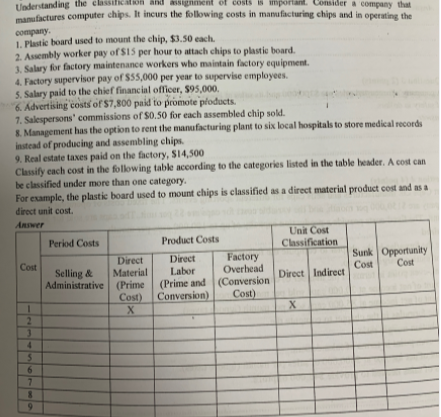

Understanding the assignment manufactures computer chips. It incurs the following costs in manufacturing chips and in operating the sts is mpora. sider a company that company. 1. Plastic board used to mount the chip, $3.50 each. 2. Assembly worker pay of $15 per hour to attach chips to plastic board. 3. Salary for factory maintenance workers who maintain factory equipment. 4. Factory supervisor pay of $55,000 per year to supervise employees. 5. Salary paid to the chief financial officer, $95,000. 6. Advertising costs of $7,800 paid to promote ploducts. 7. Salespersons' commissions of S0.50 for each assembled chip sold. 8. Management has the option to rent the manufacturing plant to six local hospitals to store medical records instead of producing and assembling chips. 9. Real estate taxes paid on the factory, $14,500 Classify cach cost in the following table according to the categories listed in the table header. A cost can be classified under more than one category. For example, the plastic board used to mount chips is classified as a direct material product cost and as a direct unit cost. Answer Unit Cost Classification Period Costs Product Costs Sunk Opportunity Factory Overhead Direct Direct Cost Cost Cost Selling & Labor Administrative (Prime (Prime and (Conversion Conversion) Material Direct Indirect Cost) Cost) 2. 4561 89

Understanding the assignment manufactures computer chips. It incurs the following costs in manufacturing chips and in operating the sts is mpora. sider a company that company. 1. Plastic board used to mount the chip, $3.50 each. 2. Assembly worker pay of $15 per hour to attach chips to plastic board. 3. Salary for factory maintenance workers who maintain factory equipment. 4. Factory supervisor pay of $55,000 per year to supervise employees. 5. Salary paid to the chief financial officer, $95,000. 6. Advertising costs of $7,800 paid to promote ploducts. 7. Salespersons' commissions of S0.50 for each assembled chip sold. 8. Management has the option to rent the manufacturing plant to six local hospitals to store medical records instead of producing and assembling chips. 9. Real estate taxes paid on the factory, $14,500 Classify cach cost in the following table according to the categories listed in the table header. A cost can be classified under more than one category. For example, the plastic board used to mount chips is classified as a direct material product cost and as a direct unit cost. Answer Unit Cost Classification Period Costs Product Costs Sunk Opportunity Factory Overhead Direct Direct Cost Cost Cost Selling & Labor Administrative (Prime (Prime and (Conversion Conversion) Material Direct Indirect Cost) Cost) 2. 4561 89

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 1PB: Classify costs Cromwell Furniture Company manufactures sofas for distribution to several major...

Related questions

Question

Transcribed Image Text:Understanding the

assignment

manufactures computer chips. It incurs the following costs in manufacturing chips and in operating the

sts is mpora.

sider a company that

company.

1. Plastic board used to mount the chip, $3.50 each.

2. Assembly worker pay of $15 per hour to attach chips to plastic board.

3. Salary for factory maintenance workers who maintain factory equipment.

4. Factory supervisor pay of $55,000 per year to supervise employees.

5. Salary paid to the chief financial officer, $95,000.

6. Advertising costs of $7,800 paid to promote ploducts.

7. Salespersons' commissions of S0.50 for each assembled chip sold.

8. Management has the option to rent the manufacturing plant to six local hospitals to store medical records

instead of producing and assembling chips.

9. Real estate taxes paid on the factory, $14,500

Classify cach cost in the following table according to the categories listed in the table header. A cost can

be classified under more than one category.

For example, the plastic board used to mount chips is classified as a direct material product cost and as a

direct unit cost.

Answer

Unit Cost

Classification

Period Costs

Product Costs

Sunk Opportunity

Factory

Overhead

Direct

Direct

Cost

Cost

Cost

Selling &

Labor

Administrative (Prime (Prime and (Conversion

Conversion)

Material

Direct Indirect

Cost)

Cost)

2.

4561 89

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,