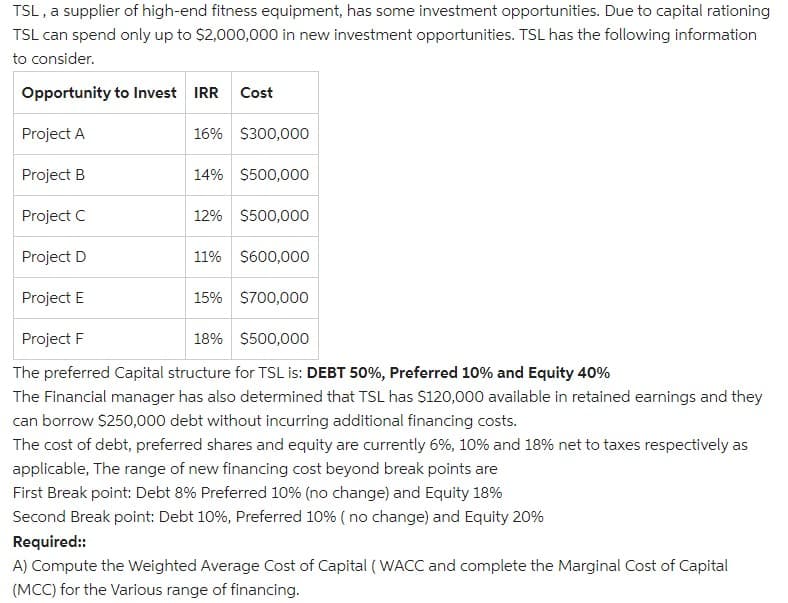

TSL, a supplier of high-end fitness equipment, has some investment opportunities. Due to capital rationing TSL can spend only up to $2,000,000 in new investment opportunities. TSL has the following information to consider. Opportunity to Invest IRR Cost Project A 16% $300,000 Project B 14% $500,000 Project C 12% $500,000 Project D 11% $600,000 Project E 15% $700,000 Project F 18% $500,000 The preferred Capital structure for TSL is: DEBT 50%, Preferred 10% and Equity 40% The Financial manager has also determined that TSL has $120,000 available in retained earnings and they can borrow $250,000 debt without incurring additional financing costs. The cost of debt, preferred shares and equity are currently 6%, 10% and 18% net to taxes respectively as applicable, The range of new financing cost beyond break points are First Break point: Debt 8% Preferred 10% (no change) and Equity 18% Second Break point: Debt 10%, Preferred 10% ( no change) and Equity 20% Required: A) Compute the Weighted Average Cost of Capital ( WACC and complete the Marginal Cost of Capital (MCC) for the Various range of financing.

TSL, a supplier of high-end fitness equipment, has some investment opportunities. Due to capital rationing TSL can spend only up to $2,000,000 in new investment opportunities. TSL has the following information to consider. Opportunity to Invest IRR Cost Project A 16% $300,000 Project B 14% $500,000 Project C 12% $500,000 Project D 11% $600,000 Project E 15% $700,000 Project F 18% $500,000 The preferred Capital structure for TSL is: DEBT 50%, Preferred 10% and Equity 40% The Financial manager has also determined that TSL has $120,000 available in retained earnings and they can borrow $250,000 debt without incurring additional financing costs. The cost of debt, preferred shares and equity are currently 6%, 10% and 18% net to taxes respectively as applicable, The range of new financing cost beyond break points are First Break point: Debt 8% Preferred 10% (no change) and Equity 18% Second Break point: Debt 10%, Preferred 10% ( no change) and Equity 20% Required: A) Compute the Weighted Average Cost of Capital ( WACC and complete the Marginal Cost of Capital (MCC) for the Various range of financing.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 8P

Related questions

Question

B) Draw the firms marginal cost of capital (MCC) and the Investment Opportunity Schedule (IOS)

C) Which of the projects should they select? why?

D) Calculate the overall cost of capital for TSL

Transcribed Image Text:TSL , a supplier of high-end fitness equipment, has some investment opportunities. Due to capital rationing

TSL can spend only up to S2,000,000 in new investment opportunities. TSL has the following information

to consider.

Opportunity to Invest IRR

Cost

Project A

16% S300,000

Project B

14% $500,000

Project C

12% $500,000

Project D

11% $600,000

Project E

15% S700,000

Project F

18% $500,000

The preferred Capital structure for TSL is: DEBT 50%, Preferred 10% and Equity 40%

The Financial manager has also determined that TSL has S120,000 available in retained earnings and they

can borrow $250,000 debt without incurring additional financing costs.

The cost of debt, preferred shares and equity are currently 6%, 10% and 18% net to taxes respectively as

applicable, The range of new financing cost beyond break points are

First Break point: Debt 8% Preferred 10% (no change) and Equity 18%

Second Break point: Debt 10%, Preferred 10% ( no change) and Equity 20%

Required:

A) Compute the Weighted Average Cost of Capital (WACC and complete the Marginal Cost of Capital

(MCC) for the Various range of financing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT