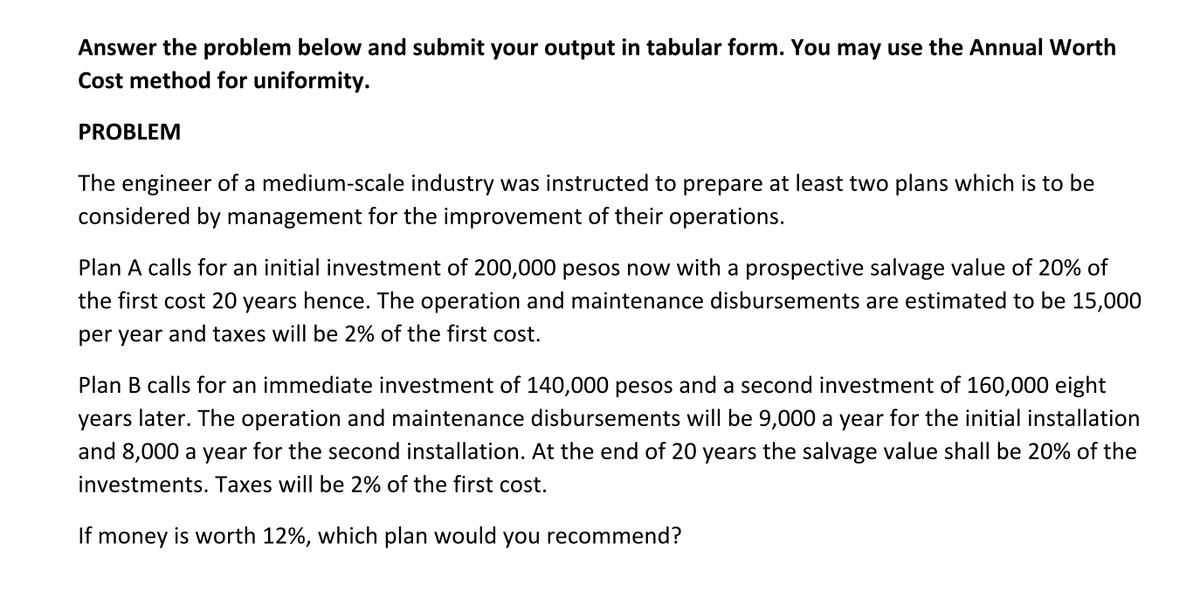

um-scale industry was instructed to prepare at least two plans whic nent for the improvement of their operations. l investment of 200,000 pesos now with a prospective salvage value

Q: he production of electrical transformers as found that the total fixed cost of the t was (1,000,000)…

A: *Answer:

Q: A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of…

A: The investment value of a property is the amount of money that an investor will pay for it. It…

Q: ifered a crane-mounted pneumatic breaker which will cost P 1,200,000 with a s 000 at the end of its…

A: Interest on investment the occasional receipt of inflows on monetary instruments like bonds,…

Q: Engr. Roque owner of the HarRoq’s Ice Plant is monitoring the cashflow of the plant. Based on the…

A: The total cost incurred by firms operating in a market is the sum of fixed costs and variable costs.…

Q: It costs P1000.00 for hand tools and P1.50 labor per unit to manufacture a product. Another…

A:

Q: A jewelry craftsman needs 100 grams of gold alloy, of 75% pure gold for his products. Only two…

A: Let x = grams of 80% pure gold and y = grams of 60% pure gold So, x + y = 100 ...(1) And similarly,…

Q: A firm hasi nitial value V and has an investment opportunity costing 400 that will yield it an…

A: Initial value of the Firm = V Let equity outstanding be = E Owners hold 10 shares Price per…

Q: The government should also consider an unconditional cash transfer program for an initial period of…

A: In this question the government is considering cash benefit to the people at the bottom of the…

Q: being evaluated: Method A. Dig a ditch. The first cost would be $60,000, and $25,000 of redigging…

A: this question belongs to the present value so the definition is: Present value (PV) is the current…

Q: As part of a broad effort to invigorate its pipeline and move more aggressively into biotechnology,…

A: Conventional benefit-cost ratio (BCR) = PW of annual revenue / (First cost + PW of annual cost)

Q: Determine the break -even point in terms of number of of umits produced following data in pesos.…

A: Break even point The break even point in financial matters, business-and explicitly cost bookkeeping…

Q: Your company plans to develop a bridge of an estimated cost of 6 million dollars ($6,000,000) of…

A: The make back the initial investment point in financial aspects, business — and explicitly cost…

Q: All documented information shall be Legible O Dated O Maintained in good order Retained O All the…

A: The documented information refers to all of the important information that must be kept organized…

Q: With respect to production, the short runis best defined as a time period O lasting up to six…

A: Economics is a branch of social science that describes and analyzes the behaviors and decisions…

Q: A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of…

A: The present value technique associate degree alysis|of study|of research} is an equivalence…

Q: The Philippines Transmission Co. makes and sells certain automotive parts. Present sales volume is…

A: Total profit is given by the difference of total revenue and total cost and the break even point is…

Q: Mr. Santos is deciding whether to stop operations or not. He estimated that he would incur Php…

A: Factors of production such as land, labor, capital, and enterprise are important for the starting…

Q: During your first month as an employee at Engro. Industries (a large drill-bit manufacturer), you…

A: In this kind of problem, the manager has to choose a product which is best fitted to the needs of…

Q: acme coral paid 5000 php to lease a railcar from the reading railroad under the terms, 1000 php of…

A: 1. The cost of production includes the cost paid for the factors of production and the assets etc.…

Q: A small shop in Bulacan fabricates threshers for palay producers in the locality. The shop can…

A: Given information: Labor cost per unit: P1800 Material cost per unit: P2500 Variable cost per…

Q: Suppose a fossil fuel has stable demand and a constant marginal cost. There are only two periods. MB…

A: Marginal cost denotes the change in total cost due to change in every additional unit produced. It…

Q: 4. (If P = 2 and Y= 1000, then which of the following pairs of values are possible? A. M = $500, V =…

A: From the quantity theory of money The equation of exchange is MV= PY Where M is money supply, V is…

Q: The following information relates to the operations of a company; cost per unit from supplier-…

A: Break even quantity is the number of extra units that a firm needs to sell to cover its investment…

Q: A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of…

A: First let us understand the major points in the question briefly: Investment= P500,000 for Auto…

Q: A pharmaceutical company has spent $500 million to date working on a blood pressure treatment. It…

A: Answer 1 Given Information Money spent till date = $ 500 million Money needed for FDA approval = $…

Q: Phillip Witt, president of Witt Input Devices, wishes to create a portfolio of local suppliers for…

A: EMV: EMV or expected market value is the overall value of various class of securities that is kept…

Q: A tire manufacturer produces a piece of tire at a labor cost of 0.50 pesos and material at 3.00…

A: Let's assume Q units are produced. Labor cost is 0.50 pesos per piece Material cost is 3 pesos per…

Q: In net present worth analysis over a period, if the net present worth value is equal to zero, the…

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any…

Q: A manufacturing company produced 40,000 boxes of a product that sold for OMR 3 per box. The total…

A: Given: A company produced = 40,000 boxes The product sold for = OMR 3 per box The total variable…

Q: The project is desirable according to Kaldor compensation criterion if gainers can compensate losers…

A: Pareto efficiency means when the redistribution of resources is impossible to better off one…

Q: Minerva will be celebrating her 60th birthday two months from now. She was able to save certain…

A: Minerva s now planning to invest it to earn something. Here lets discuss some scenarios which will…

Q: A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of…

A: Future worth is basically the value of a current asset at a future date based on a projected rate of…

Q: Ifit is said that the economic life of a challenger is four years it means that_ Oathe payback…

A: The estimated span of time during which an item will be useful to the typical owner is known as its…

Q: Service sector projects are intangible projects like health care services and credit card services.…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Select the best option based on the information below. MP, = TRS W2 Lat(x;,x;) MP, Select one: True…

A: At a marketplace, a firm make a use of different combinations of input resources to get maximum…

Q: A man is considering investing P500, 000 to open a semi-automatic autowashing business in a city of…

A: First, let us understand the major points in the question briefly: Investment= P500,000 for Auto…

Q: The Cebu City plans to increase the capacity of her existing water transmission lines. Two plans are…

A: Present Value of projected cash flows are the discounted values of future cash flows .

Q: Cobb-Douglas production function Q = Lβ1Fβ2Bβ3 Where L = labour input in worker hours F = fuel…

A: 1. Decrease in capital is given as 3%. Percentage change in output due to change in capital input…

Q: QUESTION 11 As a general decision criterion, the PW method provides a more direct solution to a…

A: Answer-1:- The given statement is True. Explanation- Present worth estimates the current value for…

Q: a.A clothing manufacturer makes trousers, skirts and blouses. Each trouser requires 20 minutes of…

A: Let consider P, Q, and R is the number of trousers, skirts, and blouses respectively. Cutting,…

Q: H-Robotic Incorporated (HRI), a world leader in the robotics industry, pro- duces a line of…

A: The overall amount of funds exchanged into and out of a firm, particularly influences liquidity is…

Q: It refers to the number of years that the original capital investment for the project will take to…

A: Profitability index(PI) is the ratio of PV(present value) of future cash flows which are expected…

Q: A man is considering investing P500, 000 to open a semi-automatic autowashing business in a city of…

A: The application of economic techniques to the evaluation of design and engineering alternatives is…

Q: se the Hotelling model to calculate the present price and the factor profit for an exhaustible…

A: The theory that includes determining the price at which a non renewable resource should be extracted…

Q: In early 1999 an investor bought 1000 shares of skandia for K127 per share. During the year…

A: Given Information: Purchased 1000 shares foe K127 per share Dividend received at K1.15 per shares…

Q: Suppose a fossil fuel has stable demand and a constant marginal cost. There are only two periods. MB…

A: MB=8-0.4qt MC = 2 Total resources=20 r=0.10 qt=q1+q2 q1--- resources used in period 1 q2---…

Q: II. PROBLEM SOLVING Lino Batumbakal is now exploring the option to start selling beef wellington. He…

A: Demand function is an inverse relation between price and quantity , whereas a supply function is a…

Q: A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of…

A: Given, Cost of Machine=P500,000 Equipment can wash 12 cars per hour on an average The Operating…

Q: ou wish to determine the dynamically efficient rate of extraction of a non-renewable resource of two…

A: *Hi there , as you have posted multiple sub -parts within the sub parts of the question . As per our…

Q: Stan Moneymaker has been informed of a major automobile manufacturer’s plan to conserve on gasoline…

A: Investment =$1200 Investment = Monthly saving×1-11+ini 1200 = 27.50×1-11+0.05n0.005 1200×0.00527.50…

Step by step

Solved in 3 steps with 2 images

- Lim Bon Fing Y Hermanos Inc has offered for sale its two-storey building in thecommercial district of Cebu City. The building contains two stores on the ground floor anda number of offices on the second floor.A prospective buyer estimates that if he buys this property, he will hold it for about 10years. He estimates that the average receipts from the rental during this period to beP350,000.00 and the average expenses for all purpose in connection with its ownershipand operation (maintenance and repairs, janitorial services, insurance, etc.) to beP135,000.00. He believes that the property can be sold for a net of P2,000,000 at the endof the 10th year. If the rate of return on this type of investment is 7%, determine thecash price of this property for the buyer to recover his investment with a 7% return beforeincome taxes.ANSWER: P2,526,768.61You need to determine whether a project is profitable or not in a long run. Based on the data given, which of theseprojects will be profitable according to engineering economy methods?a. θ = 3 yrs., Net Value: 0b. Accumulated (without interest) net values of the revenues, expenses and investments after 5 years is +300.c. Accumulated (without interest) net values of the revenues, expenses and investments after 4 years is +100.d. θ = 6 yrs., Net Value: +400Leonard Motors is trying to increase its international export business. It is considering several alternatives. Two were available earlier (per Problem 5.11), but a new one has recently been proposed by a potential internationally partnering corporation, which has funds to invest. Option 1: Equipment costs $900,000 now and another $560,000 in 2 years Annual M&O costs of $79,000 Life of project is 10 years Salvage value is nil Option 2: Subcontract production for annual payment of $280,000 for years 0 (now) through 10 Annual M&O cost is zero Life of project is 10 years Salvage value is nil Option 3: Costs are $400,000 in year 1 plus an additional 5% each year through year 5 Revenues are $50,000 per year for years 6 through 10 Life of project is 10 years Equipment salvage value is $100,000 paid in year 10 by international partner Due to stock market pressures, Leonard plans to change its MARR from its current 20% per year to 15% per year, compounded quarterly. Use PW analysis to…

- It is the first of October, and you are developing cost estimates for creating an engineering consulting business with a small group of friends. Liability insurance beginning January 1 will cost $475 per month, payable at the beginning of each month. What is the PW of this insurance for the first year as of this date? The firm’s MARR is a 12% nominal annuity rate. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.What is the effective interest rate on an overdraft facility where the bank requires 3.5% interest per quarter average utilization and a quarterly commission of 0.4% of limit? It is estimated that 70% of the limit of SEK 500,000 will be utilized.AN INVESTMENT OF P270,000.00 ON COMPUTER SHOP WILL HAVE THE FOLLOWING DATA: UNIFORM ANNUAL REVENUE-P185,000.00 FOR 5 YEARS OPERATION AND MAINTENANCE-P85,000.00/YEAR TAXES/INSURANCE-5% OF THE FIRST COST SALVAGE VALUE OF THE COMPUTERS AFTER 5 YEARS-10% OF INVESTMENT EXPECTED EARNINGS ON CAPITAL- 25% PROVE THAT THIS INVESTMENT IS JUSTIFIABLE OR NOT BY USING PRESENT WORTH METHOD PLEASE GIVE FULL AND DETAILED SOLUTION

- A business invests $5000 and initially plans to achieve annual revenue of $1100/yr with $200/yr expenses (starting at the end of ar 1) for ten years. No market value if used for ten years. 1.If at the end of the sixth year, instead, the investment is sold for $1000, calculate the PW, FW and AW for a BTCF MARR of 12%. Is the investment a good one if used this way? Why?An investment of P 270,000 can be made in a project that will produce a uniform annual revenue of P 185,400 for 5 yrs and then have a salvage value of 10% of the investment. Out of pocket costs for operation and maintenance will be P 81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment?Hajia Timber Ltd (GTL) produces and exports lumber and planks. It owns a plant whichhas value of GHC 1,800,000 as at 1 January 2010. The government of Ghana,passes alegislation that restricts the exportation of lumber. Consequently GTL has to reduceproduction by 40%. Cash flow forecast for the next five years included in the budgetsubmitted for management approval in January 2010 shows the following:Year Cash flows (GHC)2010 552,0002011 506,0002012 376,0002013 250,0002014 560,000The cashflow forecast for 2014 includes expected proceeds from disposal of the plant. Thecash flow projections also ignore the effects general upwards movement in prices.It is estimated that if the plant is sold in January 2010, it would realize the net proceeds ofGHC 1,320,000. The costs of capital for GBL is 15% (ignoring inflationary effect)RequiredCalculate the recoverable amount of the plant and impairment loss (if any).

- Marites started living in his own house after turning 25 years old. When he turned 26, he became fond of buying a pack of Pan De Manila wheat bread every Saturday at 5:30PM. The price of thebread is Php85.00 per pack. Assume the following:1. Marites will live until 95 years old.2. The price of the bread will remain constant,3. Marites' purchasing habit will not change. What is the lifetime value than can be generated from Marites as a customer of Pan de Manila wheat bread?AN INVESTMENT OF P270,000.00 ON COMPUTER SHOP WILL HAVE THE FOLLOWING DATA: UNIFORM ANNUAL REVENUE-P185,000.00 FOR 5 YEARS OPERATION AND MAINTENANCE-P85,000.00/YEAR TAXES/INSURANCE-5% OF THE FIRST COST SALVAGE VALUE OF THE COMPUTERS AFTER 5 YEARS-10% OF INVESTMENT EXPECTED EARNINGS ON CAPITAL- 25% PROVE THAT THIS INVESTMENT IS JUSTIFIABLE OR NOT BY USING ANNUAL WORTH METHOD PLEASE GIVE FULL AND DETAILED SOLUTIONA company bought an electrical equipment worth Php 235,000 with useful life of 10 years. What are the book values of the asset at the end of year if the equipment has a salvage value of Php 15,000 using: a. Straight Line Methodb. Sinking Fund Method at 12% interest ratec. Declining Balance Methodd. Double Declining Balance Methode. Sum-of-the-Year’s-Digit Method