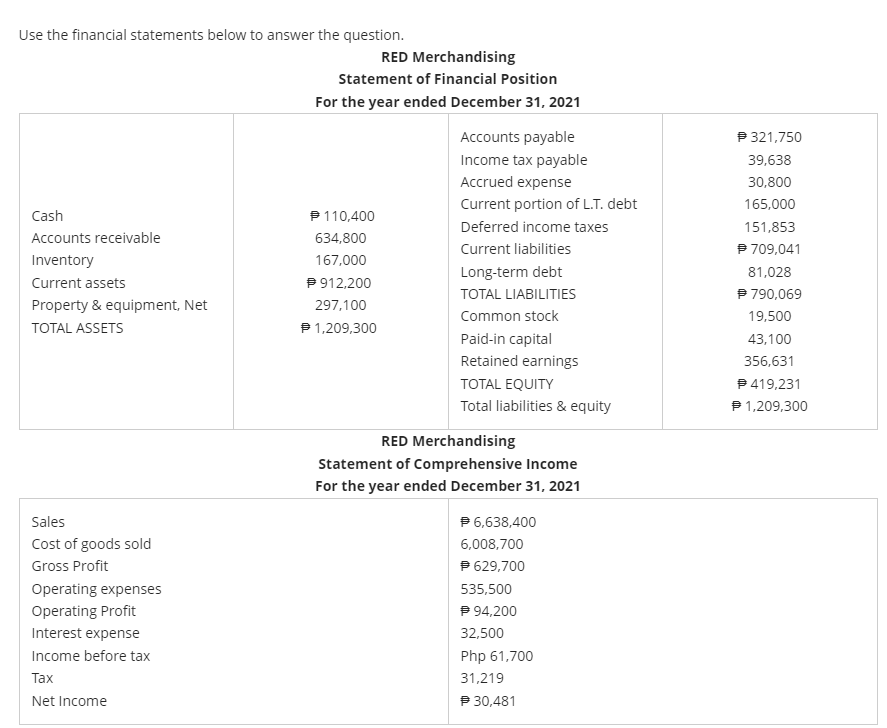

Use the financial statements below to answer the question. RED Merchandising Statement of Financial Position For the year ended December 31, 2021 Accounts payable P 321,750 Income tax payable Accrued expense 39,638 30,800 Current portion of L.T. debt 165,000 Cash P110,400 Deferred income taxes 151,853 Accounts receivable 634,800 Current liabilities P 709,041 Inventory 167,000 Long-term debt 81,028 Current assets P 912,200 TOTAL LIABILITIES P 790,069 Property & equipment, Net 297,100 Common stock 19,500 TOTAL ASSETS P1,209,300 Paid-in capital Retained earnings 43,100 356,631 TOTAL EQUITY P419,231 Total liabilities & equity P 1,209,300 RED Merchandising Statement of Comprehensive Income For the year ended December 31, 2021 Sales P 6,638,400 Cost of goods sold 6,008,700 Gross Profit P 629,700 Operating expenses Operating Profit 535,500 P 94,200 Interest expense 32,500 Income before tax Php 61,700 Тах 31,219 Net Income P 30,481

Use the financial statements below to answer the question. RED Merchandising Statement of Financial Position For the year ended December 31, 2021 Accounts payable P 321,750 Income tax payable Accrued expense 39,638 30,800 Current portion of L.T. debt 165,000 Cash P110,400 Deferred income taxes 151,853 Accounts receivable 634,800 Current liabilities P 709,041 Inventory 167,000 Long-term debt 81,028 Current assets P 912,200 TOTAL LIABILITIES P 790,069 Property & equipment, Net 297,100 Common stock 19,500 TOTAL ASSETS P1,209,300 Paid-in capital Retained earnings 43,100 356,631 TOTAL EQUITY P419,231 Total liabilities & equity P 1,209,300 RED Merchandising Statement of Comprehensive Income For the year ended December 31, 2021 Sales P 6,638,400 Cost of goods sold 6,008,700 Gross Profit P 629,700 Operating expenses Operating Profit 535,500 P 94,200 Interest expense 32,500 Income before tax Php 61,700 Тах 31,219 Net Income P 30,481

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Question

Which of the following interprets the interest coverage ratio of RED Merchandising?

-

It takes 3.2 times to earn the interest charges payment.

-

It takes 2.9 times to earn the interest charges payment.

-

It takes 3.9 times to earn the interest charges payment.

-

It takes 2.6 times to earn the interest charges payment.

Transcribed Image Text:Use the financial statements below to answer the question.

RED Merchandising

Statement of Financial Position

For the year ended December 31, 2021

Accounts payable

P 321,750

Income tax payable

Accrued expense

39,638

30,800

Current portion of L.T. debt

165,000

Cash

P110,400

Deferred income taxes

151,853

Accounts receivable

634,800

Current liabilities

P 709,041

Inventory

167,000

Long-term debt

81,028

Current assets

P 912,200

TOTAL LIABILITIES

P 790,069

Property & equipment, Net

297,100

Common stock

19,500

TOTAL ASSETS

P1,209,300

Paid-in capital

Retained earnings

43,100

356,631

TOTAL EQUITY

P419,231

Total liabilities & equity

P 1,209,300

RED Merchandising

Statement of Comprehensive Income

For the year ended December 31, 2021

Sales

P 6,638,400

Cost of goods sold

6,008,700

Gross Profit

P 629,700

Operating expenses

Operating Profit

535,500

P 94,200

Interest expense

32,500

Income before tax

Php 61,700

Тах

31,219

Net Income

P 30,481

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning