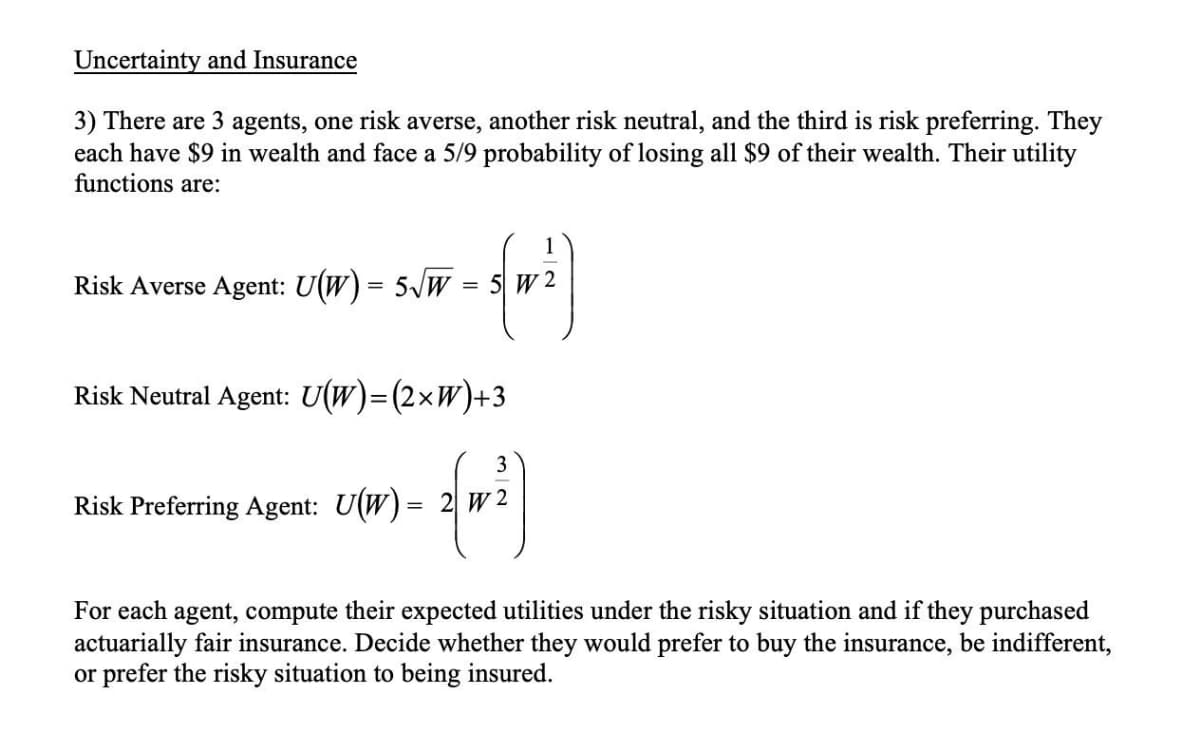

Uncertainty and Insurance 3) There are 3 agents, one risk averse, another risk neutral, and the third is risk preferring. They each have $9 in wealth and face a 5/9 probability of losing all $9 of their wealth. Their utility functions are: Risk Averse Agent: U(W)= 5/w = 5 W 2 %3D Risk Neutral Agent: U(W)=(2×W)+3 Risk Preferring Agent: U(W)= 2| w 2 For each agent, compute their expected utilities under the risky situation and if they purchased actuarially fair insurance. Decide whether they would prefer to buy the insurance, be indifferent, or prefer the risky situation to being insured.

Q: Two chemical companies, A and B, operate in a small New England town. Every week A releases 40 gallo...

A: Hi! Thank you for the question as per the honour code, we’ll answer the first question since the exa...

Q: 3. Howard consumes only two goods. An economist has collected the following data on Howard's consump...

A: Paul Anthony Samuelson, an American economist, introduced the concept of revealed preference in 1938...

Q: n your view, should an organization engage in a dialogue with all of its stakeholders all of the tim...

A: Stakeholder: A stakeholder is a party that has an interest in an organization and can either influen...

Q: In the graph, if the government sets a price floor of 90 75 50 25 10 D 200 500 800 O shortage of 600...

A: Price floor refers to the legal minimum price that can be charged for a good.

Q: Suppose that you have two opportunities to invest $1M. The first will increase the amount invested b...

A: Utility function = 2.3ln(1+4.5x) First opportunity : Returns = + or - 50% Probability of gain = 0....

Q: Income Expenditures 0 100 100 150 200 200 300 250 Refer to the table above to answer the following...

A: Aggregate expenditure is a sum of consumption spending, investment, government spending and net expo...

Q: Blana is the manager of a local bank branch in College Station where he consumes bundles of two comm...

A: Utility function of Diana U(x,y)=x+y ... (1) Income of Diana at college station is $5000.

Q: Often the marginal cost (MC) is initially decreasing as Q rises because... the marginal productivity...

A: Marginal product refers to change in total output due to an addition of one more unit of input.

Q: Identify 2 possible exclusions to GDP and discuss why they have to be excluded.

A: GDP means the total market value of goods and services produced domestically during the year. The...

Q: Explain how an export subsidy is theoretically meant to work. Think of the application to “infant in...

A: When talking about export subsidy, it is explains by two separate economic concepts that are exports...

Q: From the following table, interpolate the missing values. "ear Production (in '000 tonnes) : 3 200 2...

A:

Q: Can the developing countries escape from middle-income trap ? How ? Explained with comprehensive

A: Developing economies are defined as those economies which have lower human development index as comp...

Q: Suppose that a consumer cannot vary hours of work as he or she chooses. In particular, he or she mus...

A: In a perfectly competitive market, one of the determinants of the equilibrium wage and quantity of l...

Q: Suppose you are given the following information about a particular industry: QD = 3600 – 200P Market...

A: QD= 3600-200P QS=1000P

Q: Q,-82 million barrels per day. the pre-ANY simplicity, assume that the supply and demand curves are ...

A: Note : Since you have asked for only 2nd part. But I am doing whole question, it will be easily unde...

Q: 6. In the year 2017, the net national product for a country was RM12 000 million. In year 2019, the ...

A:

Q: Why do some marginalised groups in the USA and Canada reject the idea of globalisation? In answering...

A: The relationship between policies that promote globalisation, economic growth, inequality, and pover...

Q: 13.03 Homework • Answered If the average variable cost of producing 4 jeans at Jerry's factory is $6...

A: We know that, Total Cost(TC)= Total Fixed Cost(TFC)+Total Variable Cost(TVC),Average Variable Cost(A...

Q: Country S and Country T are two similar countries with the same working population equal to 100. Fir...

A: Introduction Two countries S and T are given. and both the countries have same working population wh...

Q: A concrete pavement on a street would cost $10,000 and would last for 5 years with negligible repair...

A:

Q: I need clarification on what a "numerical solution" should be in the context of my economic question...

A: Economics is termed as the "Queen of social sciences". And this is so because economics in general c...

Q: Other things held constant, the greater the price of a good the greater the consumer surplus. the hi...

A: Consumers have a desire to purchase a product, and manufacturers create a supply to match that deman...

Q: How do laws and politics affect the trade between states?

A: Worldwide alternate laws create the rules that international locations and groups need to comply wit...

Q: happens to the marginal product labor? Y=zF(K,N) Labor (N) O It increases O It decreases O It increa...

A: The production function depicts the technical association between the quantities of output (Q) that ...

Q: Suppose that Mr. Ali's disposable income declined from 15 000 TL to 12 000 TL. Given that Mr.Ali's m...

A: Marginal Propensity to Consume is the proportion of an increase in income that gets spent on consump...

Q: Income Expenditures 0 100 100 150 200 200 300 250 Refer to the table above to answer the following...

A: AE is shows aggregate expenditure in the economy, some of which is autonomous and some is induced.

Q: What is “B.O.P”? Explain the importance of “Balance of Payments” to Managers of Public and Private ...

A: "Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: are goods more expensive in 2021 with a CPI of 271.4 or in 1930 with a CPI of 17.7? Why or why not

A: Given: CPI 2021=271.4 CPI 1930=17.7

Q: Apply the gravity model to India and China. Why has it taken so long for India and China to become s...

A: 1. Between 2014-15 and 2019-20, India's economic relationship with China has been characterised by t...

Q: ase go to www.federalreserve.gov e and briefly describe the structure of the U.S. Federal Reserve sy...

A: The central banking system of the United States of America is known as the Federal Reserve System. I...

Q: Use the information in the table to calculate the inflation rate. The base year is 1989. Market bask...

A: The given table provide information about the price and quantity of different goods in year 1990 and...

Q: A4 1. Two chemical companies, A and B, operate in a small New England town. Every week A releases 40...

A: *Hi there , as you have posted multiple question . As per our guidelines we are only allowed to solv...

Q: 1. What is likely to cause inflation? a. increase in oil prices b. Increase of prices of computers c...

A: Government has certain tax revenue with them through which they have to carry developmental expenses...

Q: The People's Republic of China has an estimated $101.54 trillion of capital with a depreciation rate...

A: The contribution of capital is 0.4 and it would affect the GDP accordingly. The rise in capital stoc...

Q: Suppose you bought a condo for $200,000 financing it with a $40,000 down payment of your own funds a...

A: * SOLUTION :- Given that , (2) Based on given information the calculation is as follows.

Q: Do undocumented immigrants overall represent a net economic cost or benefit to the United States?

A: Immigration:- The global movement of individual to a target nation where they will not be natives a...

Q: If the production function is q = min{L, K/3} and the price of L is $3 per unit (w=3), and the price...

A: Given Production function q=minL,K/3 ... (1) Price of labor (w) = $3 Price of capital ...

Q: The New York Times has stated that Mylan, the company that makes the now infamous Epipen, has become...

A: A patent is a sort of intellectual property that grants its possessor the legal right to prevent som...

Q: Nhen buyers of insurance have more information about whether they are high-risk or low-risk than the...

A: While purchasing insurance if one party has more information than other, the situation is called adv...

Q: Problem 3.3 A monopoly's inverse demand function is p=160-4Q and it has no fixed costs. Initi...

A: Demand function shows the functional relationship between Quantity demanded for a commodity and its ...

Q: provide more detail on elasticity of demand, specifically how it helps determine changes in total re...

A: Price elasticity of demand is an important concept in economics. It measures the responsiveness of q...

Q: Rewrite it

A: The article is about the PPF. PPF refers production possibility frontier, which is also known as the...

Q: International trade causes the loss of jobs in industries where a country has Select the correct ans...

A: When there is free trade, parties involved gains from trade by trading with each other.

Q: In Econland, the monetary base is $1,000. People hold one-third of their money in the form of curren...

A: please find the answer below.

Q: An Edgeworth box is shown for individuals M and N. In total, there are 100 units of good 'X and 80 u...

A: Edgeworth box represents the pareto efficient allocation. It represents the indifference curve of 2 ...

Q: A machine has a first cost of $5,000 with a useful life of 5 years. It will have a salvage value of ...

A: Given The first cost of machine =$5000 Useful life= 5 years Yearly maintenance cost =$500 Salvage v...

Q: When talking about compensating wage differentials and the market for risky jobs, we assume that the...

A: Compensating wage differentials refer to higher wages that are required to be offered to the labor f...

Q: The late 19th century city was often dense, crowded, and dirty. This often led to disease and someti...

A: Industrialization was the rapid growth period of the economies because, under the industrial revolut...

Q: 3. In a von Thunen model with homogeneous labor with subways and cars, an improvement in automobile ...

A: The Von Thunen model of agricultural land use which explains the relationship between the cost of la...

Q: Define own price elasticity on-demand with an example b. define cross-price elasticity on-demand wi...

A: Price elasticity of demand is the price the degree of responsiveness or sensitivity of demand with r...

Step by step

Solved in 2 steps with 1 images

- V7 Consider a owner-manager problem in which πgross = 2e + ε [manager has control over e, ε are factors outside of manager’s control, ε~N(0,σ2 )] The owner pays the manager a salary of s out of the gross profits. Manager’s cost of effort = e2 /2. Manager has constant risk aversion utility function. σ 2 = 4 A = 1 a) What is the first-best outcome for manager utility, manager effort, and net profits of the owner? b) Now consider that the owner cannot observe manager effort and offers a salary tied to gross profits: s(πgross) = a + b πgross What is the second-best outcome for manager utility, manager effort, and net profits of the owner?Mf. Mean variance utility defines risk using certainty equivalent wealth. The lower the certainty equivalent wealth, the lower the mean variance utility. uestion Select one: O True O False Under constant relative risk aversion, the lower the certainty equivalent wealth is than the average wealth of a lottery the riskier the lottery. Select one: O True O False Given a normally distributed risky asset and a risk free asset, a person with a lower CRRA risk aversion coefficient will put less in the risk free asset than a person with a higher CRRA risk aversion. Select one: O True O False Greater risk aversion means a plot of utility vs. wealth would look less curved. Select one: O True O False The greater the wealth, the less the utility of the next dollar of wealth. Select one: O True O False People don't like risk because it means they get poorer when they're poorer and richer when they're rich. In fact, a financial security…Microeconomics Wilfred’s expected utility function is px1^0.5+(1−p)x2^0.5, where p is the probability that he consumes x1 and 1 - p is the probability that he consumes x2. Wilfred is offered a choice between getting a sure payment of $Z or a lottery in which he receives $2500 with probability p = 0.4 and $3700 with probability 1 - p. Wilfred will choose the sure payment if Z > CE and the lottery if Z < CE, where the value of CE is equal to ___ (please round your final answer to two decimal places if necessary)

- Suppose that there are two types of entrepreneur: skilled and unskilled. Skilled entrepreneurs have a probability p = 2/3 of success if they get the loan. Unskilled entrepreneurs have zero chance of being successful. Despite that, assume that unskilled entrepreneurs want to take up the loan, because it is cool to say you have a startup. The bank does not observe skill. The share of skilled entrepreneurs is s. Question 1: 1A). TRUE OR FALSE: If L = 2, R = 6, and s = 0.5, then the bank would have zero expected profits, but entrepreneurs would never take up the loan. 1B. ) TRUE OR FALSE: If the loan amount is L = 2, the payback amount is R = 3, and the share of skilled entrepreneurs is s = 0.9, then the bank will have positive expected profits.Y5 Alfred is a risk-averse person with $100 in monetary wealth and owns a house worth $300, for total wealth of $400. The probability that his house is destroyed by fire (equivalent to a loss of $300) is pne = 0.5. If he exerts an effort level e = 0.3 to keep his house safe, the probability falls to pe = 0.2. His utility function is: U = w0.5 – e where e is effort level exerted (zero in the case of no effort and 0.3 in the case of effort).a. In the absence of insurance, does Alfred exert effort to lower the probability of fire?HINT: Calculate and compare the expected utility i) with effort, and ii) without effort. If effort is exerted, then the effort cost is paid regardless of whether or not a fire occurs.b. Alfred is considering buying fire insurance. The insurance agent explains that a home owner’s insurance policy would require paying a premium α and would repay the value of the house in the event of fire, minus a deductible “D”. [A deductible is an amount of money that the…Consider the model of competitive insurance. Peter is a risk averse individual with the utility function u(w) = w0.5. His current wealth is $300 and with probability 1/2 he will incur a loss of D = $240, but with probability 1/2 he will incur no loss. Ann has the same utility u(w) = w0.5 and current wealth $300 as Peter, but a different probability of loss: she will incur a loss of D = $240 with probability 0.3, and no loss with probability 0.7. In the separating equilibrium Peter is offered actuarially fair full insurance contract, so his wealth is equal to $180, whether loss happens or not. What amount of insurance (approximately) will Ann be offered an insurance contract with?

- When the second order derivative of a function is greater than zero than the agent is risk lover. question; Asses the risk attitude of an agent represented by the expected utility function u(x)= 2x2-5. However my course material writes that this agent is risk neutral because it is affine. My question is that whys is this so despite the fact that the second order derivative is '4' which is >0. Kindly explain this to me with complete steps.Suppose that Winnie the Pooh and Eeyore have the same value function: v(x) = x1/2 for gains and v(x) = -2(|x|)1/2 for losses. The two are also facing the same choice, between (S) $1 for sure and (G) a gamble with a 25% chance of winning $4 and a 75% chance of winning nothing. Winnie the Pooh and Eeyore both subjectively weight probabilities correctly. Winnie the Pooh codes all outcomes as gains; that is, he takes as his reference point winning nothing. For Pooh: What is the value of S? What is the value of G? Which would he choose? Eeyore codes all outcomes as losses; that is, he takes as his reference point winning $4. For Eeyore: What is the value of S? What is the value of G? Which would he choose?Assume that there are two parties, I and V. I engages in an activity that tends to injure V. V and I both can take care to reduce the expected harm from accidents. Specifically, suppose that if I takes no care (i.e., spends $0 on accident precautions), expected injury to V is $250. If I spends $40 on accident precautions, however, the expected injury to V is reduced to $175. Further suppose that V has a choice between taking no care or spending $50 in care to avoid accidents. If V spends $50 in care, V’s expected harm falls by $20 regardless of the level of care that I takes. Assume that courts adopt the socially‐optimal level of injurer care as the negligence standard. That is, if I takes less than the socially‐optimal level of care, she will be found negligent and must pay for all damages to V. If I takes at least the socially optimal level of care, she will not have to compensate V for his damages. 1. Under a negligence standard, what is I’s dominant strategy? a) I does not have a…

- Use the following information for questions 12-14. Assume that there are two parties, I and V. I engages in an activity that tends to injure V. V and I both can take care to reduce the expected harm from accidents. Specifically, suppose that if I takes no care (i.e., spends $0 on accident precautions), expected injury to V is $25. If I spends $5 on accident precautions, however, the expected injury to V is reduced to $18. Further suppose that V has a choice between taking no care or spending $4 in care to avoid accidents. If V spends $4 in care, V’s expected harm falls by $2 regardless of the level of care that I takes. Assume that courts adopt the socially-optimal level of injurer care as the negligence standard. That is, if I takes less than the socially-optimal level of care, she will be found negligent and must pay for all damages toV. If I takes at least the socially optimal level of care, she will not have to compensate V for his damages. Under a negligence standard, what is…Use the following information for questions 12-14. Assume that there are two parties, I and V. I engages in an activity that tends to injure V. V and I both can take care to reduce the expected harm from accidents. Specifically, suppose that if I takes no care (i.e., spends $0 on accident precautions), expected injury to V is $25. If I spends $5 on accident precautions, however, the expected injury to V is reduced to $18. Further suppose that V has a choice between taking no care or spending $4 in care to avoid accidents. If V spends $4 in care, V’s expected harm falls by $2 regardless of the level of care that I takes. Assume that courts adopt the socially-optimal level of injurer care as the negligence standard. That is, if I takes less than the socially-optimal level of care, she will be found negligent and must pay for all damages toV. If I takes at least the socially optimal level of care, she will not have to compensate V for his damages. Under a negligence standard, what are…Use the following information for questions 12-14. Assume that there are two parties, I and V. I engages in an activity that tends to injure V. V and I both can take care to reduce the expected harm from accidents. Specifically, suppose that if I takes no care (i.e., spends $0 on accident precautions), expected injury to V is $25. If I spends $5 on accident precautions, however, the expected injury to V is reduced to $18. Further suppose that V has a choice between taking no care or spending $4 in care to avoid accidents. If V spends $4 in care, V’s expected harm falls by $2 regardless of the level of care that I takes. Assume that courts adopt the socially-optimal level of injurer care as the negligence standard. That is, if I takes less than the socially-optimal level of care, she will be found negligent and must pay for all damages to V. If I takes at least the socially optimal level of care, she will not have to compensate V for his damages. What is the Nash equilibrium of this…