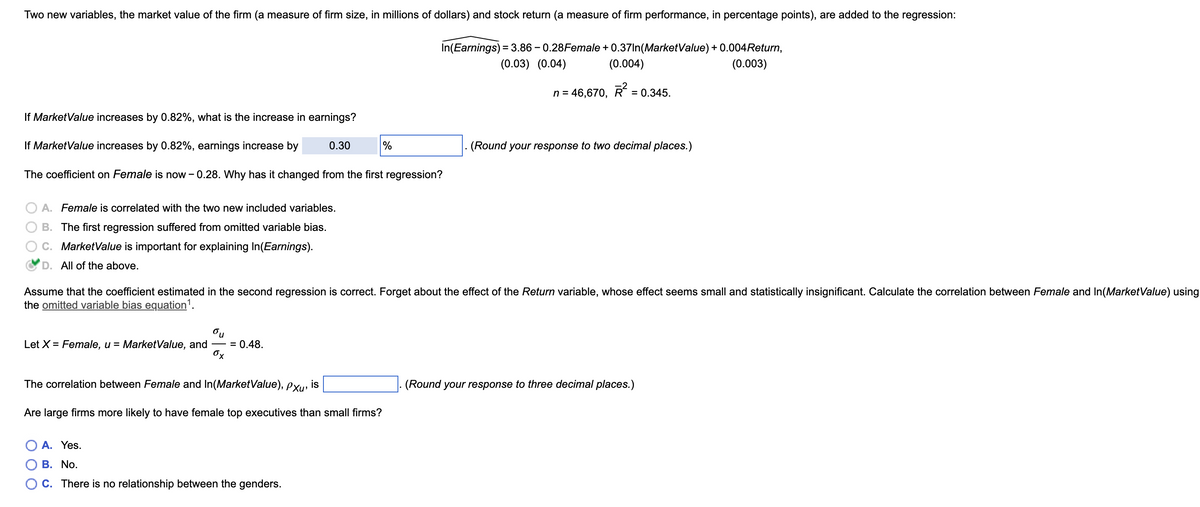

Two new variables, the market value of the firm (a measure of firm size, in millions of dollars) and stock return (a measure of firm performance, in percentage points), are added to the regression: In(Earnings) = 3.86-0.28Female +0.37In(MarketValue) + 0.004 Return, (0.03) (0.04) (0.004) (0.003) n = 46,670, R² = 0.345. If MarketValue increases by 0.82%, what is the increase in earnings? If Market Value increases by 0.82%, earnings increase by The coefficient on Female is now -0.28. Why has it changed from the first regression? OA. Female correlated with the two new included variables. 0.30 % (Round your response to two decimal places.)

Two new variables, the market value of the firm (a measure of firm size, in millions of dollars) and stock return (a measure of firm performance, in percentage points), are added to the regression: In(Earnings) = 3.86-0.28Female +0.37In(MarketValue) + 0.004 Return, (0.03) (0.04) (0.004) (0.003) n = 46,670, R² = 0.345. If MarketValue increases by 0.82%, what is the increase in earnings? If Market Value increases by 0.82%, earnings increase by The coefficient on Female is now -0.28. Why has it changed from the first regression? OA. Female correlated with the two new included variables. 0.30 % (Round your response to two decimal places.)

Chapter4: Linear Functions

Section: Chapter Questions

Problem 30PT: For the following exercises, use Table 4 which shows the percent of unemployed persons 25 years or...

Related questions

Question

please answer the third and fourth part

Transcribed Image Text:Two new variables, the market value of the firm (a measure of firm size, in millions of dollars) and stock return (a measure of firm performance, in percentage points), are added to the regression:

If Market Value increases by 0.82%, what is the increase in earnings?

If MarketValue increases by 0.82%, earnings increase by

The coefficient on Female is now -0.28. Why has it changed from the first regression?

A. Female is correlated with the two new included variables.

B. The first regression suffered from omitted variable bias.

C. MarketValue is important for explaining In(Earnings).

D. All of the above.

0.30

ou

Let X = Female, u = MarketValue, and - = 0.48.

ox

The correlation between Female and In(MarketValue), Pxu' is

Are large firms more likely to have female top executives than small firms?

A. Yes.

B. No.

OC. There is no relationship between the genders.

In(Earnings) = 3.86 -0.28Female + 0.37In(MarketValue) + 0.004 Return,

(0.03) (0.04)

(0.004)

(0.003)

n = 46,670, Ŕ² = 0.345.

%

Assume that the coefficient estimated in the second regression is correct. Forget about the effect of the Return variable, whose effect seems small and statistically insignificant. Calculate the correlation between Female and In(Market Value) using

the omitted variable bias equation¹.

(Round your response to two decimal places.)

(Round your response to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning