lizable value. Required: For each item, (a)-(d), prepare the journal entry to correct the balances presently reported. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list <> To record the elimination of consignment inventory, which does not belong to SLC. 1 elong to 2 To record the rectification for recording $6,700 supplies as inventory. 3 To record the elimination of $9,700 cost of goods sold in

lizable value. Required: For each item, (a)-(d), prepare the journal entry to correct the balances presently reported. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list <> To record the elimination of consignment inventory, which does not belong to SLC. 1 elong to 2 To record the rectification for recording $6,700 supplies as inventory. 3 To record the elimination of $9,700 cost of goods sold in

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 4PB: The accounts and their balances in the ledger of Markeys Mountain Shop as of December 31, the end of...

Related questions

Question

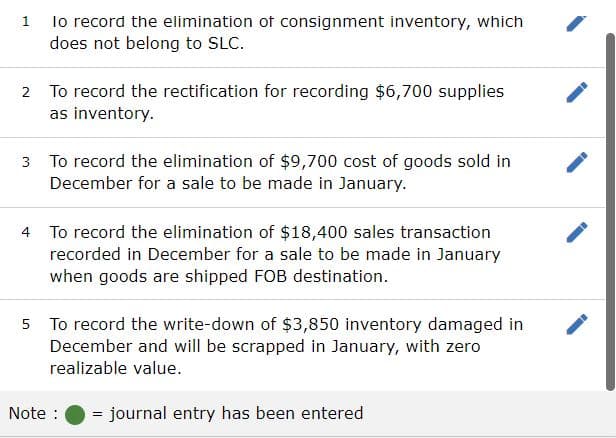

Transcribed Image Text:lo record the elimination of consignment inventory, which

does not belong to SLC.

1

2 To record the rectification for recording $6,700 supplies

as inventory.

3 To record the elimination of $9,700 cost of goods sold in

December for a sale to be made in January.

4 To record the elimination of $18,400 sales transaction

recorded in December for a sale to be made in January

when goods are shipped FOB destination.

5 To record the write-down of $3,850 inventory damaged in

December and will be scrapped in January, with zero

realizable value.

Note :

= journal entry has been entered

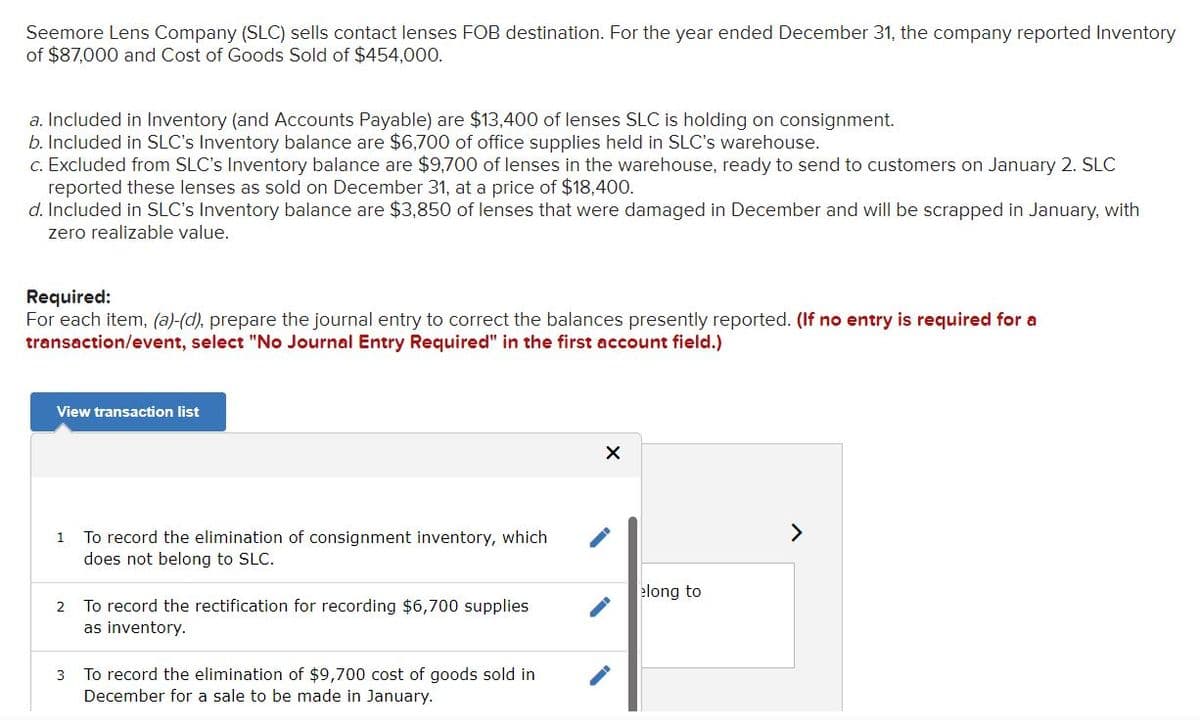

Transcribed Image Text:Seemore Lens Company (SLC) sells contact lenses FOB destination. For the year ended December 31, the company reported Inventory

of $87,000 and Cost of Goods Sold of $454,000.

a. Included in Inventory (and Accounts Payable) are $13,400 of lenses SLC is holding on consignment.

b. Included in SLC's Inventory balance are $6,700 of office supplies held in SLC's warehouse.

c. Excluded from SLC's Inventory balance are $9,700 of lenses in the warehouse, ready to send to customers on January 2. SLC

reported these lenses as sold on December 31, at a price of $18,400.

d. Included in SLC's Inventory balance are $3,850 of lenses that were damaged in December and will be scrapped in January, with

zero realizable value.

Required:

For each item, (a)-(d), prepare the journal entry to correct the balances presently reported. (If no entry is required for a

transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

>

To record the elimination of consignment inventory, which

does not belong to SLC.

1

elong to

2

To record the rectification for recording $6,700 supplies

as inventory.

To record the elimination of $9,700 cost of goods sold in

December for a sale to be made in January.

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning