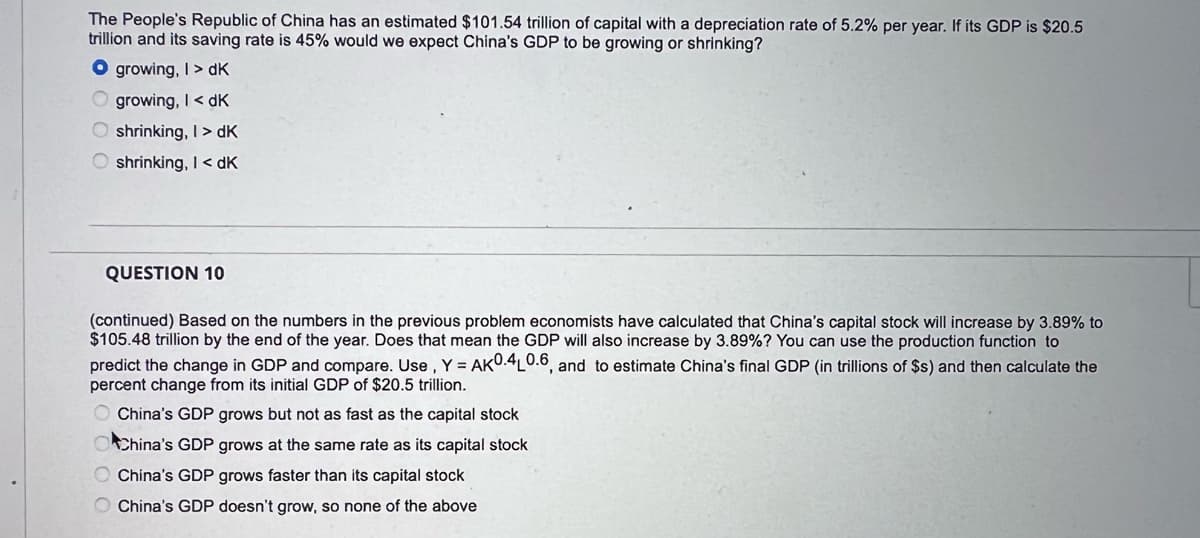

The People's Republic of China has an estimated $101.54 trillion of capital with a depreciation rate of 5.2% per year. If its GDP is $20.5 crillion and its saving rate is 45% would we expect China's GDP to be growing or shrinking? O growing, I> dK O growing, I< dK O shrinking, I> dK O shrinking, I< dK QUESTION 10 (continued) Based on the numbers in the previous problem economists have calculated that China's capital stock will increase by 3.89% to $105.48 trillion by the end of the year. Does that mean the GDP will also increase by 3.89%? You can use the production function to predict the change in GDP and compare. Use, Y = AKU.4L0.6, and to estimate China's final GDP (in trillions of $s) and then calculate the

The People's Republic of China has an estimated $101.54 trillion of capital with a depreciation rate of 5.2% per year. If its GDP is $20.5 crillion and its saving rate is 45% would we expect China's GDP to be growing or shrinking? O growing, I> dK O growing, I< dK O shrinking, I> dK O shrinking, I< dK QUESTION 10 (continued) Based on the numbers in the previous problem economists have calculated that China's capital stock will increase by 3.89% to $105.48 trillion by the end of the year. Does that mean the GDP will also increase by 3.89%? You can use the production function to predict the change in GDP and compare. Use, Y = AKU.4L0.6, and to estimate China's final GDP (in trillions of $s) and then calculate the

Microeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter14: Investment, The Capital Market, And The Wealth Of Nations

Section: Chapter Questions

Problem 16CQ

Related questions

Question

10 only

Transcribed Image Text:The People's Republic of China has an estimated $101.54 trillion of capital with a deprecíiation rate of 5.2% per year. If its GDP is $20.5

trillion and its saving rate is 45% would we expect China's GDP to be growing or shrinking?

O growing, I> dK

O growing, I< dK

O shrinking, I > dK

shrinking, I< dK

QUESTION 10

(continued) Based on the numbers in the previous problem economists have calculated that China's capital stock will increase by 3.89% to

$105.48 trillion by the end of the year. Does that mean the GDP will also increase by 3.89%? You can use the production function to

predict the change in GDP and compare. Use ,Y = AKU.4L0.6, and to estimate China's final GDP (in trillions of $s) and then calculate the

percent change from its initial GDP of $20.5 tríllion.

China's GDP grows but not as fast as the capital stock

China's GDP grows at the same rate as its capital stock

China's GDP grows faster than its capital stock

O China's GDP doesn't grow, so none of the above

Expert Solution

Step 1

The contribution of capital is 0.4 and it would affect the GDP accordingly. The rise in capital stock is positive, thus we can conclude that GDP would definitely rise.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning