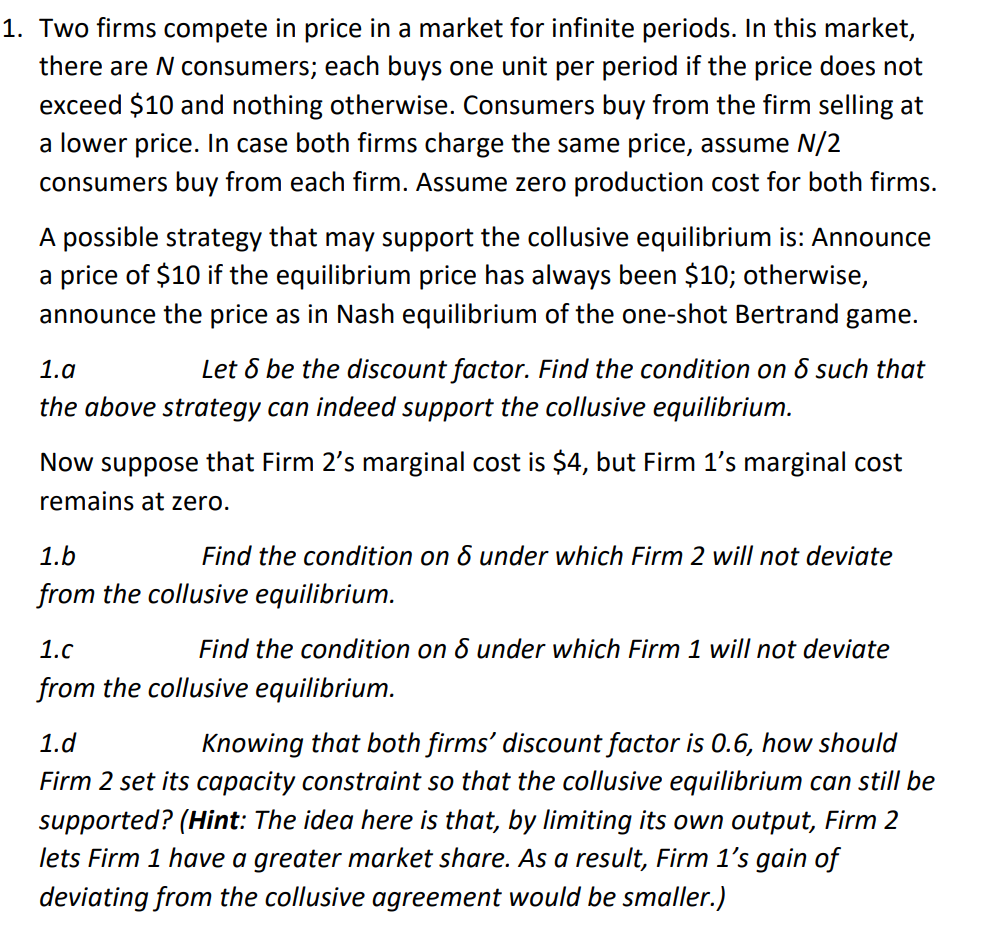

Two firms compete in price in a market for infinite periods. In this market, there are N consumers; each buys one unit per period if the price does not exceed $10 and nothing otherwise. Consumers buy from the firm selling at a lower price. In case both firms charge the same price, assume N/2 consumers buy from each firm. Assume zero production cost for both firms. A possible strategy that may support the collusive equilibrium is: Announce a price of $10 if the equilibrium price has always been $10; otherwise, announce the price as in Nash equilibrium of the one-shot Bertrand game. 1 a Let & be the discount factor Find the condition on & such that

Two firms compete in price in a market for infinite periods. In this market, there are N consumers; each buys one unit per period if the price does not exceed $10 and nothing otherwise. Consumers buy from the firm selling at a lower price. In case both firms charge the same price, assume N/2 consumers buy from each firm. Assume zero production cost for both firms. A possible strategy that may support the collusive equilibrium is: Announce a price of $10 if the equilibrium price has always been $10; otherwise, announce the price as in Nash equilibrium of the one-shot Bertrand game. 1 a Let & be the discount factor Find the condition on & such that

Chapter8: Game Theory

Section: Chapter Questions

Problem 8.9P

Related questions

Question

Transcribed Image Text:1. Two firms compete in price in a market for infinite periods. In this market,

there are N consumers; each buys one unit per period if the price does not

exceed $10 and nothing otherwise. Consumers buy from the firm selling at

a lower price. In case both firms charge the same price, assume N/2

consumers buy from each firm. Assume zero production cost for both firms.

A possible strategy that may support the collusive equilibrium is: Announce

a price of $10 if the equilibrium price has always been $10; otherwise,

announce the price as in Nash equilibrium of the one-shot Bertrand game.

1.a

Let & be the discount factor. Find the condition on & such that

the above strategy can indeed support the collusive equilibrium.

Now suppose that Firm 2's marginal cost is $4, but Firm 1's marginal cost

remains at zero.

1.b

Find the condition on & under which Firm 2 will not deviate

from the collusive equilibrium.

1.c

Find the condition on

under which Firm 1 will not deviate

from the collusive equilibrium.

1.d

Knowing that both firms' discount factor is 0.6, how should

Firm 2 set its capacity constraint so that the collusive equilibrium can still be

supported? (Hint: The idea here is that, by limiting its own output, Firm 2

lets Firm 1 have a greater market share. As a result, Firm 1's gain of

deviating from the collusive agreement would be smaller.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning