

628,750

Debit Memo:

(13,397)

Bank Service Fee:

(450)

Bank Balance 12/31/2019:

707,003

Outstanding Checks:

267,200

Deposits in Transit:

238,875

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,