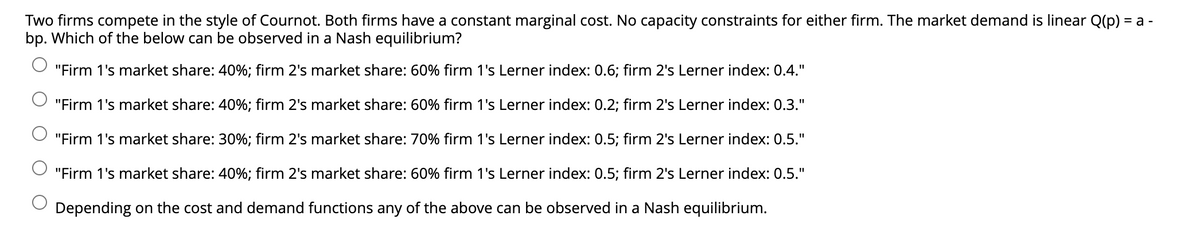

Two firms compete in the style of Cournot. Both firms have a constant marginal cost. No capacity constraints for either firm. The market demand is linear Q(p) = a - bp. Which of the below can be observed in a Nash equilibrium? O "Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.6; firm 2's Lerner index: 0.4." O "Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.2; firm 2's Lerner index: 0.3." O "Firm 1's market share: 30%; firm 2's market share: 70% firm 1's Lerner index: 0.5; firm 2's Lerner index: 0.5." O "Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.5; firm 2's Lerner index: 0.5." Depending on the cost and demand functions any of the above can be observed in a Nash equilibrium.

Two firms compete in the style of Cournot. Both firms have a constant marginal cost. No capacity constraints for either firm. The market demand is linear Q(p) = a - bp. Which of the below can be observed in a Nash equilibrium? O "Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.6; firm 2's Lerner index: 0.4." O "Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.2; firm 2's Lerner index: 0.3." O "Firm 1's market share: 30%; firm 2's market share: 70% firm 1's Lerner index: 0.5; firm 2's Lerner index: 0.5." O "Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.5; firm 2's Lerner index: 0.5." Depending on the cost and demand functions any of the above can be observed in a Nash equilibrium.

Chapter15: Oligopoly And Strategic Behavior

Section: Chapter Questions

Problem 14P

Related questions

Question

6.

Transcribed Image Text:Two firms compete in the style of Cournot. Both firms have a constant marginal cost. No capacity constraints for either firm. The market demand is linear Q(p) =

bp. Which of the below can be observed in a Nash equilibrium?

a -

"Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.6; firm 2's Lerner index: 0.4."

"Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.2; firm 2's Lerner index: 0.3."

"Firm 1's market share: 30%; firm 2's market share: 70% firm 1's Lerner index: 0.5; firm 2's Lerner index: 0.5."

"Firm 1's market share: 40%; firm 2's market share: 60% firm 1's Lerner index: 0.5; firm 2's Lerner index: 0.5."

Depending on the cost and demand functions any of the above can be observed in a Nash equilibrium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning