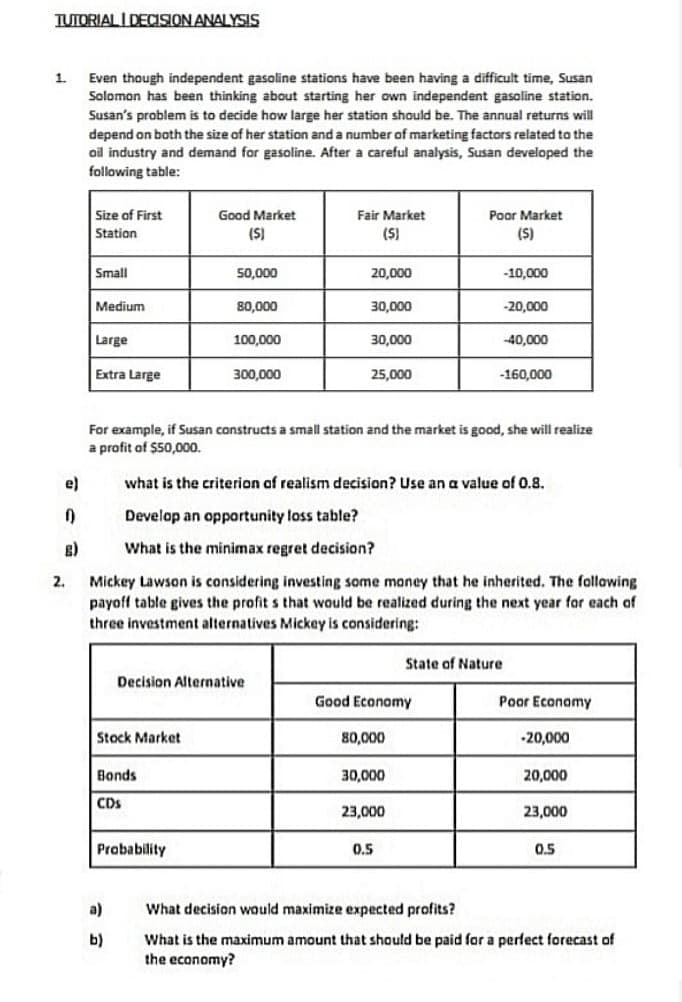

TUTORIAL I DECISION ANALYSIS 1. Even though independent gasoline stations have been having a difficult time, Susan Solomon has been thinking about starting her own independent gasoline station. Susan's problem is to decide how large her station should be. The annual returns will depend on both the size of her station and a number of marketing factors related to the oil industry and demand for gasoline. After a careful analysis, Susan developed the following table: Size of First Station Small Medium Large Extra Large Good Market (5) Stock Market 50,000 80,000 Bonds CDs 100,000 Probability 300,000 Decision Alternative Fair Market (S) 20,000 30,000 30,000 25,000 For example, if Susan constructs a small station and the market is good, she will realize a profit of $50,000. e) what is the criterion of realism decision? Use an a value of 0.8. 0 Develop an opportunity loss table? B) What is the minimax regret decision? 2. Mickey Lawson is considering investing some money that he inherited. The following payoff table gives the profit s that would be realized during the next year for each of three investment alternatives Mickey is considering: Good Economy 80,000 30,000 Poor Market (S) 23,000 -10,000 -20,000 0.5 -40,000 -160,000 State of Nature Poor Economy -20,000 20,000 23,000 0.5

TUTORIAL I DECISION ANALYSIS 1. Even though independent gasoline stations have been having a difficult time, Susan Solomon has been thinking about starting her own independent gasoline station. Susan's problem is to decide how large her station should be. The annual returns will depend on both the size of her station and a number of marketing factors related to the oil industry and demand for gasoline. After a careful analysis, Susan developed the following table: Size of First Station Small Medium Large Extra Large Good Market (5) Stock Market 50,000 80,000 Bonds CDs 100,000 Probability 300,000 Decision Alternative Fair Market (S) 20,000 30,000 30,000 25,000 For example, if Susan constructs a small station and the market is good, she will realize a profit of $50,000. e) what is the criterion of realism decision? Use an a value of 0.8. 0 Develop an opportunity loss table? B) What is the minimax regret decision? 2. Mickey Lawson is considering investing some money that he inherited. The following payoff table gives the profit s that would be realized during the next year for each of three investment alternatives Mickey is considering: Good Economy 80,000 30,000 Poor Market (S) 23,000 -10,000 -20,000 0.5 -40,000 -160,000 State of Nature Poor Economy -20,000 20,000 23,000 0.5

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 33P: Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand...

Related questions

Question

Transcribed Image Text:TUTORIAL DECISION ANALYSIS

1.

e)

0

B)

2.

Even though independent gasoline stations have been having a difficult time, Susan

Solomon has been thinking about starting her own independent gasoline station.

Susan's problem is to decide how large her station should be. The annual returns will

depend on both the size of her station and a number of marketing factors related to the

oil industry and demand for gasoline. After a careful analysis, Susan developed the

following table:

Size of First

Station

Small

Medium

Large

Extra Large

Stock Market

Bonds

CDs

Good Market

(5)

Probability

a)

b)

50,000

80,000

Decision Alternative.

100,000

300,000

Fair Market

(S)

20,000

30,000

30,000

25,000

For example, if Susan constructs a small station and the market is good, she will realize

a profit of $50,000.

what is the criterion of realism decision? Use an a value of 0.8.

Develop an opportunity loss table?

What is the minimax regret decision?

Mickey Lawson is considering investing some money that he inherited. The following

payoff table gives the profit s that would be realized during the next year for each of

three investment alternatives Mickey is considering:

Good Economy

80,000

30,000

23,000

Poor Market

(5)

0.5

-10,000

State of Nature

-20,000

-40,000

-160,000

Poor Economy

-20,000

20,000

23,000

0.5

What decision would maximize expected profits?

What is the maximum amount that should be paid for a perfect forecast of

the economy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 7 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,