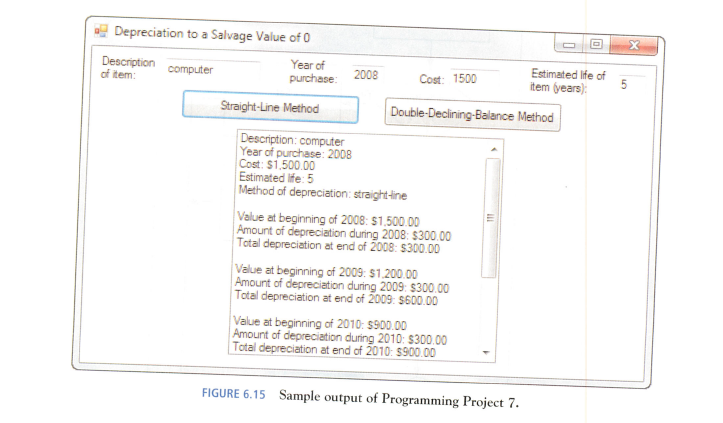

use visual basic Depreciation to a Salvage Value of 0 . For tax purposes an item may be depreciated over a period of several years, n . With the straight-line method of depreciation , each year the item dpreciates by 1/nth of it original value. with the double-declining-balance method of depreciation, each year the item depreciate by 2/nths of its value at the beginning of that year. (In the final year it is depreciated by its value at the beginning of the year. ) Write a program that performs the following tasks: (a) Request a description of the item, the year of purchase, the cost of the item, the number of years to be depreciated (estimated life), and the method of depreciation. The method of depreciation should be chosen by clicking on one of two buttons. (b) Display a year- by-year description of the depreciation. See Fig. 6.15 .

Control structures

Control structures are block of statements that analyze the value of variables and determine the flow of execution based on those values. When a program is running, the CPU executes the code line by line. After sometime, the program reaches the point where it has to make a decision on whether it has to go to another part of the code or repeat execution of certain part of the code. These results affect the flow of the program's code and these are called control structures.

Switch Statement

The switch statement is a key feature that is used by the programmers a lot in the world of programming and coding, as well as in information technology in general. The switch statement is a selection control mechanism that allows the variable value to change the order of the individual statements in the software execution via search.

use visual basic Depreciation to a Salvage Value of 0 . For tax purposes an item may be depreciated over a period of several years, n . With the straight-line method of depreciation , each year the item dpreciates by 1/nth of it original value. with the double-declining-balance method of depreciation, each year the item depreciate by 2/nths of its value at the beginning of that year.

(In the final year it is depreciated by its value at the beginning of the year. ) Write a program that performs the following tasks:

(a) Request a description of the item, the year of purchase, the cost of the item, the number of years to be depreciated (estimated life), and the method of depreciation. The method of depreciation should be chosen by clicking on one of two buttons.

(b) Display a year- by-year description of the depreciation. See Fig. 6.15 .

Trending now

This is a popular solution!

Step by step

Solved in 10 steps with 14 images