Use the following information to answer the next three (3) questions. Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. Let "return" be the total return from holding a firm's stock over the four-year period from the end of 1990 to the end of 1994. The efficient markets hypothesis says that these returns should not be systematically related to information known in 1990. If firm characteristics known at the beginning of the period help to predict stock returns, then we could use this information in choosing stocks. For 1990, let dkr be a firm's debt to capital ratio, let eps denote the earnings per share, let netinc denote net income, and let salary denote total compensation for the СЕО. There are 300 observations. The following equation was estimated: return = -14.37+.321dkr + .043eps – .0051netinc +.0035salary (.078) (.0047) (.0022) (6.89) (.201) R? = 0.0395 where the values in the parentheses are standard errors. Question 1 We reestimate the model and obtain the following results: return = -2.781+.0519salary (8.812) (.0191) R = 0.0112 We would like to test whether drk, eps and netinc are jointly significant in the original equation at the 5% significance level against a two-sided alternative. Calculate the F-statistics to test the null hypothesis. Round off your answer up to two decimal places.

Use the following information to answer the next three (3) questions. Regression analysis can be used to test whether the market efficiently uses information in valuing stocks. Let "return" be the total return from holding a firm's stock over the four-year period from the end of 1990 to the end of 1994. The efficient markets hypothesis says that these returns should not be systematically related to information known in 1990. If firm characteristics known at the beginning of the period help to predict stock returns, then we could use this information in choosing stocks. For 1990, let dkr be a firm's debt to capital ratio, let eps denote the earnings per share, let netinc denote net income, and let salary denote total compensation for the СЕО. There are 300 observations. The following equation was estimated: return = -14.37+.321dkr + .043eps – .0051netinc +.0035salary (.078) (.0047) (.0022) (6.89) (.201) R? = 0.0395 where the values in the parentheses are standard errors. Question 1 We reestimate the model and obtain the following results: return = -2.781+.0519salary (8.812) (.0191) R = 0.0112 We would like to test whether drk, eps and netinc are jointly significant in the original equation at the 5% significance level against a two-sided alternative. Calculate the F-statistics to test the null hypothesis. Round off your answer up to two decimal places.

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter1: Equations And Graphs

Section: Chapter Questions

Problem 10T: Olympic Pole Vault The graph in Figure 7 indicates that in recent years the winning Olympic men’s...

Related questions

Question

2

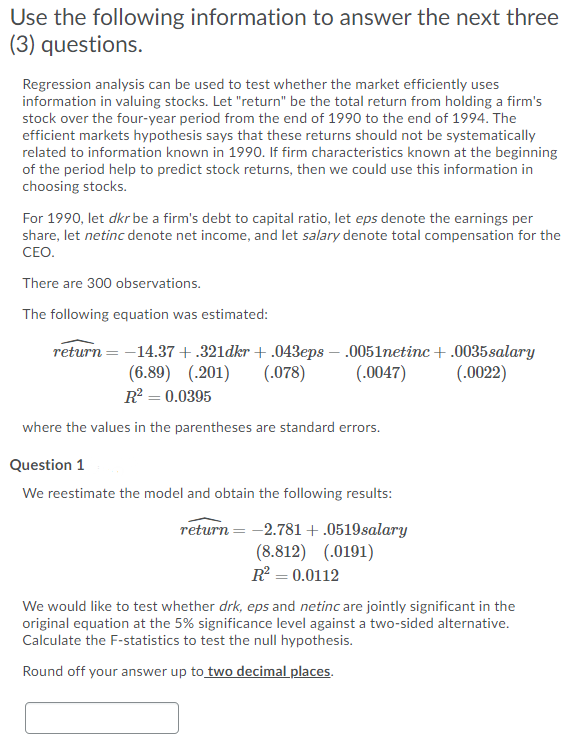

Transcribed Image Text:Use the following information to answer the next three

(3) questions.

Regression analysis can be used to test whether the market efficiently uses

information in valuing stocks. Let "return" be the total return from holding a firm's

stock over the four-year period from the end of 1990 to the end of 1994. The

efficient markets hypothesis says that these returns should not be systematically

related to information known in 1990. If firm characteristics known at the beginning

of the period help to predict stock returns, then we could use this information in

choosing stocks.

For 1990, let dkr be a firm's debt to capital ratio, let eps denote the earnings per

share, let netinc denote net income, and let salary denote total compensation for the

CEO.

There are 300 observations.

The following equation was estimated:

return = -14.37 +.321dkr + .043eps – .0051netinc +.0035salary

(.078)

(.0022)

(6.89) (.201)

R? = 0.0395

(.0047)

where the values in the parentheses are standard errors.

Question 1

We reestimate the model and obtain the following results:

return = -2.781+.0519salary

(8.812) (.0191)

R = 0.0112

We would like to test whether drk, eps and netinc are jointly significant in the

original equation at the 5% significance level against a two-sided alternative.

Calculate the F-statistics to test the null hypothesis.

Round off your answer up to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Trigonometry (MindTap Course List)

Trigonometry

ISBN:

9781305652224

Author:

Charles P. McKeague, Mark D. Turner

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning