What is the dividend you expect Yum! Brand can pay in FY T+1? Multiple Choice $1,295,139 $1,375,236 $1,395,339 $1,165,451

What is the dividend you expect Yum! Brand can pay in FY T+1? Multiple Choice $1,295,139 $1,375,236 $1,395,339 $1,165,451

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 1Q: Define each of the following terms:

Annual report; balance sheet; income statement

Common...

Related questions

Question

100%

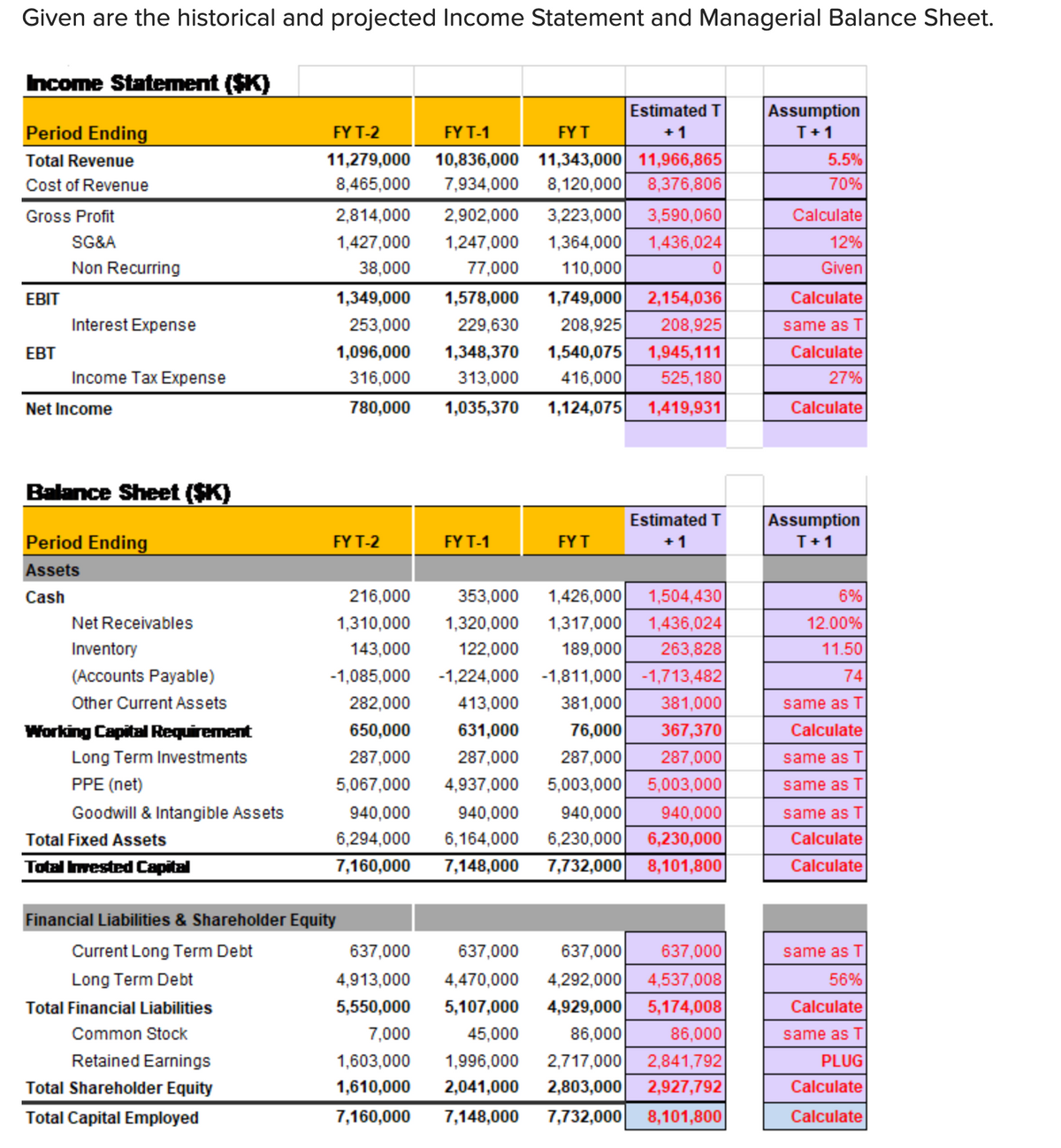

Hello Bartleby Experts. Need help figuring out this question. See screenshot attached. Thanks so much for your kind assistance :-) The question is: What is the Dividend you expect Yum! Brand can pay in FY T+1? The balance sheet and income statement is attached.

Transcribed Image Text:What is the dividend you expect Yum! Brand can pay in FY T+1?

Multiple Choice

O

$1,295,139

$1,375,236

$1,395,339

$1,165,451

Transcribed Image Text:Given are the historical and projected Income Statement and Managerial Balance Sheet.

Income Statement ($K)

Period Ending

Total Revenue

Cost of Revenue

Gross Profit

SG&A

Non Recurring

EBIT

EBT

Interest Expense

Income Tax Expense

Net Income

Balance Sheet ($K)

Period Ending

Assets

Cash

Net Receivables

Inventory

(Accounts Payable)

Other Current Assets

Working Capital Requirement

Long Term Investments

PPE (net)

Goodwill & Intangible Assets

Total Fixed Assets

Total Invested Capital

FY T-2

11,279,000

8,465,000

2,814,000 2,902,000 3,223,000 3,590,060

1,427,000 1,247,000 1,364,000 1,436,024

38,000 77,000 110,000

FY T-2

216,000

1,310,000

143,000

-1,085,000

282,000

650,000

287,000

5,067,000

1,349,000 1,578,000 1,749,000 2,154,036

253,000 229,630 208,925 208,925

1,096,000 1,348,370 1,540,075 1,945,111

316,000 313,000

416,000 525,180

780,000 1,035,370

1,124,075

1,419,931

940,000

6,294,000

7,160,000

FY T-1

FY T

10,836,000 11,343,000 11,966,865

7,934,000 8,120,000 8,376,806

Financial Liabilities & Shareholder Equity

Current Long Term Debt

Long Term Debt

Total Financial Liabilities

Common Stock

Retained Earnings

Total Shareholder Equity

Total Capital Employed

FY T-1

Estimated T

+1

353,000

1,320,000

122,000

FY T

1,426,000

1,317,000

189,000

0

Estimated T

+1

1,504,430

1,436,024

263,828

-1,224,000 -1,811,000

-1,713,482

413,000 381,000 381,000

631,000

76,000

367,370

287,000

287,000

287,000

4,937,000 5,003,000 5,003,000

940,000 940,000 940,000

6,164,000 6,230,000 6,230,000

7,148,000 7,732,000 8,101,800

637,000

637,000

637,000 637,000

4,913,000

4,292,000 4,537,008

4,470,000

5,107,000 4,929,000 5,174,008

5,550,000

7,000

86,000

45,000

86,000

1,603,000

1,996,000 2,717,000 2,841,792

1,610,000 2,041,000 2,803,000 2,927,792

7,160,000

7,148,000 7,732,000 8,101,800

Assumption

T + 1

5.5%

70%

Calculate

12%

Given

Calculate

same as T

Calculate

27%

Calculate

Assumption

T + 1

6%

12.00%

11.50

74

same as T

Calculate

same as T

same as T

same as T

Calculate

Calculate

same as T

56%

Calculate

same as T

PLUG

Calculate

Calculate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub