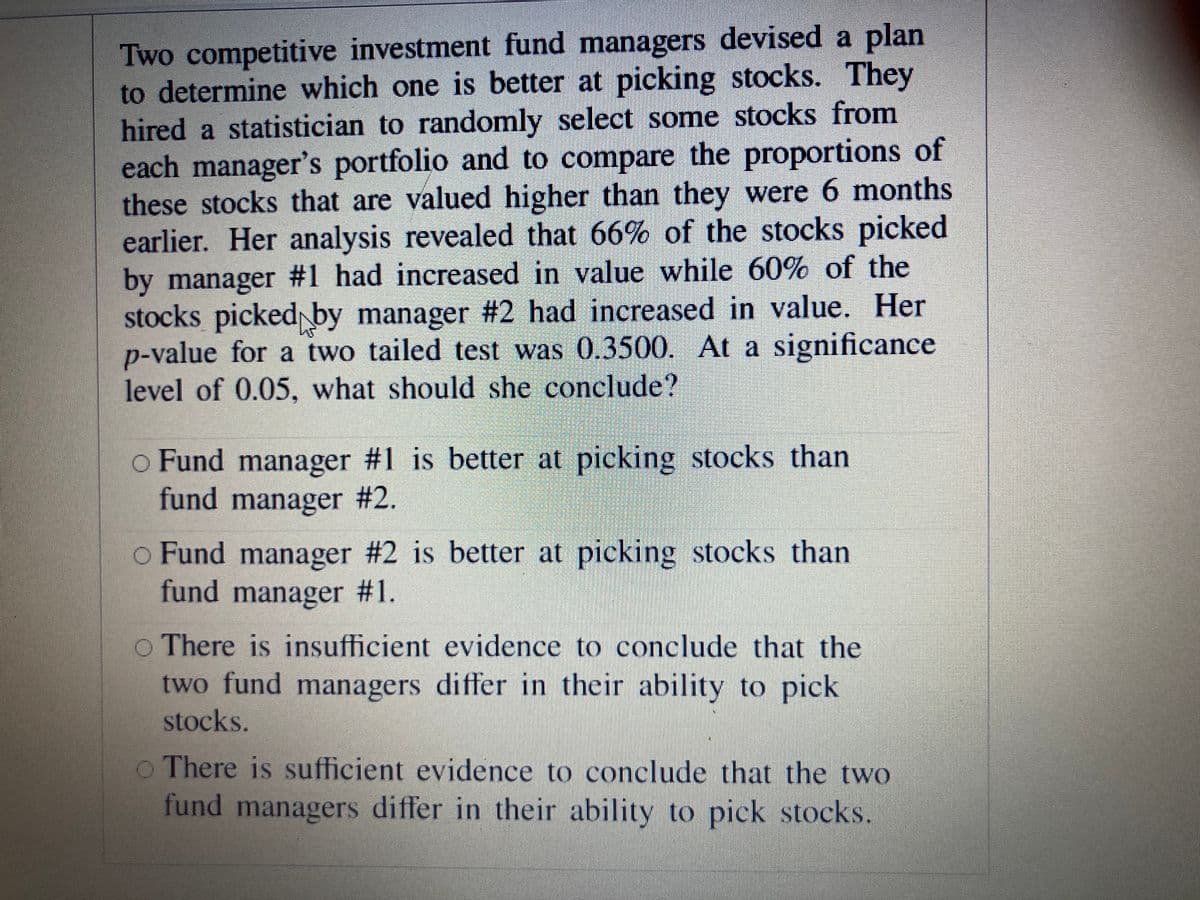

Two competitive investment fund managers devised a plan to determine which one is better at picking stocks. They hired a statistician to randomly select some stocks from each manager's portfolio and to compare the proportions of these stocks that are valued higher than they were 6 months earlier. Her analysis revealed that 66% of the stocks picked by manager #1 had increased in value while 60% of the stocks picked by manager #2 had increased in value. Her p-value for a two tailed test was 0.3500. At a significance level of 0.05, what should she conclude? o Fund manager #1 is better at picking stocks than fund manager #2. o Fund manager #2 is better at picking stocks than fund manager #1. O There is insufficient evidence to conclude that the two fund managers differ in their ability to pick stocks. o There is sufficient evidence to conclude that the two fund managers differ in their ability to pick stocks.

Two competitive investment fund managers devised a plan to determine which one is better at picking stocks. They hired a statistician to randomly select some stocks from each manager's portfolio and to compare the proportions of these stocks that are valued higher than they were 6 months earlier. Her analysis revealed that 66% of the stocks picked by manager #1 had increased in value while 60% of the stocks picked by manager #2 had increased in value. Her p-value for a two tailed test was 0.3500. At a significance level of 0.05, what should she conclude? o Fund manager #1 is better at picking stocks than fund manager #2. o Fund manager #2 is better at picking stocks than fund manager #1. O There is insufficient evidence to conclude that the two fund managers differ in their ability to pick stocks. o There is sufficient evidence to conclude that the two fund managers differ in their ability to pick stocks.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.6: Summarizing Categorical Data

Problem 10CYU

Related questions

Question

Transcribed Image Text:Two competitive investment fund managers devised a plan

to determine which one is better at picking stocks. They

hired a statistician to randomly select some stocks from

each manager's portfolio and to compare the proportions of

these stocks that are valued higher than they were 6 months

earlier. Her analysis revealed that 66% of the stocks picked

by manager #1 had increased in value while 60% of the

stocks picked by manager #2 had increased in value. Her

p-value for a two tailed test was 0.3500. At a significance

level of 0.05, what should she conclude?

o Fund manager #1 is better at picking stocks than

fund manager #2.

o Fund manager #2 is better at picking stocks than

fund manager

#1.

o There is insufficient evidence to conclude that the

two fund managers differ in their ability to pick

stocks.

o There is sufficient evidence to conclude that the two

fund managers differ in their ability to pick stocks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL