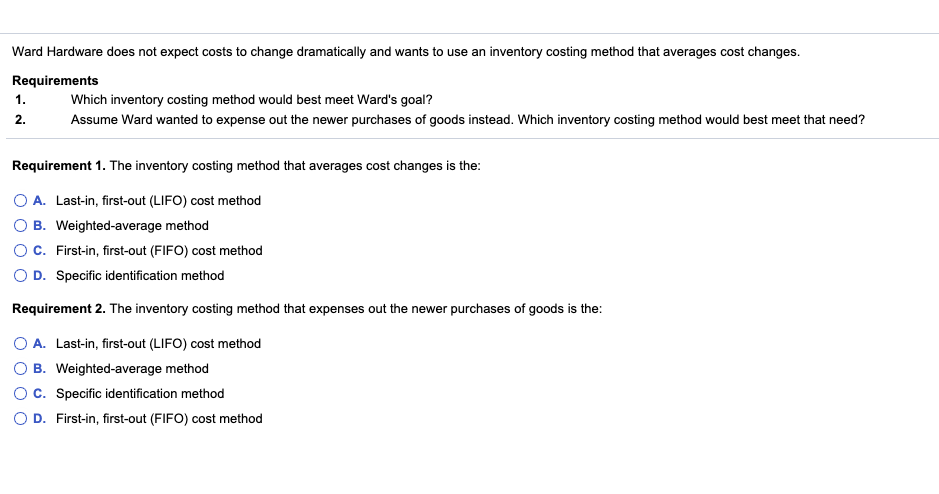

Ward Hardware does not expect costs to change dramatically and wants to use an inventory costing method that averages cost changes. Requirements 1. Which inventory costing method would best meet Ward's goal? 2. Assume Ward wanted to expense out the newer purchases of goods instead. Which inventory costing method would best meet that need? Requirement 1. The inventory costing method that averages cost changes is the: O A. Last-in, first-out (LIFO) cost method O B. Weighted-average method OC. First-in, first-out (FIFO) cost method O D. Specific identification method Requirement 2. The inventory costing method that expenses out the newer purchases of goods is the: O A. Last-in, first-out (LIFO) cost method B. Weighted-average method Oc. Specific identification method O D. First-in, first-out (FIFO) cost method

Ward Hardware does not expect costs to change dramatically and wants to use an inventory costing method that averages cost changes. Requirements 1. Which inventory costing method would best meet Ward's goal? 2. Assume Ward wanted to expense out the newer purchases of goods instead. Which inventory costing method would best meet that need? Requirement 1. The inventory costing method that averages cost changes is the: O A. Last-in, first-out (LIFO) cost method O B. Weighted-average method OC. First-in, first-out (FIFO) cost method O D. Specific identification method Requirement 2. The inventory costing method that expenses out the newer purchases of goods is the: O A. Last-in, first-out (LIFO) cost method B. Weighted-average method Oc. Specific identification method O D. First-in, first-out (FIFO) cost method

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 75.1C

Related questions

Topic Video

Question

Transcribed Image Text:Ward Hardware does not expect costs to change dramatically and wants to use an inventory costing method that averages cost changes.

Requirements

1.

Which inventory costing method would best meet Ward's goal?

2.

Assume Ward wanted to expense out the newer purchases of goods instead. Which inventory costing method would best meet that need?

Requirement 1. The inventory costing method that averages cost changes is the:

O A. Last-in, first-out (LIFO) cost method

O B. Weighted-average method

OC. First-in, first-out (FIFO) cost method

O D. Specific identification method

Requirement 2. The inventory costing method that expenses out the newer purchases of goods is the:

O A. Last-in, first-out (LIFO) cost method

B. Weighted-average method

Oc. Specific identification method

O D. First-in, first-out (FIFO) cost method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning