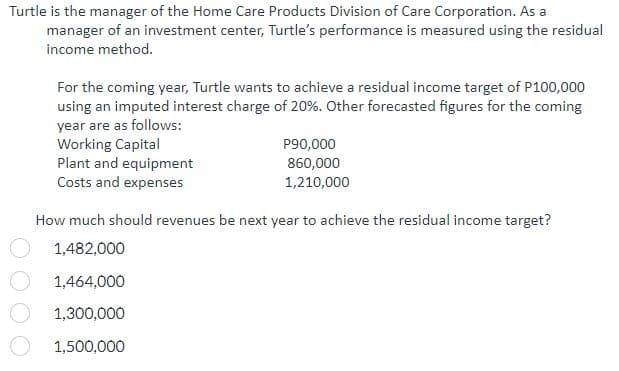

Turtle is the manager of the Home Care Products Division of Care Corporation. As a manager of an investment center, Turtle's performance is measured using the residual income method. For the coming year, Turtle wants to achieve a residual income target of P100,000 using an imputed interest charge of 20%. Other forecasted figures for the coming year are as follows: Working Capital Plant and equipment Costs and expenses P90,000 860,000 1,210,000 How much should revenues be next year to achieve the residual income target? 1,482,000 1,464,000 1,300,000 1,500,000

Turtle is the manager of the Home Care Products Division of Care Corporation. As a manager of an investment center, Turtle's performance is measured using the residual income method. For the coming year, Turtle wants to achieve a residual income target of P100,000 using an imputed interest charge of 20%. Other forecasted figures for the coming year are as follows: Working Capital Plant and equipment Costs and expenses P90,000 860,000 1,210,000 How much should revenues be next year to achieve the residual income target? 1,482,000 1,464,000 1,300,000 1,500,000

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 5PA: Falkland, Inc., is considering the purchase of a patent that has a cost of $50,000 and an estimated...

Related questions

Question

Transcribed Image Text:Turtle is the manager of the Home Care Products Division of Care Corporation. As a

manager of an investment center, Turtle's performance is measured using the residual

income method.

For the coming year, Turtle wants to achieve a residual income target of P100,000

using an imputed interest charge of 20%. Other forecasted figures for the coming

year are as follows:

Working Capital

Plant and equipment

Costs and expenses

P90,000

860,000

1,210,000

How much should revenues be next year to achieve the residual income target?

1,482,000

1,464,000

1,300,000

1,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning